The Nationwide Affiliation of State Boards of Accountancy and the American Institute of CPAs have launched a discover updating candidates on the transition coverage that can influence the 2024 Uniform CPA Examination.

The 2024 adjustments are a results of the brand new CPA Evolution mannequin, which goals to higher put together CPAs with the ever-changing abilities and competencies required from fashionable professionals by updating the testing curriculum on the CPA examination. NASBA and the AICPA have been fast to notice that these upcoming adjustments don’t have an effect on candidates who’ve handed all 4 CPA examination sections by Dec. 31, 2023 — solely to these pursuing licensure previous January 2024.

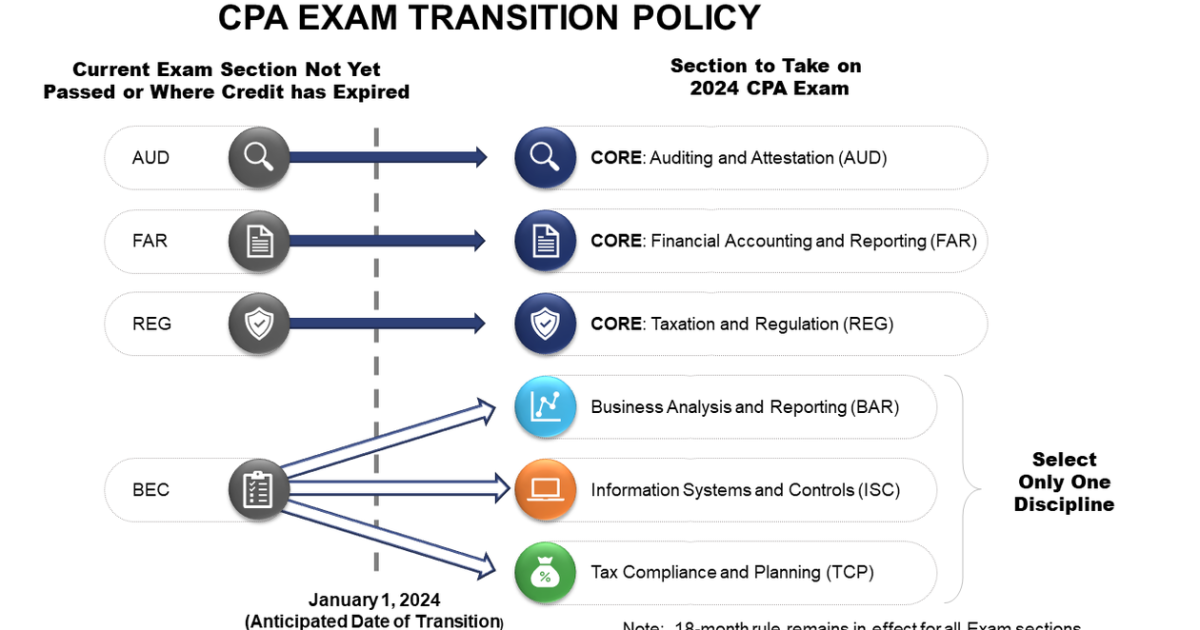

The brand new CPA examination will mirror a “Core + Self-discipline” mannequin, beginning with core testing in accounting, auditing and tax (which all candidates should full) earlier than candidates choose one among three Self-discipline sections by which to display data. CPA licensure can be awarded no matter a candidate’s chosen self-discipline; the part isn’t reflective of a lone space the place the CPA will have the ability to apply. Inside the Self-discipline part are three choices that purpose to handle core parts of the CPA occupation: enterprise evaluation and reporting (BAR), info methods and controls (ISC), and tax compliance and planning (TCP).

CPA candidates who’ve credit score for AUD, FAR or REG on the present CPA examination is not going to have to take the corresponding new core part of AUD, FAR or REG on the 2024 CPA examination. Additional, candidates who’ve credit score for BEC on the present CPA examination is not going to have to take any of the three self-discipline sections.

Nonetheless, if a candidate loses credit score for AUD, FAR or REG after Dec. 31, 2023, they’re required to take the corresponding new Core part of AUD, FAR or REG (see above). A candidate who loses credit score for BEC after Dec. 31, 2023, should additionally choose one of many three Self-discipline sections to be examined. NASBA and the ACPA word that not one of the sections of the present CPA examination can be out there for testing after Dec. 31, 2023.

“Due to the numerous variations within the present and 2024 CPA exams and the general CPA licensure mannequin, an ideal transition isn’t doable,” NASBA wrote. “The Boards of Accountancy have agreed this transition coverage greatest serves the candidates, the state boards and the general public curiosity.”

To greatest put together for the 2024 CPA examination launch, an publicity draft of the 2024 CPA examination can be made out there by the AICPA on July 1, 2022, and can define the content material and abilities proposed for every part of the 2024 CPA examination. The 2024 CPA Examination Closing Report, which can mirror the ultimate examination blueprints, is scheduled to be launched in January 2023.

For extra info on the CPA examination transition coverage, NASBA has arrange a FAQ web page on its website right here.