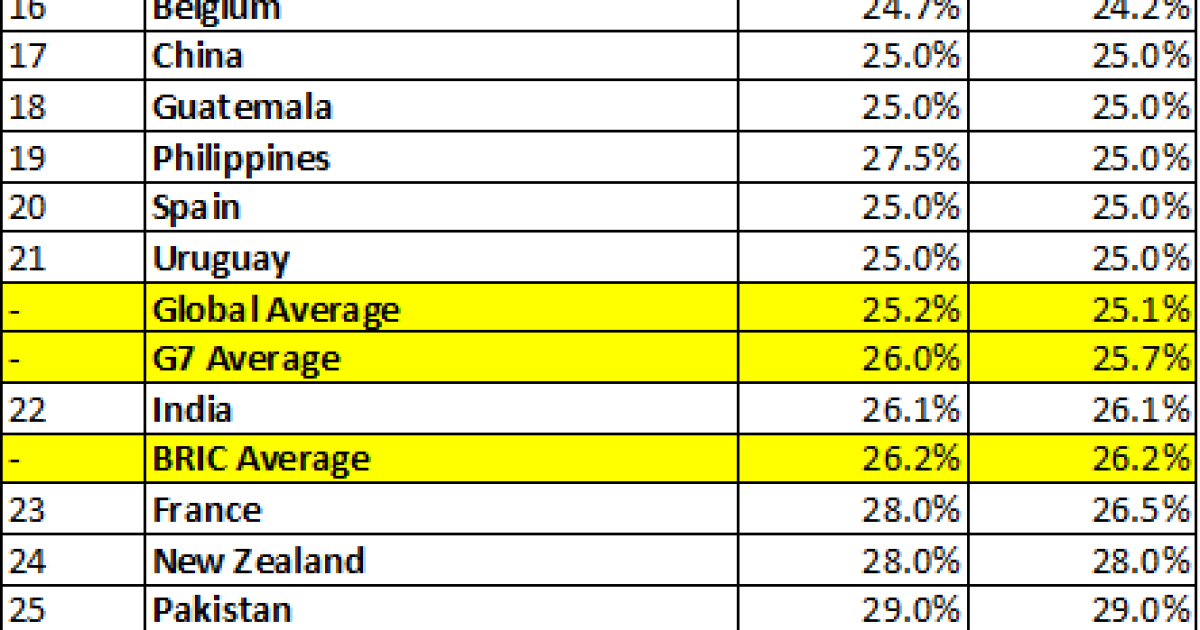

Company tax charges in main economies all over the world have fallen to a mean of simply 25.1% this 12 months, in line with a research launched Friday by the UHY worldwide accounting agency community.

With the COVID-19 pandemic leaving a gaping gap within the public funds of many nations, nevertheless, UHY predicts the development of declining company tax charges worldwide is more likely to be over for the foreseeable future. For instance, the U.Okay. authorities not too long ago introduced its intention to lift company tax charges to 25% beginning in April 2023, greater than two proportion factors greater than the European common. Argentina has already elevated its headline company tax fee from 30% to 35% in 2021. President Biden has additionally pledged to lift federal company revenue tax to 28% within the U.S., after it was reduce to only 21% by former President Trump in 2017, though Biden’s tax proposals have been going through resistance by Republicans and a few Democrats in Congress and he was unable to go the Construct Again Higher Act final 12 months.

International company tax charges have been steadily declining in recent times, with the G7 common for a enterprise recording earnings of $1 million falling from 32% in 2014-2015 to only 26% in 2020-2021. Many nations have tried to incentivize corporations to spend money on their economies by providing attractive tax charges. France, usually seen as a better tax European financial system, has lowered its headline tax fee from 31% to 26.5% up to now three years.

“Nations all over the world have needed to stay aggressive by protecting the tax burden on corporations as little as attainable in recent times,” stated UHY chairman Subarna Banerjee in a press release. “The cash-strapped governments of 2022 will probably now be contemplating rising taxes on corporates. Public funds must be shored up someway and corporates may be a better goal politically than people. Companies worldwide needs to be ready for his or her tax prices to start to rise within the coming years.”

The Netherlands not too long ago decreased its company tax fee to 16.5% for corporations with taxable revenue underneath $450,000, whereas Croatia now provides a fee of simply 10% for corporations with a turnover of lower than $1,125,000.

The Group for Financial Cooperation and Growth introduced in October that 136 nations had signed onto a deal to implement a minimal company tax fee of 15% beginning in 2023. The OECD deal will permit nations to tax multinationals that make gross sales inside their jurisdictions even when they lack a bodily presence there. On account of rising political strain, some lower-tax jurisdictions will most likely now have to extend their company tax charges for multinational corporations, UHY predicted. Nations equivalent to Eire have come underneath hearth for his or her low company tax fee of simply 12.5%.

Treasury Secretary Janet Yellen has been pushing for nations like Poland to conform to the OECD deal, though the minimal tax deal is going through skepticism within the U.S. from Republicans and a few Democrats in Congress. Such a deal could require the Senate to ratify new tax treaties, which might be unlikely to occur.

Multinational companies have change into one of many largest targets for presidency clampdowns worldwide, with some multinationals selecting to function from lower-tax nations, as they document decrease earnings in higher-tax nations.

Creating nations surveyed by UHY usually already had greater company tax charges than extra economically developed counterparts. India’s tax charges elevated to 34% for the biggest companies, with Nigeria implementing a headline fee of 32%, and Argentina charging its resident corporations 35% on their earnings.

Some nations could also be hesitant to lift taxes additional than the excessive ranges they now levy. Japan already taxes its corporations at charges as much as 38.2%, whereas Malta has equally excessive charges at 35%.