Senate Finance Committee Chairman Ron Wyden, D-Oregon, despatched a letter Tuesday to former President Trump’s former accounting agency, Mazars USA, asking for extra details about its disclaimer {that a} decade’s value of monetary statements ought to now not be thought-about dependable.

Democrats in Congress have been pushing Trump to reveal his tax returns and extra monetary info ever because the 2016 marketing campaign, however to date a lot of the data has but to come back to mild. Nevertheless, New York Lawyer Normal Letitia James revealed the agency’s place in a courtroom submitting in February (see story). “Final week, after evaluate of OAG’s filings, Donald J. Trump’s and the Trump Group’s former accounting agency knowledgeable the Trump Group that the Statements of Monetary Situation from 2011 by means of 2020 ought to now not be relied upon, withdrew from representing the Trump Group, and instructed the Trump Group’s Normal Counsel to tell recipients that the statements may now not be relied upon,” mentioned the submitting.

Wyden’s workplace famous that it’s extremely unusual for a world accounting agency to forged doubt on the validity of labor for a serious shopper, particularly a multibillion-dollar firm primarily owned by somebody who turned the president of the US.

Wyden requested in his letter to Mazars in regards to the agency’s place on the accuracy of former President Trump’s tax returns, and the extent to which the agency has notified the previous president’s companies about the necessity to file amended returns with the IRS or alert lenders of inaccuracies or misrepresentations in paperwork submitted to acquire loans. A Mazars spokesperson didn’t instantly reply to a request for remark.

“In mild of Mazars’ current letter, it seems the Trump Group might have submitted inaccurate or deceptive statements of monetary situation info with a purpose to acquire loans,” Wyden wrote. “As you might be conscious, the fraudulent inducement of a mortgage or different contract is a federal felony offense. As licensed tax practitioners, Mazars’ staff are certain by a number of duties regarding the identification of incorrect info or omissions associated to tax returns ready for its purchasers.”

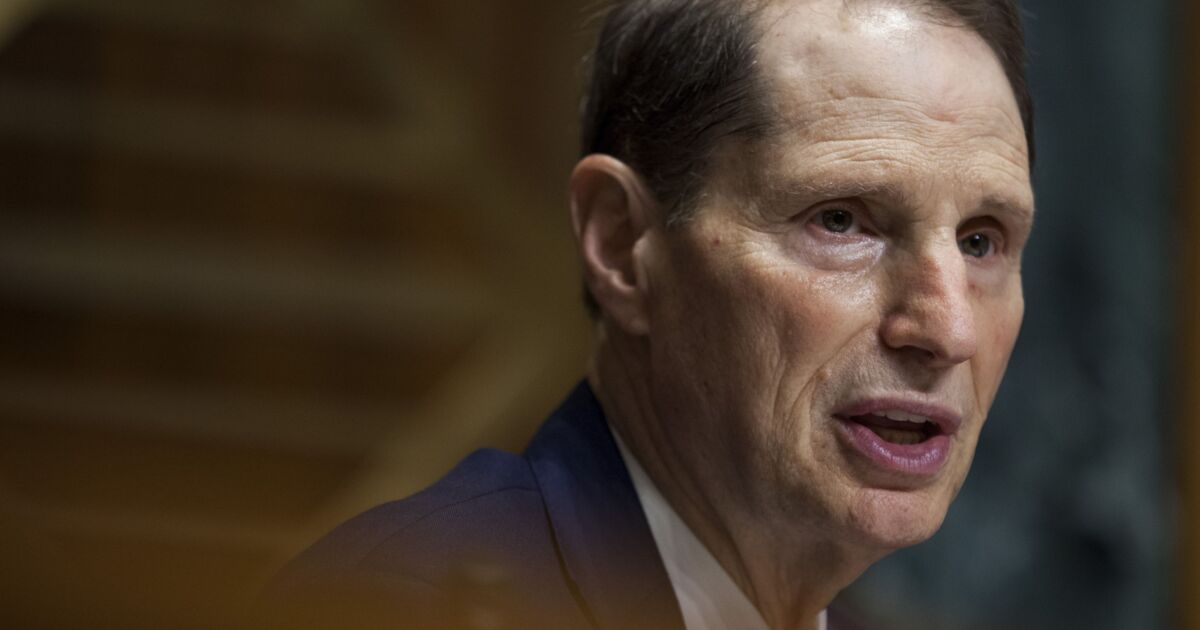

Sen. Ron Wyden, D-Oregon

Zach Gibson/Bloomberg

He identified that Treasury Division laws require those that follow earlier than the IRS to inform their purchasers when it learns that the shopper has “not complied with the income legal guidelines of the US or has made an error in or omission from any return, doc, affidavit, or different paper which the shopper submitted or executed underneath the income legal guidelines of the US.”

“These laws additionally require practitioners to take steps to make sure that return info being supplied to the IRS is correct and full,” mentioned Wyden. “The failure to do that can have vital penalties for the shopper, together with the reopening of a closed audit ‘if there’s proof of fraud, malfeasance, collusion, concealment, or misrepresentation of fabric truth.’”

Within the letter, Wyden requested the agency a collection of questions, together with whether or not Mazars stands by the accuracy of the federal tax returns it ready for the Trump Group and its associates that have been submitted to the IRS between 2011 and 2020, whether or not it had notified Trump about any errors or omissions, if it had alerted any monetary establishments that the Trump Group’s statements of monetary situation for these years have been to not be relied upon, whether or not it had performed an inner investigation into the reliability of the monetary statements and if it had accomplished value determinations of any Trump Group property together with property.