Monetary restatements filed with the Securities and Alternate Fee by public firms hit a 15-year excessive in 2021, thanks virtually solely to particular objective acquisition firms.

In accordance with a latest report by Audit Analytics, complete restatements hit 1,470 in 2021, virtually 3 times the quantity reported in 2020, and the very best quantity since 2006, when there have been roughly 1,800.

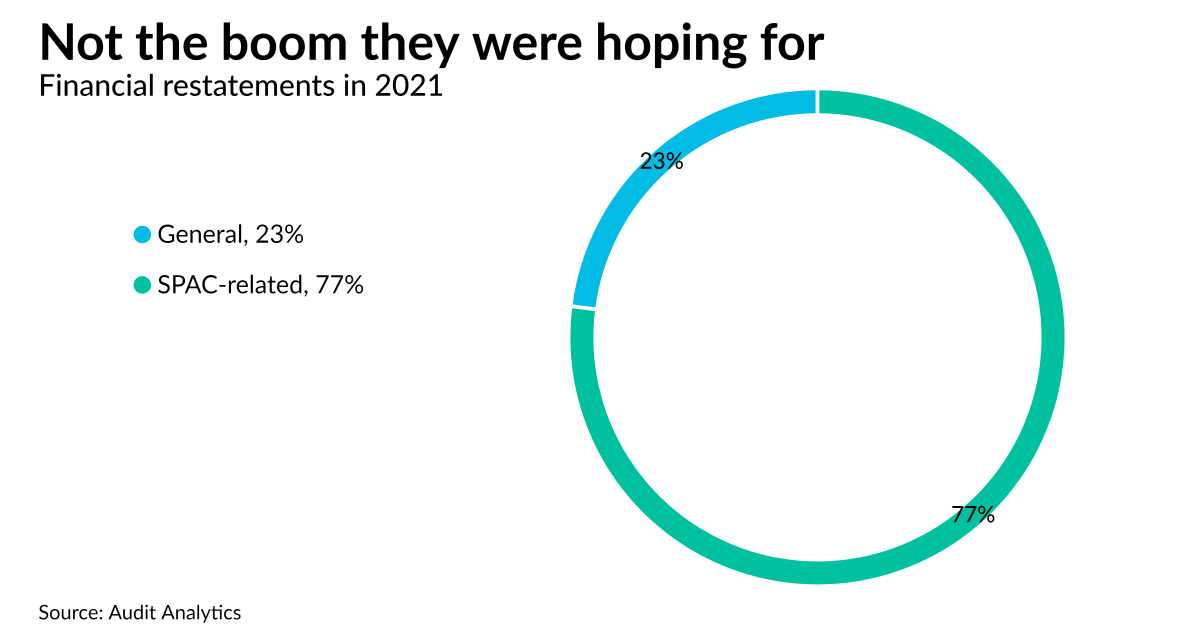

Nevertheless, with out SPAC-related restatements, the variety of restatements really decreased 10%, which is extra consistent with the final declining development over the previous decade.

SPACs are firms with no operations which are created solely to boost capital by way of an preliminary public providing, or to accumulate or merge with an already-existing firm. They’ve been significantly well-liked over the past two years, with the variety of new SPACs leaping virtually tenfold between 2019 and 2021, in response to Investopedia.

In response to that development, the SEC final yr in April issued a workers assertion that put a damper on SPAC enthusiasm — and helped unleash the flood of restatements, because the SEC warned firms with warrants issued by SPACs to rethink the accounting therapy of these warrants.

“The SEC’s steering on accounting for redeemable shares and warrant liabilities resulted in important will increase noticed in each the variety of restatements filed and the variety of firms that disclosed a restatement throughout 2021,” the report mentioned.

Audit Analytics’ report, which covers 21 years of tendencies in monetary statements, is accessible right here.