What many tax preparers have usually suspected seems to be true: The choice to make use of both DIY software program or a paid skilled comes right down to, principally, price versus accuracy, in response to a latest examine.

A examine lately revealed within the American Accounting Affiliation’s journal Accounting Horizons finds that what motivates a call to make use of both DIY tax software program or a paid preparer come submitting season comes right down to the particular priorities of every group, particularly price versus accuracy. Whereas each components had been cited as essential by examine individuals, those that favor utilizing DIY software program discovered minimizing prices extra beneficial, whereas those that favor a paid preparer stated accuracy was their primary precedence.

The researchers — Leigh Rosenthal, Bonnie Brown, Julia Higgs and Timothy Rupert — got here to this conclusion after surveying 308 taxpayers. The pattern was break up into two teams: those that used DIY tax software program to finish their 2017 federal revenue tax return and those that used a paid skilled. From these topics, the researchers gathered details about the taxpayer’s motivation for his or her preparation mode, their consolation with know-how, and tax return and demographic info.

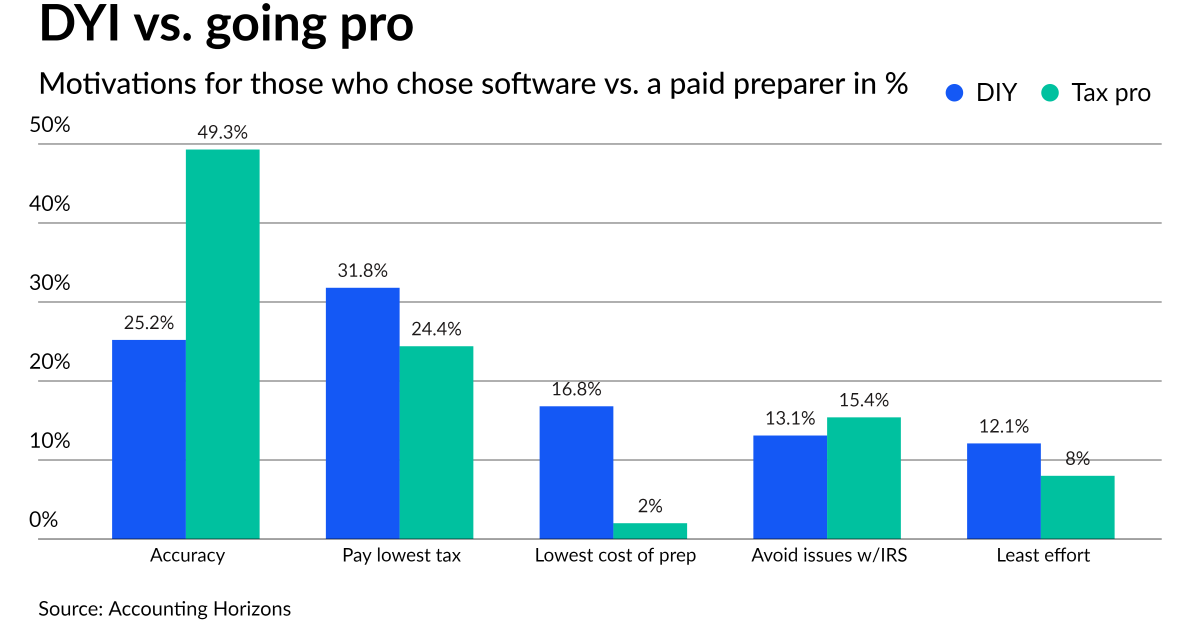

“We discover that the motivations for selecting both software program or a paid preparer differ between the teams. … when requested what the only most essential issue was for choosing their tax preparation mode, the software program group cited minimizing the quantity of taxes paid whereas the paid preparer group chosen making ready probably the most correct return doable,” the authors wrote.

The examine discovered that 16.8% of DIY tax software program customers cited minimizing prices as their main cause versus 2% of those that used a paid preparer; additional, 12.1% of tax software program customers stated their main cause was minimizing complete effort, in distinction to the 8% of paid preparer customers who did so. The researchers expressed some shock at this, saying that utilizing tax software program would appear to require extra effort than paying somebody.

Past motivation, the researchers discovered different components that predict whether or not somebody can be extra possible to make use of DIY tax software program versus a paid preparer. Age is one: The biggest group of DIY tax software program customers are these of their 20s and 30s, and make up 29% of software program customers. In distinction, those that favor paid preparers are usually older, with 25.4% of them being 60 or up.

Earnings is one other issue: 35.5% of those that favor DIY tax software program make between $25,000 and $50,000, versus solely 15.4% of those that use a paid preparer; of those that favor a paid preparer, 31.3% make between $75,000 and $100,000, versus solely 7.5% of those that use DIY software program.

Variations had been additionally linked to what sort of return one filed. Extra DIY software program customers had been single filers, 43.9%, whereas those that used paid professionals had been extra prone to be married submitting collectively, 48.8%. Additional, solely a 3rd of DIY software program customers filed a Kind 1040 versus half of those that used a paid preparer. When requested what supplemental schedules had been filed, 35.3% of the paid professionals group filed a Schedule Some time solely 21.5% of the DIY software program customers did so.

The examine didn’t, nevertheless, discover notable variations by way of training stage or gender.

Researchers stated the findings have implications for the tax preparation business. Given the examine’s conclusions, they urged tax software program corporations might want to spotlight instruments to attenuate tax prices, corresponding to instruments for selecting retirement contributions, deciding on amongst academic incentives, or deciding which price restoration incentives to make use of. Equally, paid preparers trying to appeal to new shoppers might want to emphasize their consideration to element and prioritization of accuracy.