Whereas the worth of worldwide M&A offers reached an all-time excessive in 2021 of US$4.9 trillion, up 5 per cent on 2020, quantity noticed a starker enhance.

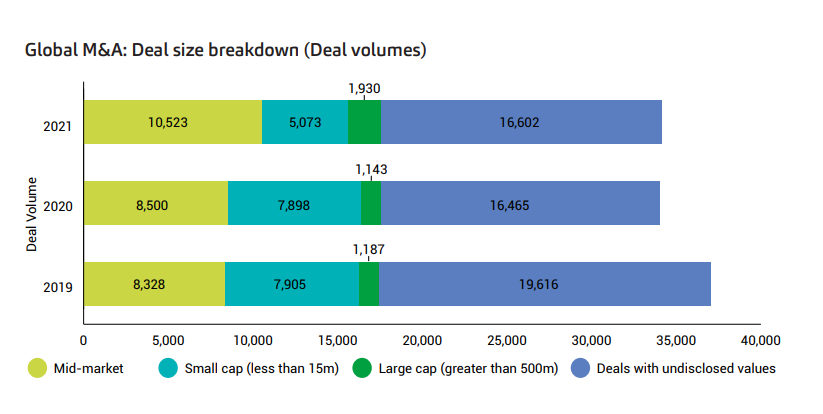

International M&A deal volumes rose to 34,128 transactions in 2021, from 34,006 in 2020, remaining beneath pre-pandemic quantity.

Mid-market transactions elevated to 10,523 from 8,500 in 2020, suggesting dealmakers are persevering with to leverage the sturdy fundamentals and observe information of companies increasing into new markets.

However even earlier than the conflict in Ukraine, dealmakers have been sounding the alarm on escalating world tensions.

Europe’s M&A restoration has been much less dramatic than in different areas, with deal totals down from 2020 and nicely beneath pre-pandemic figures. Nonetheless, deal values rose sharply, up 50 per cent to US$1.35 trillion.

Whereas the tempo of M&A picked up within the second half of the yr, as a sequence of mega offers was introduced in Europe and competitors erupted for extremely prized property, there isn’t any doubt the Ukrainian conflict will stall some dealmaking.

“The conflict in Ukraine, and the political and financial uncertainties it brings may trigger a slowdown within the M&A market,” says Rob Dando, Company Finance Companion & Transaction Companies Chief at MHA, a part of the Baker Tilly Community within the UK.

“We’ve had suggestions from purchasers already that the method of acquiring new funds for dealmaking may take for much longer than initially anticipated, particularly within the US with firms trying to transact in Europe.

“In conditions like these, as we noticed within the early a part of the pandemic, deal doers (and makers) are likely to pause, take a breath, and consider the state of affairs to see the way it will play out.”

It stays to be seen if the influence of these considerations can be contained to Europe or whether or not different areas will proceed to transact at a fast tempo.

North America was the highest geography by M&A deal worth in 2021, recording almost US$three trillion in offers, whereas the Asia Pacific area had the very best degree of deal quantity, with greater than 11,500 offers.

Mr Dando stated there have been quite a few elements that dealmakers internationally would want to evaluate when deciding to pursue or progress offers within the shadow of conflict.

“It is perhaps, how will this influence world commodity costs, vitality costs and the fairness capital markets for instance,” he stated.

“These macroeconomic results then filter down into the mid and smaller markets. We’ve not but seen a slowdown however that doesn’t imply to say there received’t be one.”