Having dominated the quarterly lists of recent Securities and Change Fee audit engagements for a lot of 2021, BF Borgers topped the rankings for the entire yr, whilst the overall variety of general new engagements — and shopper departures — rebounded from a number of years of declines.

The Lakewood, Colorado-based auditor introduced on 39 new SEC purchasers and netted 25 (see “Web engagement leaders”). Prime 10 Agency Grant Thornton got here in second, onboarding 29 purchasers and netting 18, whereas Huge 4 agency Deloitte truly added extra new purchasers, with 33, however netted 13.

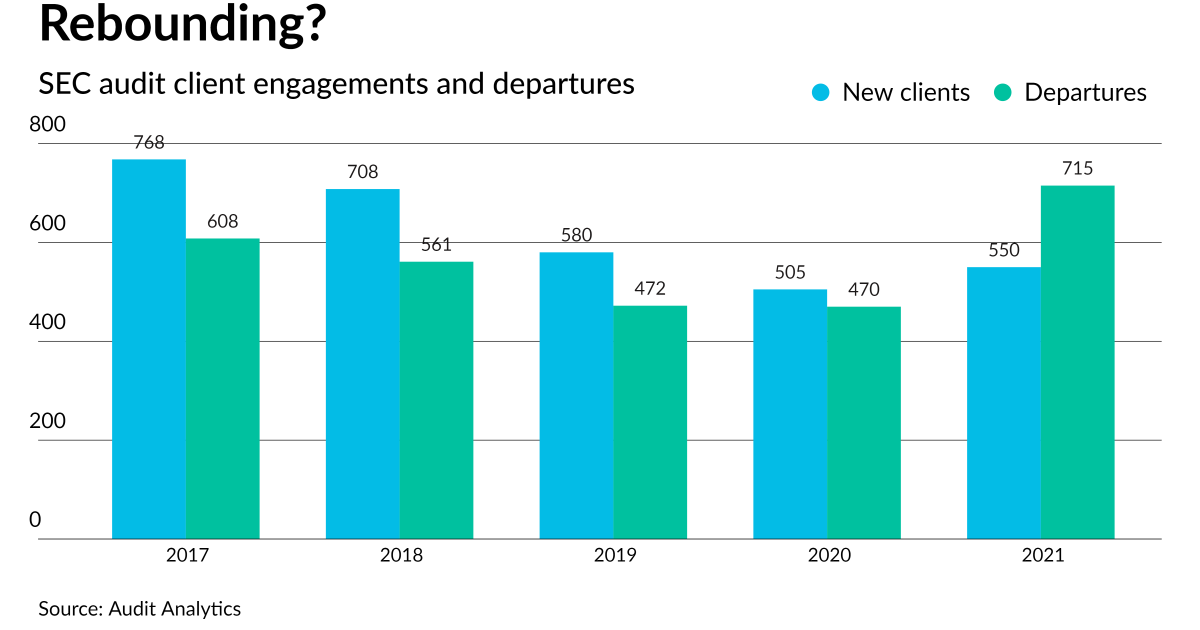

The 550 new engagements signed in 2021 marked a departure from a declining development: The quantity had dropped from 608 in 2017 to a decrease of 505 in 2020. Consumer departures additionally rebounded — and for the primary time far outpaced new purchasers, pushed by an uncommon exodus of 110 purchasers from Prime 100 Agency Marcum, which was prohibited in late 2020 by the Public Firm Accounting Oversight Board from auditing purchasers in China for 3 years. (See “Consumer features & losses.”)

M&A performed much less of a job in new engagements than it has previously, although it was not fully absent: 9 out of California-based Prime 100 Agency Macias Gini & O’Connell’s 12 new purchasers got here aboard from its January 2021 merger with Irvine, California-based Corridor & Co., whereas Baker Tilly added 4 new purchasers because of its November merger with Boston’s Moody Famiglietti & Andronico.

New engagements by sort of filer have been blended; BF Borgers took the lead amongst smaller reporting corporations, whereas Grant Thornton and Deloitte traded first and second place between accelerated and enormous accelerated filers. Singapore based mostly Audit Alliance introduced on essentially the most non-accelerated filers. (See “Audit leaders.”)

Deloitte topped all of the league tables for brand spanking new market capitalization audited, new belongings audited, with engineering conglomerate Normal Electrical, which accounted for $92.5 of the Huge 4 agency’s new market cap, $79.62 billion of its new belongings, and $61.6 million in audit charges. To provide a way of GE’s contribution, Deloitte’s next-biggest shopper — medical lab community Laboratory Corp. of America Holdings — added $19.69 billion in market cap, $13.98 billion in belongings, and $3.7 million in audit charges. (See “New shopper leaders.”)

PwC got here second in new market cap audited, with its largest single chunk — $14.38 billion out of a complete $26.01billion — coming from transportation and logistics firm J.B. Hunt Transport Companies.

Ernst & Younger took second in new belongings, with insurer American Fairness Funding Life Holding accounting for the largest chunk by far, with $71.39 billion out of whole $109.18 billion.

Because of its giant variety of new engagements, Grant Thornton got here second in new audit charges; most of its new purchasers’ charges have been $2 million or under, however restaurant gear maker Welbilt Inc. stood out with $4.69 million in charges.

Knowledge for the rankings are offered by Audit Analytics, a premium on-line intelligence service delivering audit, regulatory and disclosure evaluation. Attain them at (508) 476-7007, information@auditanalytics.com or www.auditanalytics.com.