For those who’re a type of who thinks highschool children ought to be capable of elect Regents Trigonometry or Monetary Literacy to get their diploma, there’s some excellent news for a change.

A brand new bank card unveiled in Might is designed with children in thoughts, supervised by mother and father and imparting the basics (and extra) about find out how to responsibly handle private finance.

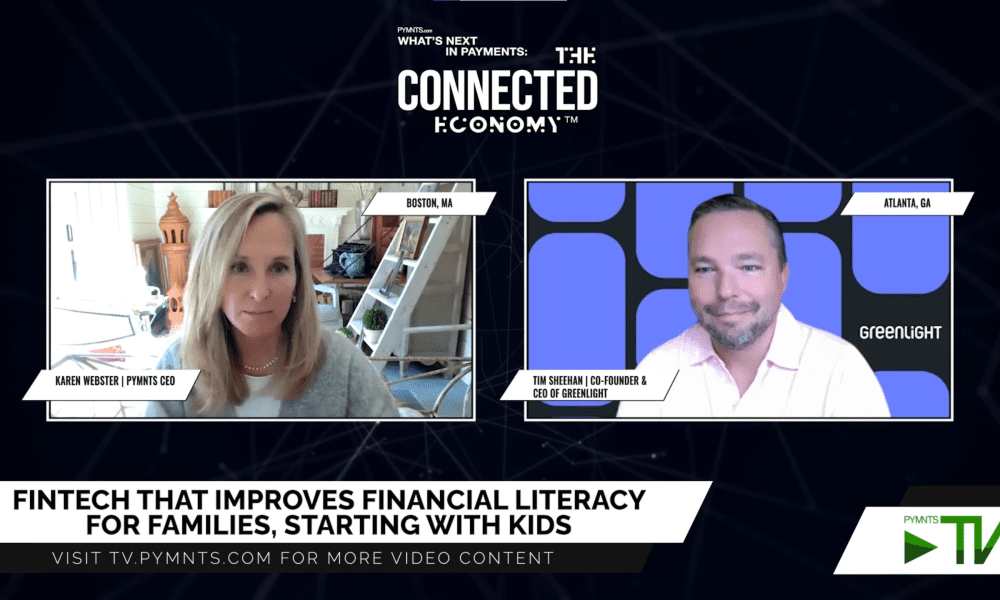

Talking with PYMNTS’ Karen Webster about its new Household Money Mastercard, Greenlight Co-Founder and CEO Timothy Sheehan pointed to analysis the corporate commissioned, discovering that 90% of oldsters want that they had saved extra for his or her children’ faculty prices and future.

Calling it “a large drawback,” Sheehan and his workforce grasped the underlying truth that almost all mother and father didn’t have the additional cash to place apart. It obtained them fascinated with methods to make investing easier for households.

“Is there a method we may come out with one thing like we’ve the place it’s a 3% cash-back card, however the money again may very well be robotically invested into [exchange-traded funds] and ensure they’re diversified?” he stated. “However form of make it automated so that they don’t should drastically change their conduct?”

What resulted is the Household Money Mastercard, which accomplishes the financial savings mission with out disrupting on a regular basis spending — simply quietly producing money again and investing it. Dad and mom who’re additionally refined buyers can management the place the cash is invested, and it may be accessed with out penalty for emergencies. This family-friendly card and program design represents a rising realization that we are able to do higher than paycheck-to-paycheck dwelling.

“For those who have a look at the S&P 500, it’s up on common 12% over the past 50 years yearly,” he stated. “When the compounding kicks in that can create fairly a pleasant nest egg for them to assist their children go to highschool.”

Confronted with a call on whether or not to create a 529 Plan expressly for academic bills or a automobile with extra freedom, Greenlight requested mother and father, and fogeys set them straight.

“You’re speaking about 18 to 20 years that this may very well be occurring,” he stated. “A variety of issues can occur in that point, so mother and father informed us the pliability’s extra necessary than the small tax good thing about a 529, so please make it a basic account. And that’s what we did.”

See additionally: Greenlight, Mastercard Debut School Financial savings Credit score Card

‘Dad, Mother … What’s Credit score and Debit?’

Greenlight debuted its debit card for youths in 2017 and positioned it on the coronary heart of a company mission to make assist youngsters and younger folks change into financially literate early in life.

Whereas Sheehan is a serious advocate of monetary literacy, he agreed that sticking children in entrance of movies and web sites and anticipating them to learn to use credit score responsibly doesn’t work.

“Even have them interact and take motion and handle their very own cash,” he informed Webster. “Guess what occurs? Fascinating questions come up that they ask the father or mother, which is implausible. As any father or mother of a tween or teen is aware of, youngsters don’t wish to be questioned by their mother and father. However what occurs in utilizing Greenlight is it prompts these questions.”

He shared a narrative of a kid utilizing a Greenlight card at checkout and having to reply the easy query — credit score or debit? The father or mother walked the kid by way of the transaction, which became a automobile trip based mostly across the theme “Dad, Mother … what’s credit score and debit?”

“That’s the place the educational occurs,” Sheehan stated. “Primarily they’re studying as a result of they’ve a motive to know what they’ve requested, they usually’re going to retain what they’re informed.”

It goes in lots of instructions as children should resolve about their openness to purchasing and whether or not these headphones are definitely worth the tradeoff of not going out this weekend.

Sheehan stated, “It’s actually fascinating as a result of we didn’t know all of this once we began the corporate. Dad and mom that had been utilizing Greenlight form of taught us how they had been utilizing it, they usually had been sharing with us the conversations that had been developing.”

See additionally: Household Finance Phase Booms Amid Rising Competitors To Serve Money-Free Children

Credit score For Any Age

With monetary literacy nearly as large an issue amongst many 40-year-olds as it’s for the everyday 17-year-old, Greenlight is a moneymaking proposition underpinned with altruistic goal and made to assist evolve the pondering and spending for the financially uninformed of any age.

Sheehan stated, “One of many issues I’m pleased about with Greenlight is it’s a mass market product. It’s not one thing that’s just for the rich or for a specific section. It’s for everyone.”

He added that “The product itself is fixing this drawback [of], what father or mother doesn’t need their little one to be sensible about cash and private finance? All of us need that, it doesn’t matter what your revenue is or what you had been taught by your mother and father. Even when the father or mother doesn’t essentially really feel like they’re an skilled on private finance, they know sufficient that they need their little one to be.”

Right here’s what’s cool: It appears to be having the specified impact. Sheehan informed Webster, “I’ve seen suggestions the place the children are beginning to learn to make investments utilizing Greenlight,” resulting in moments like, “Hey mother, dad, have you learnt what a P/E ratio is?’” he joked.

As a result of crypto is all over the place — together with videogames and NFTs — that entered the dialog as nicely. “It’s what Jim Kramer would possibly name a ‘spec’ — extremely speculative,” he stated. However he admits it has potential, particularly for youthful buyers.

However that’s one other chapter in Monetary Literacy for Excessive Faculty Seniors when such a category possibly sometime begins to push out trig as a requirement. It’s no knock in opposition to superior arithmetic or STEM college students, however that doesn’t assist tweens perceive rates of interest.

He stated that Greenlight customers who start as youngsters have a tendency to stay with Greenlight by way of faculty — and why the corporate is exploring extra methods to construct that loyalty right into a lifelong buyer relationship.

“Because the little one grows and turns into a younger grownup, they go to school, then they’re out on their very own,” he stated. “What may we do for them to assist them extra? We’re positively wanting into that, however nothing to announce. We’re taken with attempting to proceed to assist that individual as they develop from little one to teen to younger grownup who’s out on their very own and attempting to make it.”

——————————

NEW PYMNTS DATA: THE TAILORED SHOPPING EXPERIENCE STUDY – MAY 2022

About: PYMNTS’ survey of two,094 customers for The Tailor-made Purchasing Expertise report, a collaboration with Elastic Path, exhibits the place retailers are getting it proper and the place they should up their sport to ship a personalized purchasing expertise.