Paul Zimmerman/Getty Photographs Leisure

Virtu Monetary (VIRT) is an attention-grabbing firm. It isn’t that previous, not a lot of a historical past to the inventory or its dividend, but it surely’s come far in a really quick time.

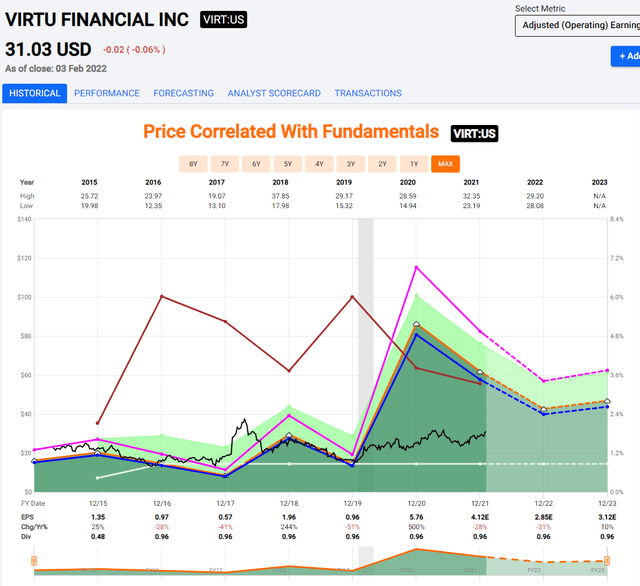

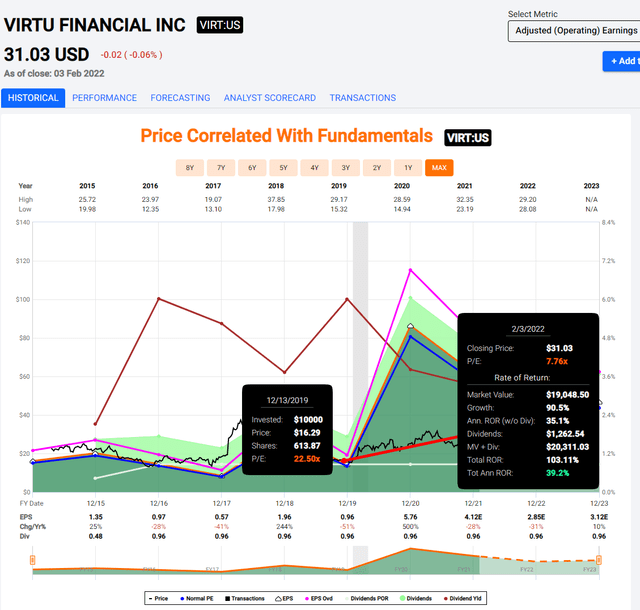

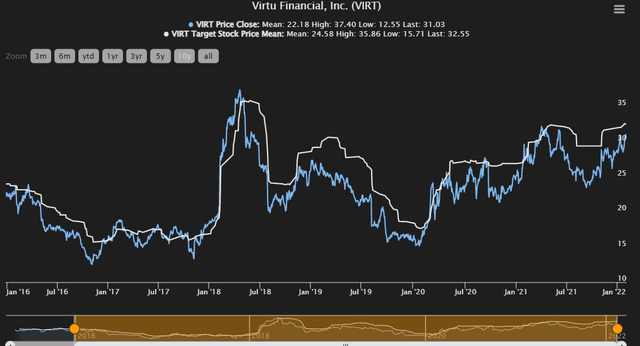

An funding in Virtu would have principally saved tempo lock-step with the market, at 8-year returns of round 7.6% on an annualized foundation. Nothing to write down residence about on that entrance – however there are underlying developments that may make this 3.1%-yielding Banking/brokerage inventory attention-grabbing to you.

As all the time, it is about understanding.

So, let’s first perceive Virtu Monetary.

Virtu Monetary Brand (Virtu Monetary)

Virtu Monetary – Understanding the corporate

Fundamentals first, as a result of I am pretty positive most readers could have little or no thought what Virtu monetary truly does.

The agency is described as “leveraging innovative know-how to ship liquidity to the worldwide markets and progressive, clear buying and selling options to our purchasers.” This tells us just about nearly nothing.

What does a “market maker” do?

A market maker similar to Virtu supplies what’s referred to as “deep liquidity” to securities, similar to shares. In Virtu’s case, for 25,000 securities in 36 international locations. On a excessive stage, the corporate supplies monetary providers, buying and selling merchandise and market-making providers. These market-making providers are, amongst different issues, offering quotations and providers to patrons and sellers.

Primarily, Virtu affords the power for purchasers, via know-how and its liquidity and merchandise, to commerce. They provide this in over 50 international locations and throughout a number of courses of property, together with however not restricted to world shares, ETF’s, International exchanges, futures, mounted revenue, and different commodities.

The corporate affords submit and pre-trading providers that assist purchasers commerce in addition to handle their danger throughout world markets.

Virtu Monetary does this with proprietary know-how and what they see as a low-cost construction, which supplies the potential for scale.

So, the corporate’s income is made by commissions, charges, and execution/market-making providers. A dealer utilizing Virtu Monetary is paying for the providers, for the liquidity, for trades, and so forth. The corporate additionally makes cash on the bid/ask unfold after they purchase/promote securities.

Virtu is extraordinarily tech-heavy. As talked about, the corporate has developed what they name proprietary multi-asset, multi-currency know-how platforms which is built-in instantly with exchanges, liquidity facilities, and purchasers. Virtu’s merchandise work together with a whole bunch of retail brokers, registered advisors, personal shopper networks, sell-side, and buy-side establishments.

The corporate reviews in two segments which work as follows:

- Market making focuses on money, futures, choices mounted revenue, FX, and commodities throughout the worldwide market. Virtu monetary needs to supply probably the most cost-effective liquidity and value competitors in its markets. The corporate commits its capital by providing to purchase/promote securities to banks, brokers, and establishments. The corporate additionally operates within the OTC market. The corporate states it makes the markets extra environment friendly by standing able to, at any time, purchase/promote substantial quantities of anybody safety of their geographies. Virtu trades Global Equities, International Fastened Earnings, Currencies, Commodites, Choices, and “different” merchandise. The corporate’s world groups survey and monitor the markets and techniques 24 hours a day, 5 days every week in places of work all over the world.

- Execution providers concentrate on offering clear buying and selling, together with issues like execution-only buying and selling performed via Algo buying and selling, principal buying and selling, and utilizing applications/software program to match shopper orders with the market. It affords workflow know-how via broker-neutral buying and selling instruments throughout the globe (Order/execution administration) and it additionally affords buying and selling analytics, enabling merchants to enhance pre-trade analytics and execution efficiency. It additionally permits portfolio development, optimization, and valuation providers.

Shoppers embrace mutual funds, pension plans, hedge funds, trusts, dealer offers, banks, and the like. Virtu’s client-side publicity is well-managed, with lower than 10% from anybody singular shopper.

On a really excessive stage, Virtu Monetary is a major beneficiary of a risky market. It is because, in a risky market, the ask/bid spreads widen, and with uncertainty comes better income. That is additionally why, when taking a look at firm revenue developments, risky markets have the potential to 4-5X firm earnings in a really quick time, just for them to go straight again down as soon as the market calms down. It provides them an almost-cyclical character, however with an “anti-cyclical” part, whereby they transfer the precise reverse as some cyclical shares which go down in volatility and up instability.

Which means that there’s excessive significance for the corporate’s providers that are not reliant on market volatility to make cash – similar to charges not centered on commerce, however on merchandise/providers exterior of the market, with the intention to cushion a few of these ups and downs.

Virtu monetary, on a excessive stage, has what I might think about being sub-standard fundamentals. The corporate has round 44% debt/cap and is rated solely at a BB-, effectively inside junk territory. At a market cap of round $5.7B, it isn’t all that massive to a few of the larger banks and brokerages on the market. Nevertheless, its dividend of three.1% is well-covered for the foreseeable future, and in 2020 it had a payout ratio of lower than 20%.

It is necessary to say, nevertheless, that Virtu monetary lacks any direct public competitors, a minimum of insofar as its full suite of product choices go. Particular person merchandise do compete, however not the verticality of the corporate’s choices. There are market-making corporations that do compete with Virtu, and these embrace Broadridge Monetary (BR) and Corelogic (CLGCX) in addition to corporations like Citadel Securities, Two Sigma, and so forth. To be frank with you, Broadridge is round 5 instances as giant as Virtu, and Corelogic is about twice as giant when it comes to valuation and market cap. Broadridge is even BBB+ rated. So whereas there are specific arguments why Virtu’s merchandise are pretty distinctive and Virtu is a market chief in high-frequency buying and selling, dealing with round 1/fifth of the day’s quantity, the competitors for Virtu is fierce. The excessive capital prices from growing these applied sciences forestall anybody with out deep pockets from getting into the market, and this does present some safety from competitors.

So, that’s what Virtu Monetary does, who it competes with, and the way the corporate makes its cash. From a monetary perspective, its revenues movement primarily from buying and selling revenue revenues and commissions, and its bills are totally on the brokerage facet (clearance charges, funds for order flows, and so forth). The corporate’s EBITDA and working margins have been very risky. Pre-pandemic numbers at round 60% on an adj. EBITDA foundation, right down to lower than 45% in 2019, as much as 72.6% in 2020.

The corporate’s revenue is extremely tilted in the direction of market-making, with over 70% of the adjusted internet buying and selling revenue flowing from market-making. This implies, and confirms the corporate’s reliance on the every day movement of the market, and the volatility discovered therein. Whereas execution providers do see volatility as effectively, Market-making buying and selling revenue nearly tripled in lower than a yr going into 2020. The implications listed here are clear.

Latest outcomes have are available in at comparatively good ranges, however there is not any serving to that present market developments don’t equate these of early 2020-2021. 2021E is predicted to be a serious EPS-negative yr for the corporate – dropping round 28%, although that is after a large 500% EPS progress in 2020.

Virtu Monetary EPS Tendencies (F.A.S.T graphs)

Different forecasts from S&P International verify this general analyst view, and I concur. I count on EBITDA and EPS to drop a minimum of 20%, and doubtlessly as a lot as 28% throughout this yr, and I count on the 2022E development to be destructive as effectively, based mostly on present developments in rates of interest and fund flows available on the market.

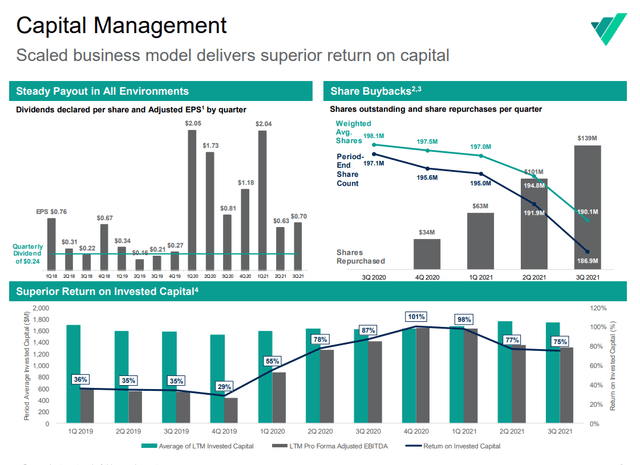

The corporate has reported some good financials, diminished debt, good general EBITDA, and a margin that is near the 60% of an adjusted EBITDA stage. Virtu can be shopping for again inventory, as much as $750M of it with an enlargement of the already-finished repurchase program. Virtu has purchased again and retired greater than 7% of its float, which is necessary to think about when viewing valuation.

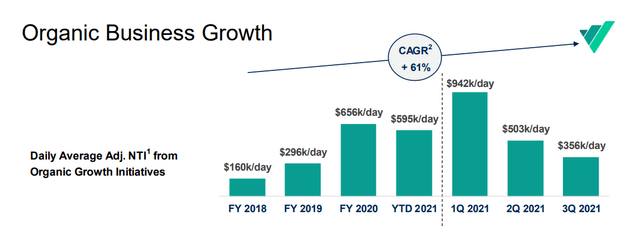

Nevertheless, nothing can change the basic indisputable fact that Enterprise/order progress is declining. It could be up considerably on a long-term foundation, however the peaks of 2020-2021 are over.

Virtu Monetary 3Q21 (Virtu Monetary IR)

The corporate’s return metrics usually are not o be trifled with, with record-high ROIC, buybacks, and good payouts.

Virtu Monetary Returns (Virtu Monetary IR)

We have seen a vastly altering dynamic over the previous 2-Three years. Retail movement within the US alone makes up for 20% of the full market quantity, and with commission-free retail buying and selling made doable throughout a number of venues regardless of wholesalers being required to commit capital or sourcing liquidity externally, the underlying market circumstances for market makers like Virtu are good. It is also extraordinarily useful to US retail traders. There may be an estimate from Schwab (SCHW) that Trade buying and selling charges alone would have been near $1B in 2020, for Schwab alone, if that they had charged it. There are clear flaws at present available on the market, which Virtu are mentioning, and which may enhance issues when it comes to wholesalers/retail brokers. Now, these are what I might think about extraordinarily superior investing ideas – so in case you’re enthusiastic about these, I can suggest the corporate’s filings and materials – however we cannot delve deeper into them right here.

Let’s simply say there are potential efficiencies to be made.

Virtu believes that the mixtures of its median through-cycle earnings, with natural enterprise progress and its return on capital administration, will have the ability to drive progress, dividends, and share repurchases. I don’t disagree fully with these assumptions – I simply do not suppose they maintain the identical validity as they did when the market was extra risky, and I do not suppose that Virtu can transcend its reliance on market volatility as an revenue driver.

The explanation that Virtu Monetary “received” in 2020, is that it quotes purchase/promote costs for shares and securities that it trades, and earns on the spreads. When there is a greater demand for liquidity, high-frequency buying and selling corporations like Virtu do extraordinarily effectively. They’d not like me as a shopper, as a result of I do possibly 2-5 trades monthly. That is it.

I am not sharing any “secret sauce” by telling you the enterprise is cyclical and Virtu does not carry out effectively in easy waters. Anybody with eyes can see that by taking a look at any sheet. Earnings drops and income drops throughout these circumstances are meteoric of their character. For example, Virtu monetary was down 38% when the S&P was up 28%.

It is honest to say that Virtu Monetary has a excessive historic correlation to the CBOE Volatility Index (VIX). Nevertheless, on the identical time, Virtu has been making an attempt exhausting to easy out its curves and a few of these developments via diversification into Execution providers. They purchased ITG again in -19, and so they’re beginning to actually drum up enterprise for these items.

Sadly, as I see it, historical past is a harsh instructor on the subject of investing on this enterprise.

The valuation

We’re shifting right down to earth. Let’s recap.

Virtu Monetary is a junk-rated (BB-) Banking/brokerage agency with a concentrate on high-frequency buying and selling. It at present depends closely on market volatility to make outsized returns. Barring these market circumstances, Virtu has carried out very poorly, and its historic returns on an 8-year foundation don’t beat the market. It has a 44% long-term debt/cap, and its share value over the previous few years has been bolstered by shopping for again greater than 7% of shares excellent in beneficiant buyback applications – that are persevering with.

For those who’re unfamiliar with the high-level impacts of share buybacks, let me shortly let you know, that the boosts this motion provides to ratios like EPS, RoA, RoE are not due to a sudden enhance in profitability. It isn’t due to revenue progress. Share buybacks may give unrealistic footage of an organization, portray a really rosy view of the financial actuality.

The hazard that I see in Virtu is strictly what I mentioned. It is a BB- rated firm in an earnings excessive, shopping for again extreme quantities of shares to maintain that “sugar excessive” going for so long as doable. Whereas I am positive there are different causes for this, and from a 2-Four yr EPS common, Virtu bulls will argue that the corporate is “low cost” right here, I preserve my stance that we’re seeing a too-high valuation for the corporate distorted by giant quantities of buybacks.

Moreover, the present timing the place we’re simply shifting out of a really risky, earnings-high interval for Virtu might be one of many worst instances in historical past to purchase Virtu Monetary.

When can be a great time to purchase Virtu?

Just about a day after a crash.

F.A.S.T graphs Virtu Monetary Historical past (F.A.S.T graphs)

As you’ll be able to see, shopping for the corporate after we count on huge spikes in worry and high-frequency buying and selling will be a wonderful thought. Nevertheless, at present ranges, I’ll argue with you that the FactSet forecasts for the corporate, regardless of their positivity, don’t matter.

The analysts have worse accuracy than a coin toss (10% MoE) and have, on a 6-year foundation, not as soon as managed to forecast firm EPS inside a 10% margin of error precisely. it is both under (60%) or above (40%). This makes the forecasts as risky as the corporate’s earnings, and they need to, in my opinion, barely be thought-about indicative.

Given its junk score standing, I’ll low cost Virtu closely. I’ll settle for that Virtu’s EPS could stabilize at greater ranges than pre-pandemic, and can low cost S&P International 2023E by 10%, reaching round $2.6/share, which is considerably greater than 2018 and contains a few of the constructive issues for the corporate’s long-term progress, however I will not need to pay greater than 10X P/E for such an organization, given the volatility and reliance on a few of these developments. This displays the corporate’s short-term earnings a number of. Due to this fact, I might value Virtu at round $25-$26/share, which is a big low cost to analyst averages, and consistent with the analyst goal vary lows for the corporate (Supply: S&P International). I’ll level to historic analyst developments, which have a historical past of round 10-15% overvaluation for the goal imply right here.

Virtu Monetary S&P International Targets (S&P International/Tikr.com)

It is necessary to notice that I would not essentially purchase Virtu at these valuations both. Due to its risky developments and poor credit standing, I might desire a greater yield earlier than investing, as different options available on the market give me much better conservative upside potentials than Virtu does.

Attributable to this, I name Virtu a “HOLD” with a $25-$26 PT vary, and never a essentially enticing choice even then.

Thesis

My thesis for Virtu is:

- The corporate is an attention-grabbing market maker, and one of many main high-frequency ones on the planet. On the proper value, it will be enticing.

- Nevertheless, the way in which its earnings movement and its reliance on VIX make this incompatible with what I see as my funding method. I might “HOLD” right here with a PT of $25-$26 – at most.

- Earning money on Virtu is feasible – however I would keep on with ridiculously underpriced-strike Put choices. For those who can seize June 2022 @ $23 strike put choices for a cash-covered put at a premium of a minimum of $0.75, you may make 9.32% annualized, which I might view as greater than anticipated from the funding till then. You’ll then be shopping for Virtu at not more than $22.25, which even I might think about attention-grabbing.

- Nevertheless, the widespread share is a no-go for me. I say “no” right here.

Keep in mind, I am all about :

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

This course of has allowed me to triple my internet price in lower than 7 years – and that’s all I intend to proceed doing (even when I do not count on the identical charges of return for the following few years).

For those who’re enthusiastic about considerably greater returns, then I am in all probability not for you. For those who’re enthusiastic about 10% yields, I am not for you both.

For those who nevertheless need to develop your cash conservatively, safely, and harvest well-covered dividends whereas doing so, and your timeframe is 5-30 years, then I could be for you.

Virtu Monetary is at present a “HOLD”

Thanks for studying.