Final month, the Federal Reserve launched a brand new report: Financial Nicely-Being of U.S. Households in 2021 [PDF]. This annual survey gauges American monetary well being and attitudes. The 2021 version was performed final November.

Listed here are some highlights from the report:

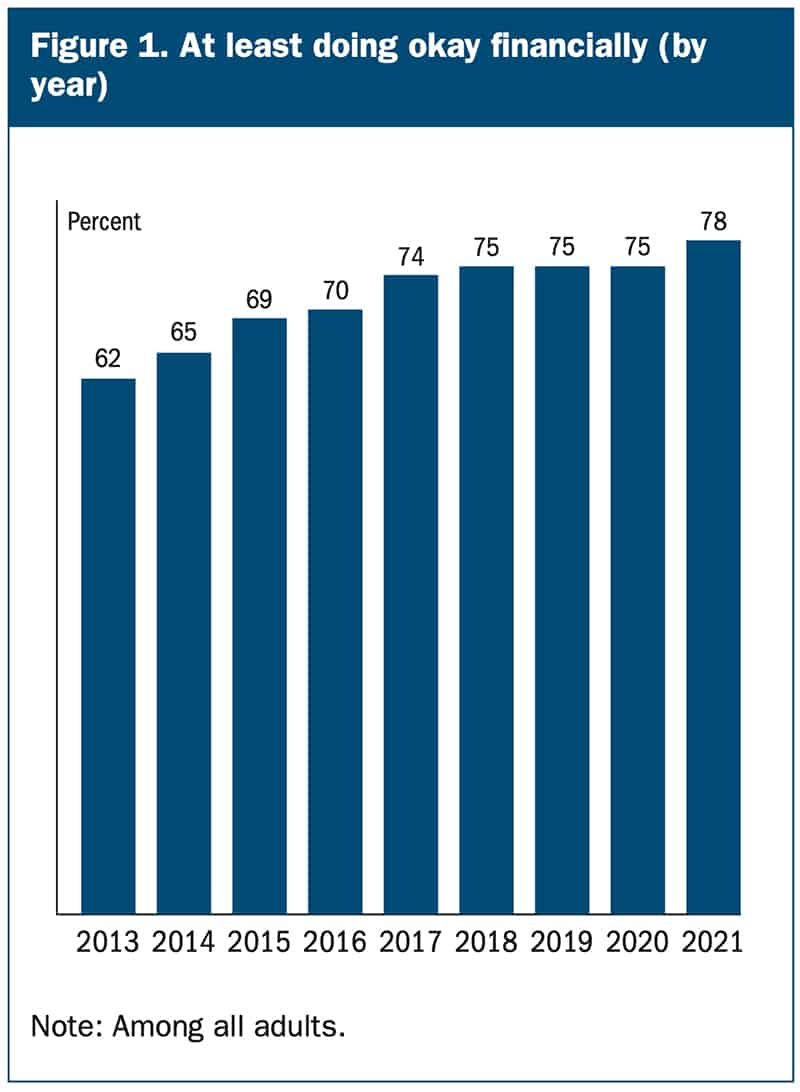

- Seventy-eight % of adults have been both doing okay or dwelling comfortably financially, the very best share with this degree of monetary well-being for the reason that survey started in 2013.

- Fifteen % of adults with earnings lower than $50,000 struggled to pay their payments due to various month-to-month earnings.

- Fifteen % of employees mentioned they have been in a special job than twelve months earlier. Simply over six in ten individuals who modified jobs mentioned their new job was higher total, in contrast with one in ten who mentioned that it was worse.

- Sixty-eight % of adults mentioned they’d cowl a $400 emergency expense completely utilizing money or its equal, up from 50 % who would pay this manner when the survey started in 2013. (Be aware that this survey is the unique supply of this oft-quoted statistic.)

- Six % of adults didn’t have a checking account. Eleven % of adults with a checking account paid an overdraft payment within the earlier twelve months.

These little nuggets of information are fascinating, positive, however what I discover much more fascinating are the charts and graphs documenting long-term traits.

The Demographics of Financial Nicely-Being

Right here, as an example, is a chart that reveals how individuals really feel about their present monetary state of affairs:

In 2021, 78% of adults on this nation reported “doing okay” or “dwelling comfortably”. That is up considerably from when this survey began in 2013.

The following logical query, in fact, is how completely different demographics really feel about their monetary state of affairs. The Fed report affords some perception into that.

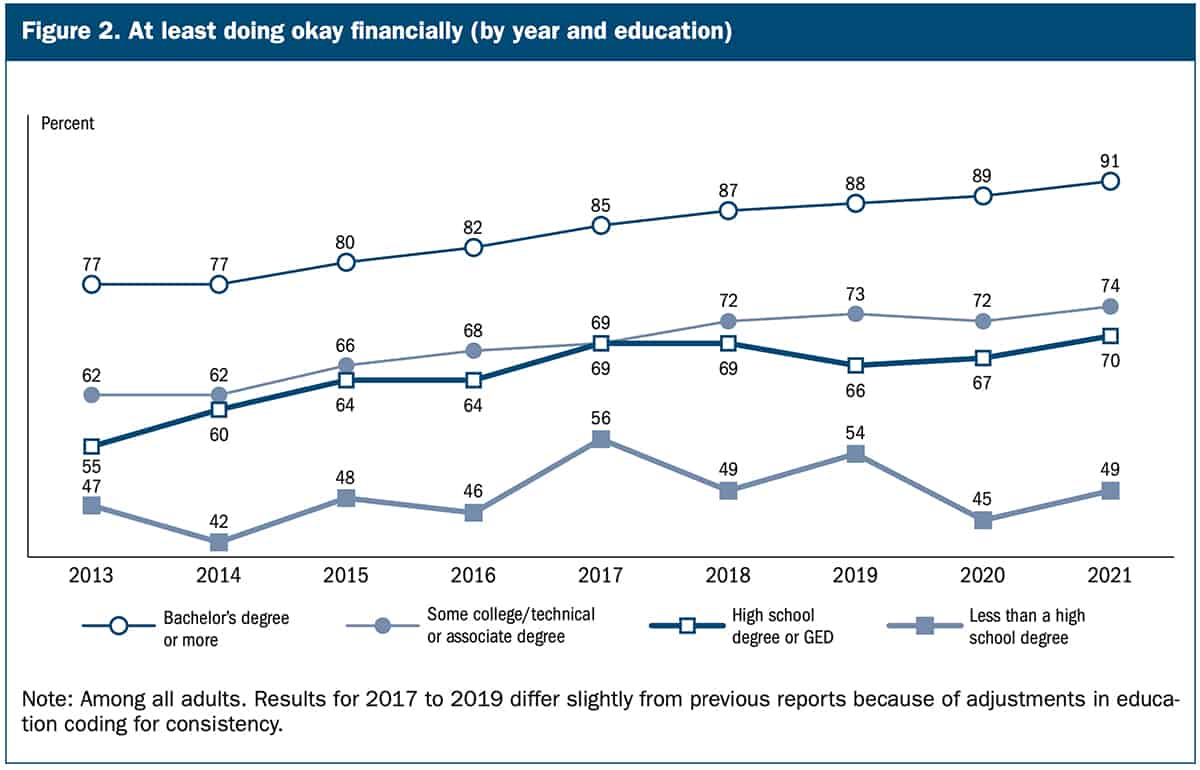

Here is a chart that reveals (as soon as once more) the worth of a school diploma).

Though it is standard in some corners to bad-mouth faculty levels, based on the U.S. Census Bureau (and lots of different sources) your schooling has a better influence on lifetime incomes potential than another demographic issue. Schooling issues greater than age. Schooling issues greater than race. Schooling issues greater than gender. On the subject of being profitable, schooling issues most.

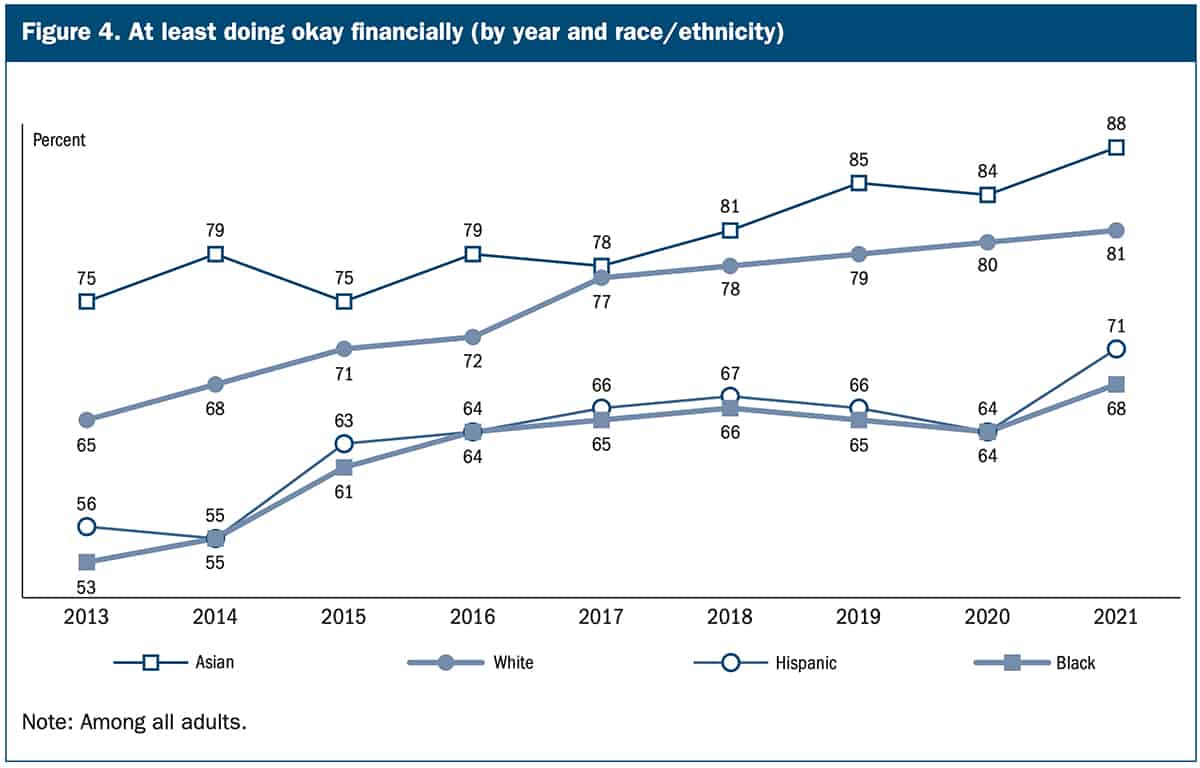

Subsequent, this is a chart from the Fed report that paperwork financial well-being by race and ethnicity:

Evidently financial well-being has improved throughout the board throughout the previous decade.

Private Nicely-Being Versus Nationwide Nicely-Being

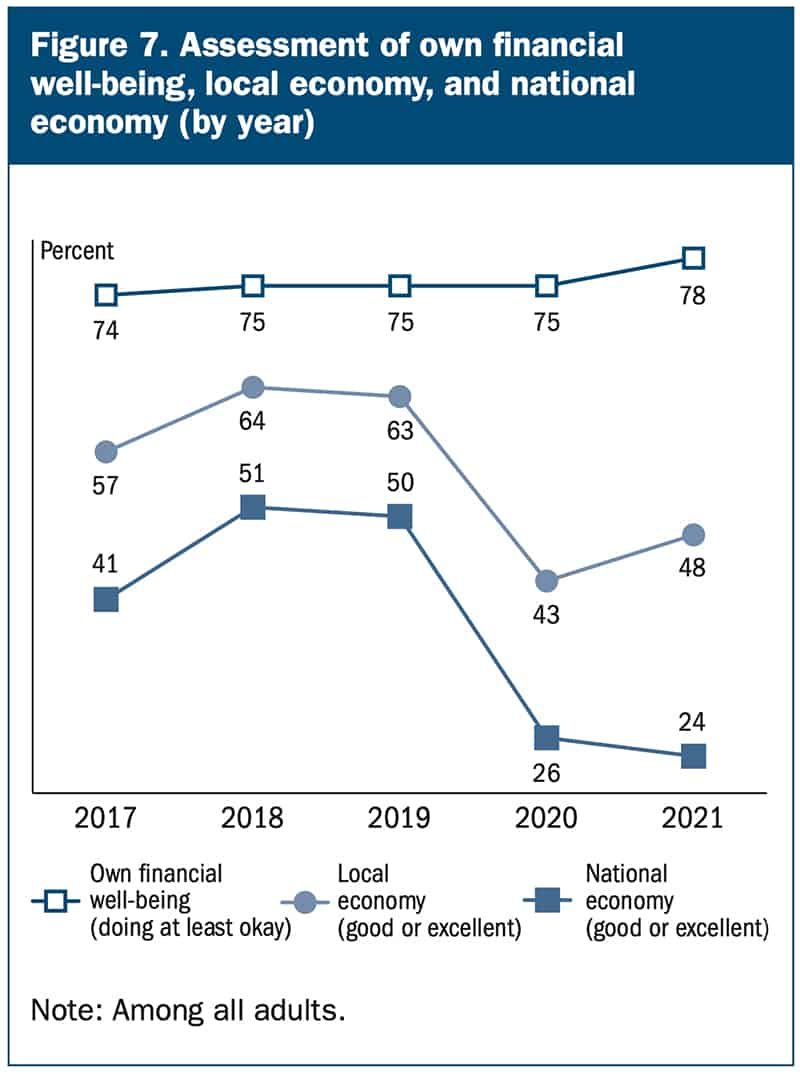

To me, nevertheless, essentially the most fascinating chart is that this one, which compares respondents’ assessments of their private well-being with their evaluation of native and nationwide economies. Have a look at this chart and inform me what you make of it. (I’ve an opinion, however I need you to develop your individual speculation earlier than studying mine…)

From the report:

Just like individuals’s perceptions of their native economic system, the share score the nationwide economic system favorably fell precipitously from 2019 to 2020, after the onset of the pandemic ). Nonetheless, individuals’s perceptions of the nationwide economic system continued to say no in 2021. Solely 24 % of adults rated the nationwide economic system as ‘good’ or ‘wonderful’ in 2021, down 2 proportion factors from 2020 and about half the speed seen in 2019. This pattern contrasts starkly with individuals’s more and more favorable evaluation of their very own monetary well-being.

The Fed report tells us this discrepancy exists however it would not inform us why it exists. Why do 78% of Individuals say that their very own monetary state of affairs is at the very least okay, however almost the identical quantity imagine that the nationwide economic system is not doing properly? I do not know. However I can consider two doable causes.

First, maybe most Individuals have realized to handle cash. Maybe they have been studying cash blogs and listening to cash podcasts, and now the teachings have sunk in. Perhaps they’ve begun saving and investing properly over the previous fifteen years in order that their private economic system is now shielded from the gyrations of the economic system at massive.

Maybe.

I harbor a suspicion, nevertheless, that there is one thing else at play right here.

Lengthy-time readers know the way a lot I abhor the information media. The mass media doesn’t report actuality. In the event you envision life as a bell curve (or “regular distribution”, in case you choose), the mass media tends to report solely outlier occasions — particularly damaging outlier occasions. The overwhelming majority of our lives comprise regular, optimistic, wholesome interactions and relationships and situations. The information would not report these.

On this case, I can not assist however ponder whether this disparity between perceptions of private financial well-being and nationwide financial well-being are pushed (at the very least partly) by damaging financial information, information that highlights the issues with our economic system somewhat than the issues which are going proper.

That is what I believe. What do you assume? What is the cause for this hole in notion?

Closing Ideas

There’s far more information and perception on this 92-page report. I’ve highlighted just some stats from the primary part on total monetary well-being. Different sections cowl earnings, employment, sudden bills, banking and credit score, housing, schooling, pupil loans, retirement and investments, and extra.

I discovered the part on pupil loans fascinating too. It incorporates a variety of insights. Debtors with much less schooling, for instance, usually tend to be behind on mortgage funds. This makes some sense, I believe. In the meantime, fewer individuals are behind on funds than two years in the past (and this is applicable throughout all demographics).

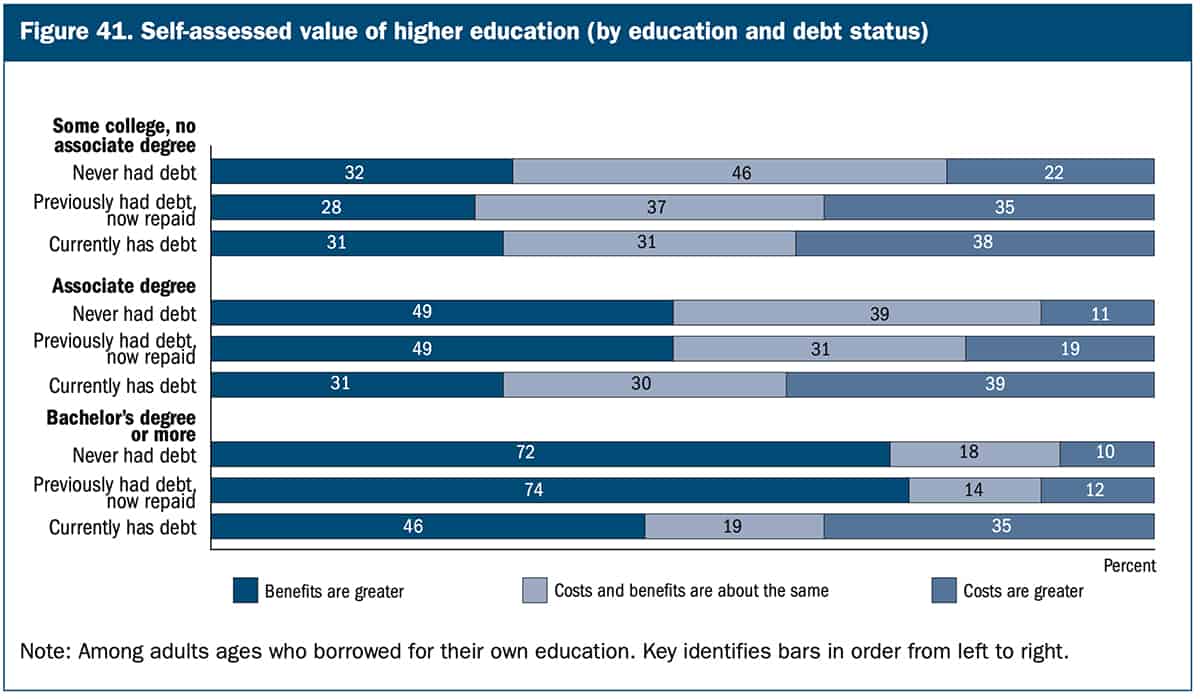

Right here, although, is my favourite chart from the complete report. It measures the self-assessed worth of upper schooling:

Two issues appear clear right here. First, of us who by no means needed to borrow for faculty imagine their schooling is price extra. Second, the extra schooling one obtains, the extra useful it appears.

Okay, a 3rd factor. Evaluate this chart with the one I shared earlier that highlights monetary well-being by degree of schooling. It is clear that (objectively) schooling does enhance monetary well being. However those that have pupil loans cannot all the time see that. Their subjective expertise appears to contradict the info. Fascinating…

Anyhow, the Fed’s Financial Nicely-Being of U.S. Households in 2021 is stuffed with fascinating information. It is price studying (or skimming) the subsequent time you sit all the way down to waste time on the web!