The Inside Income Service is taking steps to extend its audit charges of higher-income taxpayers after coming beneath sharp criticism in Congress over its lagging audit numbers.

At the side of the discharge final week of its annual Knowledge Ebook for 2021, which incorporates a wealth of statistics on examination charges, the IRS response to the COVID-19 pandemic, the availability of advance Little one Tax Credit and Financial Impression Funds, together with the same old info on the humber of returns processed, income collected and tax refunds issued, the IRS launched a separate assertion offering an replace on its newest audit numbers, pointing to how it’s rising its audits of higher-income taxpayers.

The transfer comes after current studies from the Treasury Inspector Basic for Tax Administration (TIGTA) and Syracuse College’s Transactional Data Entry Clearinghouse (TRAC) discovered audit charges plummeting for wealthier taxpayers (see story). For lower-income taxpayers, the IRS is commonly ready to make use of know-how to identify discrepancies between the tax returns filed by particular person taxpayers and the knowledge returns filed by their employers and different companies to focus on them for examination. Within the assertion the IRS highlighted current knowledge displaying an uptick in audit charges.

Inside Income Service headquarters in Washington, D.C.

Samuel Corum/Bloomberg

“In truth, it’s helpful to check out what more moderen knowledge mirror, significantly on higher-income taxpayers the place examination exercise is commonly initiated later within the statutory interval (new exams may be initiated as much as at the very least three years after a tax return is filed),” stated the IRS. “The extra figures beneath present 2019 audit charges doubling within the final seven months for taxpayers in each revenue class above $100,000. For instance, primarily based on ongoing examination exercise, audit charges for revenue classes between $500,000 and $1 million doubled to 0.6%. Audit charges for the $1 million to $5 million class greater than doubled to 1.3% and taxpayers incomes greater than $10 million jumped 4 occasions — reaching 8%.”

The IRS included the next chart to bolster its argument, indicating that the IRS started stepping up its audit fee of wealthier taxpayers extra just lately than the Knowledge Ebook suggests:

Nevertheless, the IRS acknowledged that it’s dealing with useful resource constraints, with fewer workers accessible with the required experience to conduct audits of high-income taxpayers who might have refined, complicated tax methods.

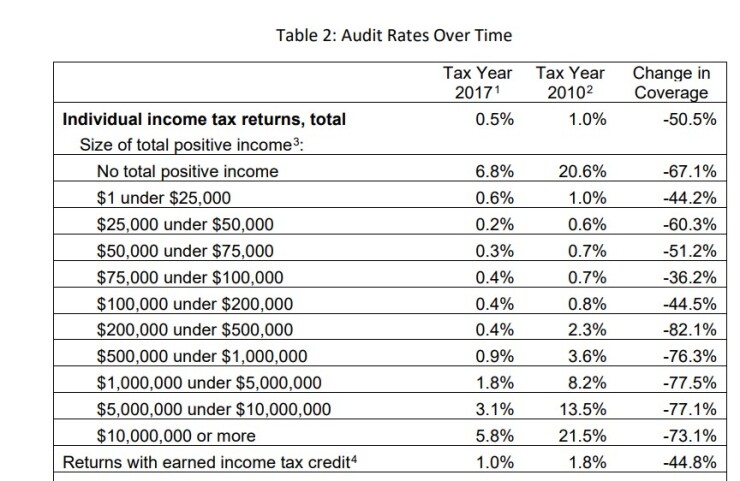

“Whereas these statistics present a extra real-time estimate of the continued work that the IRS is taking steps towards addressing high-end noncompliance, useful resource constraints restrict the work that the company is ready to do,” stated the IRS. “There are solely about 6,500 front-line, income brokers who’re within the area performing some of these exams. These useful resource limitations end in ranges of enforcement exercise on the high-end of the distribution, significantly for world excessive net-worth people, massive firms, and complicated constructions like partnerships are far decrease than up to now. Certainly, general audit charges for these high-end returns have considerably declined over a seven-year interval.”

The following desk supplied by the IRS certainly exhibits a a lot greater disparity between its audit charges for upper-income and lower-income taxpayers, echoing the findings of the TIGTA and TRAC studies that prompted complaints from lawmakers in Congress:

IRS Commissioner Chuck Rettig argued throughout an oversight listening to in March that the IRS was not concentrating on lower-income taxpayers, pointing to the IRS Knowledge Ebook, the most recent version of which had not been launched at that time (see story).

“I’m bored with having to cope with this problem,” he stated. “We audit high-income taxpayers greater than every other class within the Inside Income Service. Taxpayers reflecting over $10 million of revenue are audited at a fee exceeding 7%. Taxpayers on the $25,000 stage, which is primarily the Earned Revenue Tax Credit score taxpayer, can be the one individuals we’d take a look at, are audited at 1.1%. These are correspondence audits.”

He blasted Syracuse College’s TRAC report, and in flip, TRAC referred to as on the IRS to launch the most recent numbers. The discharge final week of the fiscal 12 months 2021 Knowledge Ebook, which covers the interval from Oct. 1, 2020, to Sept. 30, 2021, and the extra assertion from the IRS sheds gentle on the strikes the IRS has been making to counter the argument that it’s concentrating on lower-income taxpayers for audits.

In a press release final week together with the Knowledge Ebook launch, Rettig additionally highlighted the onerous work the company had been performing to answer the pandemic and the varied types of tax aid and stimulus funds delivered by the IRS.

“Throughout Fiscal 12 months 2021, the COVID-19 pandemic continued to current the IRS with a few of the best challenges in our company’s historical past, and the way in which our workers responded illustrates the numerous function that the IRS performs within the general well being of our nation,” Rettig stated in a press release. “The IRS was referred to as on to offer financial aid throughout this nationwide disaster whereas additionally fulfilling our company’s core duties of tax administration; IRS workers answered Congress’ name to ship two extra rounds of Financial Impression Funds and likewise carried out modifications to the Earned Revenue Tax Credit score, the Little one Tax Credit score and different refundable credit as a part of the American Rescue Plan. The breadth of those missions has strengthened my perception {that a} totally functioning IRS is essential to the success of our nation.”