The Securities and Change Fee is requiring some monetary varieties that at the moment are allowed to be filed or submitted in paper format to be filed or submitted electronically.

The SEC adopted a set of amendments final week to require structured information reporting and take away a number of the outdated references for a few of its varieties. The amendments purpose to advertise effectivity, transparency, and operational resiliency by modernizing how data is filed or submitted to the SEC and disclosed to the general public. The purpose can also be to assist buyers and the general public by making digital filings extra simply accessible to the general public and obtainable on the SEC web site in simply searchable codecs.

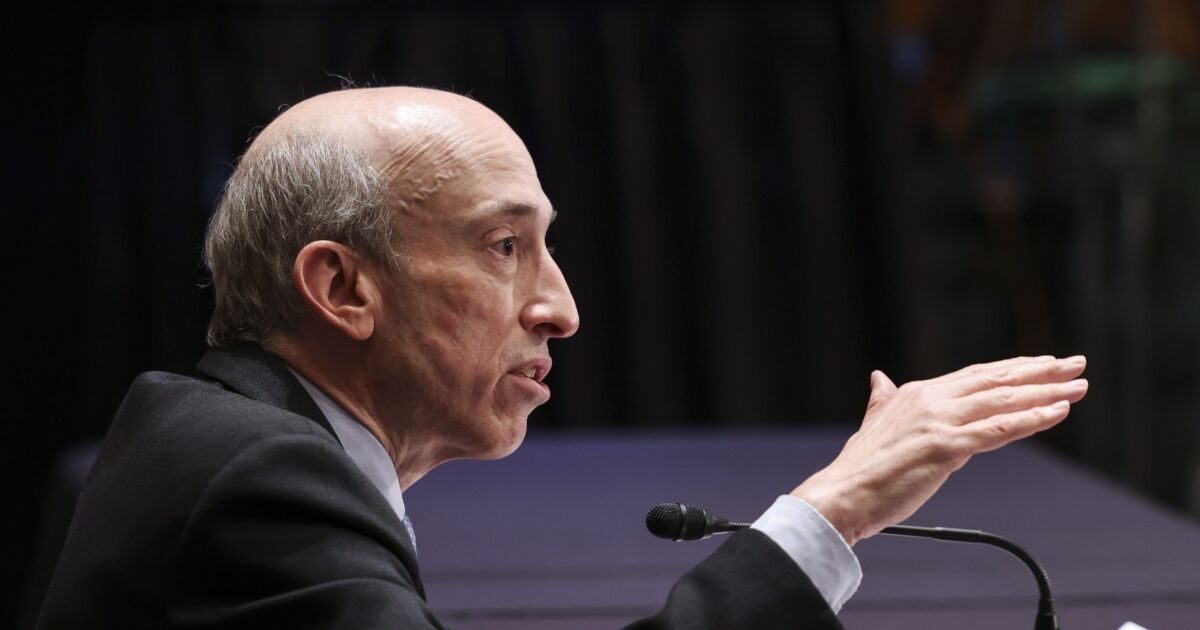

“I’m happy to assist these amendments as a result of they’ll modernize and enhance the effectivity of the submitting course of — for filers, buyers, and the SEC,” mentioned SEC Chair Gary Gensler in a press release Friday. “In a digital age, it’s necessary for buyers to have simple, on-line entry to materials data, relatively than needing to go to SEC amenities to entry that data. That is notably necessary throughout COVID-19, which has made in-person visits to entry these filings much more difficult. Even when entry to bodily copies isn’t restricted, there are different prices related to paper filings. It prices buyers time and cash to journey to the SEC’s studying room. It prices the SEC time and cash to course of paper filings. These amendments will scale back prices and drive extra efficiencies for buyers, filers and the SEC.”

Gary Gensler

Evelyn Hockstein/Bloomberg

In some instances, the amendments require the usage of Inline XBRL (Extensible Enterprise Reporting Language) for use, a data-tagging format that’s already extensively in use for a lot of monetary filings.

The SEC famous that digital submitting capabilities have helped deal with logistical and operational points raised by the unfold of COVID-19. Increasing digital submission will permit the Fee and filers to navigate extra successfully any future disruptive occasions that make the paper submission course of unnecessarily burdensome, impractical, or unavailable.

The amendments will take impact 30 days after publication within the Federal Register. The SEC is offering the next transition intervals to offer filers with ample time to organize to submit these paperwork electronically in accordance with the EDGAR Filer Handbook, together with making use of for the required filer codes on EDGAR:

- Six months after the efficient date of the amendments for filers to submit their “shiny” annual experiences to safety holders electronically in accordance with the EDGAR Filer Handbook and, aside from for Type 144, for paper filers who could be first-time digital filers;

- Six months after the date of publication within the Federal Register of the Fee launch that adopts the model of the EDGAR Filer Handbook addressing updates to Type 144 for submitting Type 144 electronically on EDGAR; and

- Three years after the efficient date of the amendments for filers to submit the monetary statements and accompanying schedules to the monetary statements required by Type 11-Okay within the Inline XBRL structured information language.

The SEC famous in an accompanying truth sheet that the amended guidelines would promote extra environment friendly storage, retrieval and evaluation of paperwork in comparison with a paper submission and modernize the way in which wherein data is submitted to the SEC. The amended guidelines additionally will enhance the SEC’s potential to trace and course of filings and modernize the SEC’s data administration course of.

The SEC supplied additional particulars on particular varieties:

The amended guidelines apply to numerous issuers, associates and nationwide securities exchanges that file or submit experiences to the SEC and would require the digital submitting or submission of:

● Paperwork that at the moment are permitted to be submitted electronically beneath Rule 101(b) of Regulation S-T, together with notices of exempt solicitations and exempt preliminary roll-up communications, the “shiny” annual report back to safety holders, Type 144 for gross sales of securities of issuers topic to the reporting necessities of Part 13 or 15(d) of the Change Act, filings on Type 6-Okay, and filings made by multilateral growth banks;

● Certifications made based on Part 12(d) of the Change Act and Change Act Rule 12d1-Three {that a} safety has been accredited by an trade for itemizing and registration; and

● Sure international language paperwork.

The SEC adopted guidelines and kind amendments to:

● Mandate the digital submitting or submission of sure paperwork that at the moment are allowed to be filed or submitted in paper; and

● Mandate the usage of Inline XBRL for submitting the monetary statements and accompanying schedules to the monetary statements required by Type 11-Okay.

The amended guidelines additionally would require the usage of Inline XBRL for submitting monetary statements and accompanying notes to the monetary statements required by Type 11-Okay and make a number of technical updates to Type F-10, Type F-X and Type CB to do away with some outdated references.