20 years after passage of the Sarbanes-Oxley Act, public firms are spending extra money and time making an attempt to adjust to SOX necessities, regardless of the growing use of know-how to automate the method.

A survey launched Thursday by the consulting agency Protiviti discovered that the variety of hours dedicated to SOX compliance elevated for 53% of firms throughout most industries, firm sizes and reporting varieties final yr. The survey polled greater than 560 audit, compliance and finance leaders in March and April 2022, and located that whereas firms are growing their use of automation and exterior assets, there are nonetheless many alternatives to average value will increase for SOX compliance.

A mean of 41% of surveyed organizations’ SOX compliance prices are for outsourced assets, both onshore or offshore, up from 37% in 2021. Corporations use know-how instruments on a median of 25% of their total SOX compliance program actions, leaving important room for enchancment.

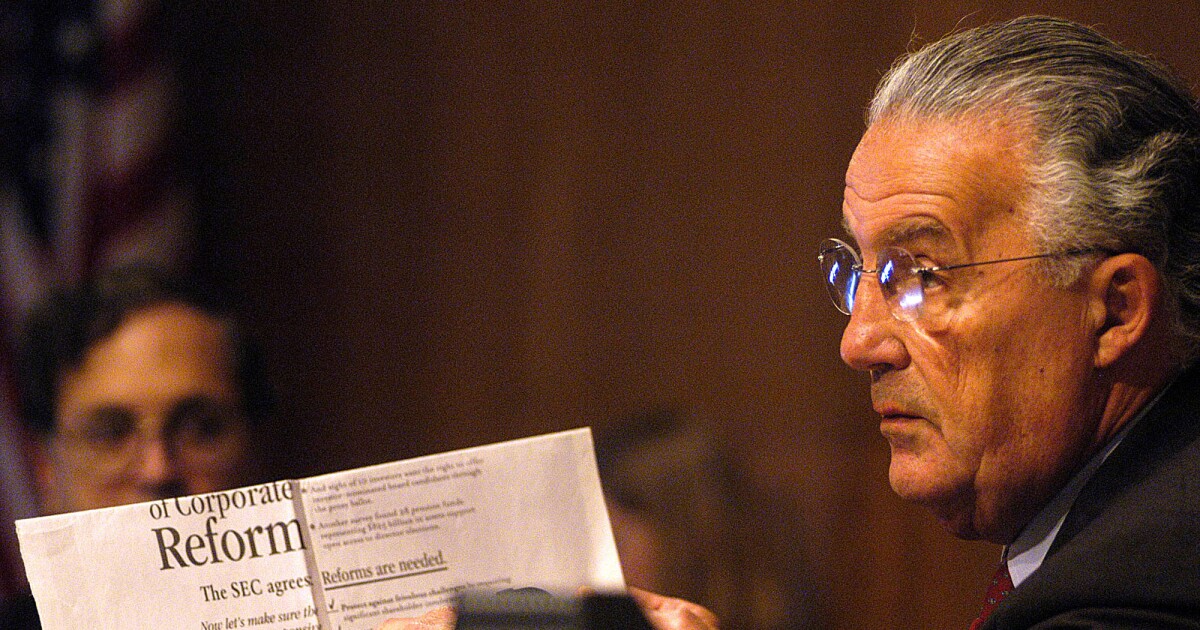

Paul Sarbanes

Jay Mallin/Bloomberg Information

SOX was handed by Congress in 2002 within the wake of a sequence of high-profile accounting scandals at firms together with Enron, WorldCom and Tyco. The regulation required public firms to arrange inner controls over monetary reporting that will be signed off on by prime executives and auditing companies, and established the Public Firm Accounting Oversight Board to set auditing requirements and examine the work of audit companies.

Regardless of enhancements in SOX and auditing know-how in current many years, prices preserve going up. The survey discovered that for firms which might be past their second yr of SOX compliance, common annual prices for SOX compliance rose 18% from 2021 to 2022. Thirty % of surveyed firms past their second yr of SOX compliance spent over $2 million of their most up-to-date fiscal yr, in comparison with 24% the earlier yr.

“In the present day inner audit and finance leaders have a menu of choices out there to innovate and streamline their SOX compliance applications and reduce inner burdens, from know-how instruments that assist automation, present workflow capabilities and assist doc administration, to various supply fashions, similar to facilities of excellence managed internally or by an exterior outsourcing companion,” mentioned Andrew Struthers-Kennedy, a Protiviti managing director and international chief of the agency’s inner audit and monetary advisory observe, in an announcement. “The continued conflict for expertise underscores the urgency for inner audit leaders to discover the staffing and retention benefits that various service supply fashions can yield. Supply heart organizational constructions supply inner audit groups the power to concentrate on strategic contributions and keep away from burnout and turnover associated to sure repetitive and routine SOX program actions.”

For a corporation with 200 controls, a discount of 1 hour in, for instance, testing for working management effectiveness can save 200 particular person hours and result in important advantages in effectiveness and inhabitants protection, in response to Protiviti.

Corporations are turning to know-how to attempt to make the method extra environment friendly, with 54% of surveyed firms leveraging audit administration and governance, danger and compliance (GRC) know-how, whereas two out of 5 organizations are utilizing knowledge analytics and visualization platforms. One in three are using segregation of duties evaluation instruments and steady monitoring. However know-how is just being utilized in about one out of 4 of their total SOX compliance efforts on common.