Nonprofit organizations have been rising their working reserves during the last yr, regardless of the pandemic, whereas experiencing different constructive adjustments, in accordance with a brand new survey.

The survey from BDO USA discovered that whereas 28% of nonprofits had lower than 4 months of working reserves in 2020, 38% of the organizations polled mentioned they now have over 12 months of extra money readily available. Different constructive adjustments cited by nonprofits included accelerated investments in expertise (60%), new service or program choices (43%), sooner decision-making (43%) and an elevated consciousness of their mission (43%).

The pandemic initially stretched the funds of many charities and nonprofits that had been pressured to reply shortly to the unfold of the pandemic in early 2020, however donors supplied an outpouring of help. Authorities reduction packages just like the Small Enterprise Administration’s Paycheck Safety Program and Financial Harm Catastrophe Loans, together with financial affect funds, additionally aided many organizations, each not-for-profit and for-profit, and gave their contributors who had sufficient of a monetary cushion extra money to spend on their favourite causes.

“There was an inflow of capital nearly by no means seen earlier than within the nonprofit business,” mentioned Adam Cole, nationwide co-leader of BDO’s nonprofit and schooling apply. “Most of the organizations took benefit of this chance to recapitalize and reprioritize in order that they might actually have a dynamic group post-pandemic.”

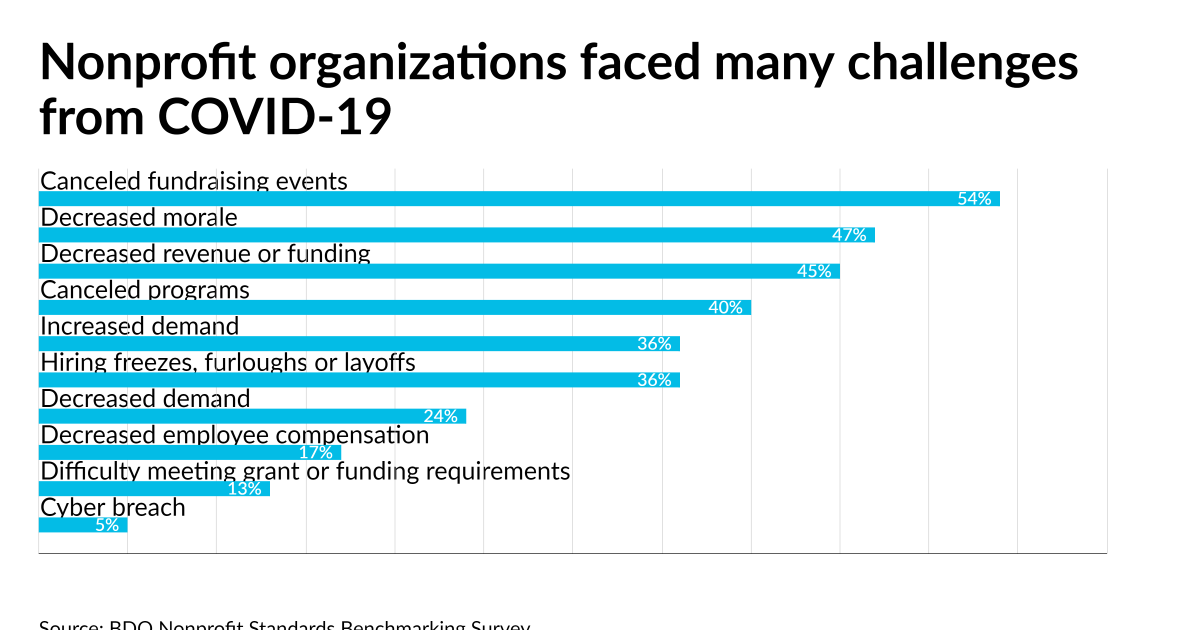

Nonetheless, nonprofits confronted many challenges from the pandemic, and the survey discovered that over half (54%) of them needed to cancel their fundraising occasions because of COVID-19, and 47% skilled decreased morale, 45% noticed decreased funding, and 40% needed to cancel packages. That was regardless of the 36% who noticed elevated demand for his or her companies. One other 36% needed to impose hiring freezes, furloughs or layoffs, 17% needed to decrease worker compensation, 13% had problem assembly grant or funding necessities, and 5% skilled cyber breaches.

The canceled fundraisers could have been a blessing in disguise, as organizations took benefit of videoconferencing companies like Zoom to carry on-line advantages that price a lot much less cash than renting out an costly venue and paying for the catering employees.

“A lot of the fundraising and outreach that a variety of the organizations did, they did much more as a result of they might do it just about electronically,” mentioned Cole. “They had been in a position to do extra and at subsequent to no price to arrange and execute these occasions. Many of those occasions have very slim margins. They’re about branding, getting folks collectively, and educating them on the occasion. Most of the organizations diminished the price of elevating {dollars} and ended up elevating web extra {dollars} because of this. Earlier than, lots of them had been on junk mail and now they’re on Zoom, Groups and Google Meet calls regularly. With all people taking a look at their telephone all day and on their computer systems, they’d a extra captive viewers.”

Nonprofits nonetheless have been dealing with many challenges in coping with the human toll from the pandemic. “Quite a lot of the organizations had been first responders, both as a result of they had been well being care or human companies organizations, so the demand for his or her companies really elevated,” mentioned Andrea Espinola Wilson, who co-leads BDO’s nonprofit and schooling advisory companies apply. “Organizations handled an incredible quantity of uncertainty of their funding and the best way that they sometimes fundraise. However what we noticed was that organizations had been dramatically resilient within the face of the ever-changing panorama of COVID.”

Authorities packages aided many nonprofits. “We noticed that 69% of organizations accessed some form of CARES Act or pandemic-related federal funding,” mentioned Wilson. “That’s a really excessive quantity. Primarily that was attributable to the PPP. That considerably impacted the monetary sustainability of those organizations, particularly in the course of the first yr of the pandemic.”

Nonprofits which have managed to construct up their reserves might want to consider acceptable methods to make use of the funds to serve their mission, and accountants can assist their shoppers with recommendation. “Take into consideration how organizations can put that to greatest use,” mentioned Wilson. “Within the survey, about 60% of organizations mentioned they had been rising their funding in expertise. It actually was a time of the haves and have nots. Should you had been reliant on guide processing in these early days of the pandemic, it was actually exhausting so that you can shut your books, ship out payroll and what not. We see that organizations are taking the time and investing in expertise. We’re additionally attempting to steer them in a course of eager about what’s subsequent. Now we have to take heed to donor fatigue. When the pandemic first began, it was very apparent that particular person contributors rallied round organizations, particularly those who needed to shut their doorways. Take into consideration museums and live performance halls and issues of that nature. However particular person donors actually get fatigued and say, ‘Hey, you need to determine it out after a time period.’ So our recommendation to organizations is de facto to proceed to be agile, and proceed to make use of your expertise and knowledge in that decision-making course of.”

The administration groups and boards of trustees of many nonprofits need to see how they’ll plan forward higher if they’ve managed to build up better reserves and are taking a look at methods to use the funding throughout a time when it could be more durable to retain staff at a time when jobs are plentiful and wages are going up, tempting many employees to vary careers.

‘“Traditionally, many nonprofit organizations are based primarily based on a grassroots trigger, and what differentiates them from industrial enterprises is that they often begin with a variety of sweat fairness and never a variety of capital,” mentioned Cole. “Between the federal funding and a number of the different will increase by state and native governments, many organizations had been in a position to recapitalize, which is clear within the enhance within the quantity of organizations with better reserves. A few of them had been properly ready as a result of they’d a capex finances for expertise and a deal with these forms of issues. Now they’re considering, what’s subsequent? What can we do with funding in {dollars} in packages and other people, possibly to offset a few of these inflationary prices by producing programming and fundraising occasions with a better margin due to the truth that chances are you’ll not want as many people working that. What can we do in a different way? How can we do that at a special price? In lots of human service organizations, they’re competing for direct-care employees in opposition to Walmart and Amazon and lots of different organizations which might be paying $18 or $19 an hour plus advantages for warehouse work and different issues. A number of the organizations had been two or three years forward of this cycle and had been already doing a few of this, however for a lot of, it was lesson in transferring ahead.”