The to-do record for company audit committees retains increasing, with members taking over new obligations in overseeing cybersecurity, ethics and danger administration, in response to a brand new ballot.

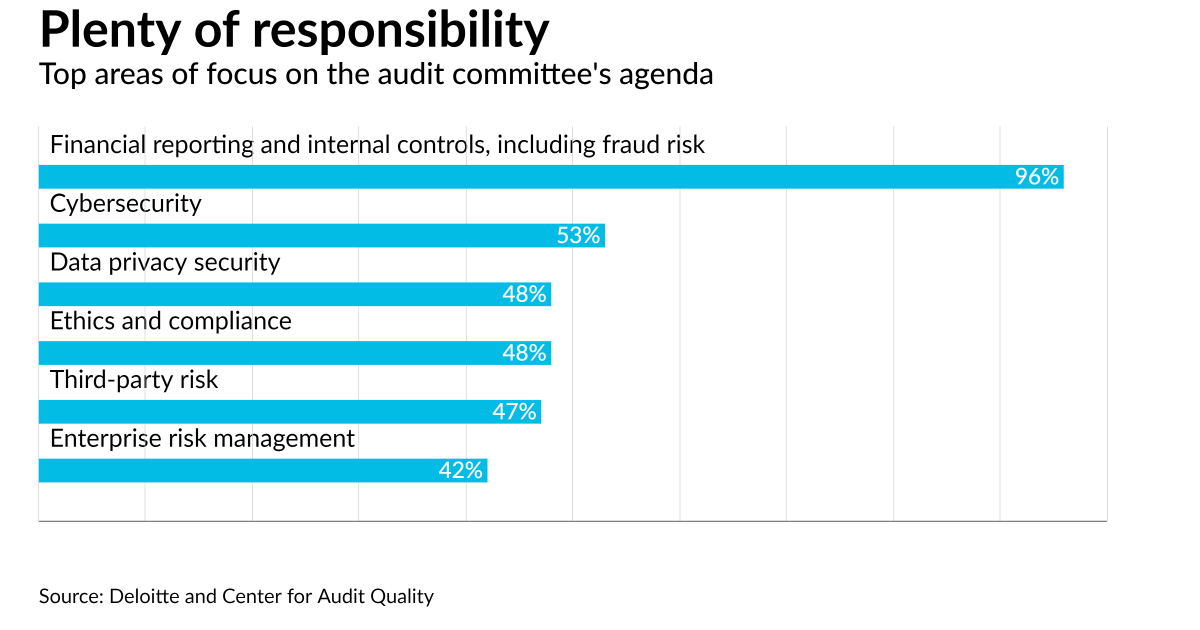

A report, launched Tuesday by Deloitte’s Heart for Board Effectiveness and the Heart for Audit High quality, based mostly on a survey of 246 audit committee members largely at giant public corporations, discovered that whereas practically all of the respondents (96%) rank monetary reporting and inside controls — together with fraud danger — as a prime space of focus, audit committees are additionally now coping with cybersecurity (53%), knowledge privateness safety (48%), ethics and compliance (48%), third-party danger (47%) and enterprise danger administration (42%).

Auditors and the audit committees that oversee their work want to concentrate to a better number of dangers in the course of the pandemic at a time of rising inflation and provide chain constraints.

“Audit committees are essential to high-quality monetary reporting that’s in flip essential to functioning capital markets,” mentioned CAQ CEO Julie Bell Lindsay in an announcement. “This report supplies useful insights for audit committee members searching for extra details about their friends’ main practices. “Because the audit surroundings continues to evolve, we encourage audit committees to grasp their function in overseeing danger areas and rising points.”

Audit committees are more and more including cybersecurity expertise/experience, in response to the report. Multiple-half (53%) of respondents mentioned they’ve oversight accountability for cybersecurity, and 69% of these anticipate spending extra time on it within the coming yr. On the similar time, 35% of respondents reported their audit committee members have cybersecurity expertise/experience, with 41% acknowledging they wanted further experience on this space – greater than some other space. Forty-two % of respondents indicated fraud danger has grown. As well as, 74% mentioned they up to date their inside controls prior to now 12 months to deal with the distant work surroundings.

“Audit committee oversight and the company governance panorama is evolving quickly and turning into more and more demanding, and that’s even earlier than contemplating the expansion round ESG reporting,” mentioned Krista Parsons, audit and assurance managing director with Deloitte’s Heart for Board Effectiveness, in an announcement. “The excellent news is most audit committee respondents acknowledge their main obligations, which embrace oversight of economic reporting, inside controls, and the impartial auditor. The problem sooner or later is sustaining this concentrate on their core obligations whereas addressing rising dangers and potential new areas of oversight. On the finish of the day, the audit committee doesn’t essentially have to oversee all new dangers. In some situations, the complete board or one other committee could also be higher positioned to take action, and the audit committee chair can drive these discussions with the board chair.”

Oversight of enterprise danger administration differed, however many survey respondents (42%) indicated the audit committee is chargeable for overseeing ERM at their corporations. Of these chargeable for ERM, 32% mentioned they anticipate to spend extra time on ERM oversight within the subsequent yr.

As well as, environmental, social, governance issues are getting the eye of audit committees. Two-thirds (66%) of the respondents indicated their firm issued a sustainability or ESG-related report, and 69% obtained or are actively discussing acquiring third-party assurance on a number of parts of ESG or sustainability knowledge. However, solely 10% of audit committee members indicated they’ve oversight accountability for ESG reporting.