This story is revealed in partnership with The 74, a nonprofit, nonpartisan information web site overlaying training in America.

Seven years after college students from a small, suburban Rhode Island highschool efficiently advocated for the adoption of statewide financial-literacy requirements, lawmakers have made proficiency in private finance a requirement for highschool commencement starting with the category of 2024.

Signed into regulation by Gov. Dan McKee on June 1, the requirement carries a Dec. 31 deadline to develop and approve state-specific consumer-education and personal-finance requirements. By the beginning of the 2022-23 college yr, all public excessive colleges in Rhode Island should supply a course aligned with these requirements.

“It’s totally aggressive to get these requirements up and operating within the timeframe that we now have set out, however we all know that it is actually essential,” mentioned state training Commissioner Angélica Infante-Inexperienced. One motive: On common, Rhode Island graduates have the second-highest student-loan debt of any state, at $36,193.

Having met with college students statewide who felt they weren’t ready to go on to varsity, and given the pandemic’s affect on pupil engagement, the commissioner mentioned this second was the time to solidify what that they had constructed momentum behind for years.

“[Students] felt like this was one thing that they had been being shortchanged [on]. So we made it a degree to push this agenda.”

Rhode Island accepted the nationwide Council on Financial Training requirements in 2014. On common, solely about 5% of Rhode Island college students obtain financial-literacy training, based on the state training division; till now, colleges may select whetherto undertake the curriculum.

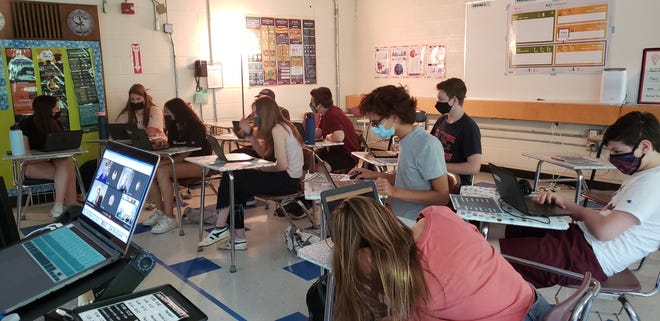

Final yr, East Greenwich Excessive College senior Saloni Jain took a personal-finance course in a hybrid studying setup, with three days of studying on-line. She mentioned course simulations similar to finishing mock income-tax returns on TurboTax and making a budgeting spreadsheet, stored her engaged throughout digital studying.

“We had been getting paychecks — how can we put that cash in direction of a 401(ok) and pay all our payments and pay down our bank card or pupil mortgage debt? That was actually useful to visualise, you recognize, how we’d stay sooner or later,” Jain mentioned. “It was only a one-semester course, nevertheless it actually modified the best way I feel so much.”

Monetary literacy: Antidote to poverty?

Nationally, 21 different states have some model of economic literacy requirements, which can be integrated into math or civics lecture rooms; solely seven require {that a} standalone, full-semester course be accomplished earlier than commencement.

In 2021, greater than 25 states have launched payments strengthening personal-finance training. Advocates contend that literacy is essential to breaking cycles of poverty, significantly because the youthful era offers with financial fallout from the pandemic. When loans, budgeting and debt administration are explicitly explored in the course of the college day, younger persons are uncovered to life-changing data as they head into maturity.

A 2018 examine from Montana State College researchers confirmed that financial-literacy commencement necessities end in decrease credit-card balances, much less high-interest pupil mortgage debt for lower-income college students and decreased use of personal loans for higher-income college students. Working- and lower-class college students who took financial-literacy programs had been additionally capable of work much less whereas enrolled in school, which may encourage school persistence and commencement. Increasing entry to personal-finance programs may help scale back racial wealth gaps and help homeownership down the road.

Even inside states thought of to have the strongest requirements and necessities, college students search extra real-world connections to arrange them for the longer term. Whitman Ochiai, who just lately graduated from highschool in Alexandria, Virginia, described his necessary course as “extra broad than it was deep.”

Left questioning about retirement selections, constructing a balanced price range and the instinct behind giant purchases, he began the MoneyEd podcast in 2019 to discover these matters. He mentioned there’s been elevated curiosity all through the pandemic, possible with extra college students working and households dealing with financial uncertainty.

“Loads of occasions the one individuals who have entry to this data are the individuals who would have had entry to it anyway,” Ochiai mentioned. “Particularly for first-generation college-goers and college students, and fogeys that will not be householders, it is a pathway for them to have a deeper understanding of finance.”

In RI, a scattershot method till now

Some Rhode Island lecturers have created elective programs of their colleges lately, heeding college students’ needs and seeing how monetary literacy might allow connections to hard-to-grasp ideas like compounding curiosity. However till now, funding and implementation was left to particular person lecturers or colleges to prioritize.

Samantha Demairias teaches math, monetary literacy and pc science at Central Falls Excessive College. She hopes the laws will open the door to monetary help from the state for credentialing and hiring, constructing extra capability to show the topic.

In any other case, she mentioned, “there’s going to be disproportionality between the districts which might be capable of shimmy round their budgets or their employees and make it work and the districts which might be weighted below all of those different issues.”

Demairias teaches about three sections of finance per yr; enrollment is all the time on the upper facet even with its elective standing, at about 25 to 30 college students per class. This fall, she’ll additionally train a bit for English-language learners to introduce college students to American cash and credit score methods.

“Should you take pleasure in studying one thing right now, unfold that information and discuss it with your mates. There is no motive why speaking about cash must be this taboo topic,” she tells her college students.

Advocates say that personal-finance training offers a possibility for college students to interrupt down stigmas about cash conversations earlier than they head into giant monetary selections similar to pupil loans, automotive possession and credit-card debt. Classes discovered may additionally make their means house and help households dealing with financial challenges.

“I take a look at the state’s implementation of this assure of a monetary training as kind of being a gateway to some significant engagement with households,” mentioned Pat Web page, a enterprise educator and vice chairman of the Rhode Island JumpStart personal-finance coalition.

Web page, a former Rhode Island trainer of the yr, has been a vocal advocate for broader monetary training for years and was one of many first within the state to show a standalone course. She supported college students, together with Sunny Sait, in testifying to the state legislature concerning the want for broader monetary training — in 2014, 2019 and once more this yr.

Seeing cash as one thing to take a position

Although Sait took Web page’s class two years in the past, he mentioned he nonetheless makes use of the ideas day by day. Now in a spot yr after graduating final spring, he’s opened up a Roth IRA and budgets his internship paycheck to verify he can nonetheless afford issues he loves, like karate.

“My mindset undoubtedly shifted somewhat bit from considering of cash when it comes to issues, however as an alternative considering of cash as a way for progress, saving and investing. I actually had my focus shift from buying, like being a shopper, to changing into an investor.”

Treasurer Seth Magaziner, who started his profession as an elementary college trainer and is at present a candidate for governor, helped introduce the laws on financial-literacy training.

“The strongest advocates, who labored very laborious to get this invoice handed, had been lecturers and college students — college students who very a lot needed this to be taught, and lecturers who’re prepared to show it,” mentioned Magaziner.

The treasurer and training commissioner each see the regulation’s signing as part certainly one of making a broader monetary literacy panorama within the state, and their hope is to broaden classes to center and elementary grades. The training, Magaziner says, will make a specific distinction in Rhode Island.

“We do have a big, rolling immigrant inhabitants, college students who’re English-language learners. We now have one of many highest poverty charges within the Northeast. Monetary training just isn’t a panacea, it is not a cure-all, nevertheless it is a crucial a part of the puzzle for the way we clear up these inequities and proper them.”