The most recent Xero Small Enterprise Insights (XSBI) information for March 2022 exhibits the affect that COVID-19 circumstances, labour shortages, provide constraints and inflation are having on small companies in Australia, New Zealand and the UK.

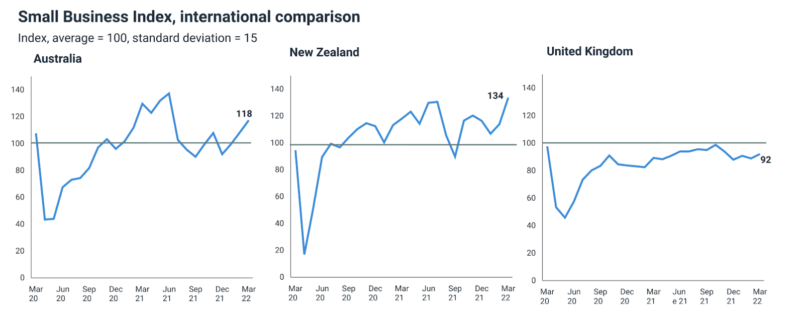

For the month of March, Xero’s Small Enterprise Index, a key indicator of the sector’s well being, was 118 in Australia, 134 in New Zealand and 92 within the UK. An index of above 100 signifies the small enterprise sector is performing higher than common (common calculated from January 2017 to December 2019) and an index of under 100 means the sector is performing under common.

The roles market problem

In current months our information has proven small enterprise jobs development slowing throughout the three international locations. In March, jobs grew 2.7% year-on-year (y/y) in New Zealand (the weakest end result since June 2020) and fell 3.6% y/y (adjusted1) within the UK and 1.1% y/y in Australia.

The slowdown in jobs development is basically all the way down to an incapability to seek out employees. That is one thing I’ve been listening to from our small enterprise prospects – that they’re discovering it powerful to seek out and maintain on to good employees. The strong gross sales development that we’ve seen for a lot of the previous yr in all three international locations suggests small companies want extra staff, however are dealing with an actual problem discovering them.

Within the UK, that is proving to be a serious impediment within the restoration of small enterprise. Gross sales grew 14.1% y/y in March (adjusted1) and it’s nice to see that UK small companies have now, on common, had greater than a yr of optimistic gross sales development. Nevertheless, there are actually 7.4% fewer individuals working in small companies than earlier than the pandemic, as British small companies are competing for a a lot smaller pool of obtainable employees to maintain up with gross sales.

In Australia and New Zealand, some sectors are additionally dealing with abilities shortages as worldwide borders in each international locations have been closed to new migrants for 2 years. I’ve seen the affect of this on small companies in agriculture that usually depend on abroad seasonal staff. The information signifies these companies are nonetheless fighting agriculture jobs declining 3.6% y/y in New Zealand and 4.0% y/y in Australia in March.

Wages development placing stress on small enterprise house owners

The XSBI information for March additionally reveals that these difficult job markets are driving wage rises in all three international locations. As an illustration, wages grew 4.2% y/y within the UK in March, the third consecutive month of wage development over 4%.

Increased wages generally is a optimistic signal {that a} small enterprise is doing nicely and contributing extra to the local people by using employees and supporting greater spending. Nevertheless, if wages rise too quick it will probably put the long run sustainability of a small enterprise in danger. This analysis notice authored by Xero Economist, Louise Southall, explores small enterprise wage developments in additional element.

We’re seeing many small companies having to pay greater wages to safe employees, which is placing stress on them financially as they’re additionally being hit with value will increase and provide points. I actually encourage small enterprise house owners to have interaction along with your advisor usually to intently monitor your money stream. Instruments like Xero Analytics Plus may also help you visually venture your potential financial institution stability as much as 90 days into the long run and get insights on your corporation efficiency, serving to you to identify alternatives and mitigate dangers forward of time.

Hospitality companies expertise sturdy wages development

In all three international locations hospitality small companies are experiencing sturdy wages development, regardless of having sluggish jobs development. In March, hospitality wages rose 7.2% y/y within the UK, 4.9% y/y in New Zealand and three.5% y/y in Australia. This displays the challenges these small companies are dealing with in attracting individuals to an business that’s been extremely disrupted by the pandemic. Hospitality employees additionally face the next potential of publicity to COVID-19 than many different industries by means of the face-to-face nature of the work, so that is additionally more likely to think about these greater wages.

Total, it’s nice to see that small enterprise efficiency is bettering. However trying forward, wages development is more likely to proceed accelerating within the subsequent few months as optimistic gross sales development underpins the continuing want for extra staff.

Learn extra in regards to the XSBI metrics for March in these updates:

Or go to the XSBI homepage.