As we proceed rolling out the extra worth to Xero’s new experiences, we’re thrilled to see small companies and practices all over the place embrace them with fervour. From simpler entry to your favorite go-to experiences, extra personalisation in how they appear to prospects, and enhanced customisation that provides higher readability and management over the numbers, our objective is that will help you streamline your monetary evaluation and get the solutions that matter, rapidly.

Founder and managing director of Aegis Enterprise Companies, chartered accountant Tori van der Donk relies on Xero’s reporting suite not solely to assist her purchasers perceive the place they stand now, but in addition to make knowledgeable plans for the longer term. Not too long ago, she sat down with me to inform us all about how essential experiences are in her enterprise, and why with the ability to customise them is the lifeblood of her work.

How lengthy have you ever been utilizing experiences in Xero?

Virtually eight years. In reality, Xero was one of many causes I had the arrogance to exit alone to start with. I’m a bonafide early adopter as a result of I’m drawn to merchandise designed with innovation and logic at their core, plus I cherished how Xero pulled down the normal limitations to entry for budding observe house owners like me. When reporting, I would like flexibility of each place and time, so having the choice to work within the cloud – in distinction to desktop-based servers – is essential.

How do you utilize experiences in your observe?

Gee, how lengthy is a chunk of string? We use experiences for every part! Our most-loved is Account Transactions, and we frequently customise it with added columns relying on our purchasers’ wants. In any other case, we very generally pull collectively payroll worker and payroll exercise experiences, steadiness sheets, P&L and exercise assertion experiences.

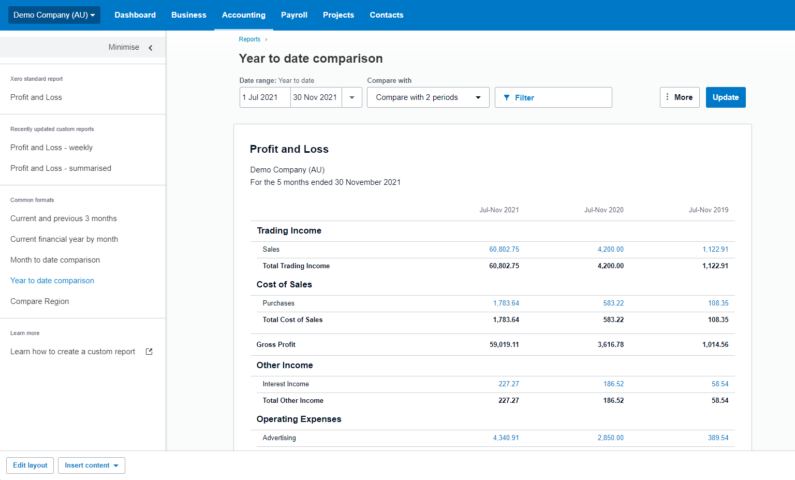

Given the character of our enterprise, we additionally create customized report packs which embody a month-to-month administration report. That is generally customised additional at a shopper degree with grouping or formulation (for instance, GP %), and BAS packs, full with not solely an Account Transactions report, however a Steadiness Sheet and Revenue and Loss report that reveals the comparability to earlier quarters, and the QTD and YTD figures.

We additionally customise payroll reconciliation packs with a P&L customised from report codes, solely exhibiting element and sub-totalled quantities for wages and salaries whereas summarising all different accounts in collapsed teams. This permits us to give attention to what’s necessary for inner evaluate functions, after which create year-end annual accounts for every entity sort, which come pre-populated with our agency’s particulars.

One factor we frequently see is that purchasers love to call their very own accounts, and generally this implies they’ll have 300 accounts when only one would do. So, we customise experiences to group these, or rename them so that they’re extra presentable from an accounting standpoint. Briefly, experiences are central to how we function, each for ourselves and our purchasers.

What impression does with the ability to customise experiences have for you?

As many observe house owners will perceive, our shopper base could be very various. So, as a lot as we’d prefer to standardise the way in which we run and organise our reporting functionality, it actually doesn’t work that approach in actuality. In fact, we might at all times power our purchasers to ‘our approach’ of doing issues, however we all know that’s not truly going to be any good for his or her enterprise, so customising our experiences in a approach that provides them solely what they should know (in essence serving to them to really feel assured of their selections) means we are able to supply a extra bespoke service.

Why do you take pleasure in utilizing new experiences?

I like the brand new experiences as a result of they’re a lot extra customisable than Xero’s older experiences. Particularly, I like the extra filters on the Account Transactions report, and I’m thrilled concerning the capability to pick out accounts with zero balances. Each new organisation I’m going into, my private behavior is favouriting it so I’ve easy accessibility to it as a common ledger. I additionally use it to search out points in reconciliations and spot-check the small print specifically accounts. It’s really easy now to drill into the unique transaction in a brand new tab, and as soon as fastened, the unique report updates with a single refresh.

Along with this, I’m having fun with the brand new sidebar on the P&L and steadiness sheet experiences, and naturally watermarks. We regularly get requested to supply draft financials for the financial institution’s use, the place the year-end work isn’t prepared but. Prior to now, we’ve needed to buy extra software program to export the PDF and add a ‘draft’ watermark earlier than sending it on. Now, we are able to do it inside Xero, and simply add it to our doc packs.

I often spend hours educating each workers member learn how to manually add in ‘Complete’ and ‘YTD’ columns (after which reteaching them once more once they inevitably overlook), so with the ability to merely tick a field for this column to show has been a lifesaver. My very own, and I’m positive many different bookkeepers, aren’t concerned in one of these reporting repeatedly, so that they shouldn’t really want to recollect learn how to customise to this extent.

How do new experiences make your observe extra environment friendly?

It’s a lot simpler now to achieve efficiencies in our observe by creating report templates that we’ve customised for our wants, like BAS packs, which we use to facilitate a straightforward evaluate of BAS prep work by our supervisors. With out them, we’d must cost a lot increased charges to our purchasers due to all the time we’d spend on creating Excel templates, or paying for different apps that enable us to do it to our necessities.

In all honesty, I don’t understand how a observe can present recommendation to a shopper with out detailed experiences, given every shopper has such totally different wants. With out seeing the element customisation presents, I feel there’s potential for issues to be missed and incorrect assumptions acted upon, and naturally, if incorrect data is offered to the tax authority, the monetary implication of this may be important. With the ability to customise (and save configurations of) experiences signifies that we are able to arrange reporting as soon as, tweak them if wanted, after which get the proper data every time that report is rerun.

General, new reporting has offered me with faster entry to solutions, extra highly effective customisation and higher streamlined monetary evaluation. Should you’ve not already tried the brand new experiences, I’d positively suggest giving them a go.