Consider automation because the brawn in your enterprise or observe. Whenever you use instruments and options that do the heavy lifting of all of these little day by day to-dos, you unencumber the mind to deal with the larger image.

At Xero, we wish each buyer to say goodbye to mundane knowledge entry and good day to elevated productiveness and readability, with a set of automation instruments which can be designed to lighten the load of each a part of their workflow.

Right here’s an inventory of our current automation favourites (and a few new enhancements) to incorporate in your toolkit, providing you ease and velocity when these issues matter most.

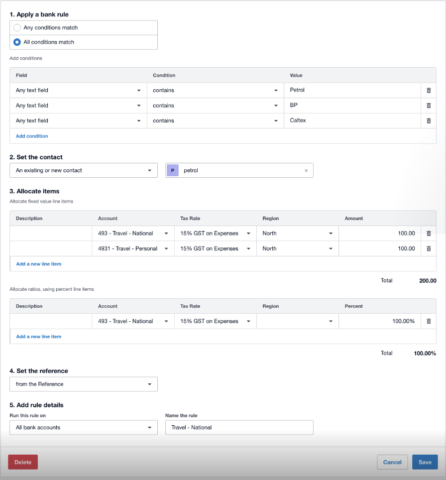

A brand new search for financial institution guidelines

Establishing financial institution guidelines is a straightforward solution to get Xero to routinely code transactions in your financial institution reconciliation display screen, based mostly on standards you’ve set. They will prevent time, cut back human error and guarantee constant coding, which suggests you may get pleasure from extra environment friendly reporting.

We’ve just lately given financial institution guidelines a brand new look that aligns with different options in Xero. It’s all a part of our work to improve the expertise that underpins our platform, so we will launch new options sooner than ever earlier than. We’ve additionally improved the performance, together with streamlining the steps to create or edit a financial institution rule, in addition to the power to modify between rule sorts with out dropping knowledge.

Highly effective, correct financial institution reconciliation

Finally, our purpose is so that you can open your financial institution reconciliation display screen and, with as little enter as doable, have an correct and up-to-date basic ledger. The progress we’ve taken to automate how simply and effectively you may reconcile represents an enormous step in the direction of this.

Final yr, we introduced that we’re constructing machine studying algorithms to energy financial institution reconciliation predictions, so we will precisely predict your transactions’ contact and account codes.

Our system suggests the who and the what of your transaction, eliminating the psychological load of getting to recollect and log on a regular basis enterprise exercise. All you’ll need to do is click on ‘OK’ to reconcile the transaction absolutely, and it’ll be coded to an account out of your chart of accounts.

Speedy bill administration

For a small enterprise, money circulation is king. However whenever you’re knee deep in every part from gross sales conferences to life admin, creating, sending or following up on invoices can simply fall to the wayside. New invoicing lets you add a layer of ease to your invoicing, which in flip, takes care of your backside line.

Options like computerized bill reminders and repeating invoices helps lighten your workload, so that you don’t have to recollect to ship or chase invoices. Including Sq. and Stripe (with Apple Pay and Google Pay) as a fee methodology in your on-line invoices may enable you to automate the method of getting paid in a means that fits your prospects’ need for a low-touch, digital fee expertise.

Velocity up invoice entry with eInvoicing

We consider that something that helps small companies and their advisors receives a commission sooner is a worthwhile endeavour, and our deal with eInvoicing (accessible in Australia, New Zealand and Singapore) automates the method of exchanging invoices with different companies and authorities departments.

Xero’s eInvoicing resolution provides close to real-time supply of invoices immediately into the recipient’s accounting software program, showing as a draft invoice to be accepted and paid. General, it’s a safer and sooner solution to ship and obtain invoices, saving you time and serving to facilitate you getting paid sooner.

When you already use Xero and are in Australia or New Zealand, sending eInvoices gained’t be too completely different out of your standard course of, and you may register to ship or obtain them proper now. When you’re in Singapore, you’ll find out extra about learn how to register utilizing Invoici from Xero.

Enhancements to Hubdoc

Logging bills is a important a part of working a enterprise or observe, however the work concerned in manually inputting these particulars has concerned a hefty time funding prior to now. After we acquired Hubdoc, we wished to make sure that its main knowledge seize expertise would assist to carry this load.

We’re persevering with to put money into Hubdoc and shall be rolling out quite a lot of enhancements quickly to enhance your expertise and proceed to enhance velocity and stability of the product. The extra options embrace the power to add HEIC/HEIF paperwork out of your iPhone, and a sooner response when typing within the Xero ‘contact’ discipline. We hope these enhancements give you larger worth from Hubdoc, so you may extract the data you want in seconds.

Finally, the extra day-to-day enterprise practices you may automate, the higher. In spite of everything, much less time on guide toil means extra productive time to deal with rising your enterprise and serving your prospects. We need to make enterprise lovely for everybody, so we encourage you to start out utilizing one (or extra) of our automation favourites in Xero immediately.