Rates of interest on house mortgages are rising quickly throughout america, which appears to be slowing most housing markets. (Some, just like the market right here in Corvallis, have been much less affected. Give it time.)

The common mortgage charge for a 30-year mortgage was about 3.0% at the beginning of the 12 months; immediately, it is at 6.245% — even for anyone with a superb credit score rating over 800.

Kim and I are lucky that we purchased our house in 2021 as a substitute of ready till 2022. Mortgage charges weren’t really an element throughout our deliberations final 12 months; the traditionally low charges have been merely an added bonus for getting after we did.

Once we bought our house final August, we took out a $480,000 mortgage at 2.625%. We did not hit the exact backside of the mortgage market (that was early January 2021, after we might need had a mortgage for two.5%), however we got here shut.

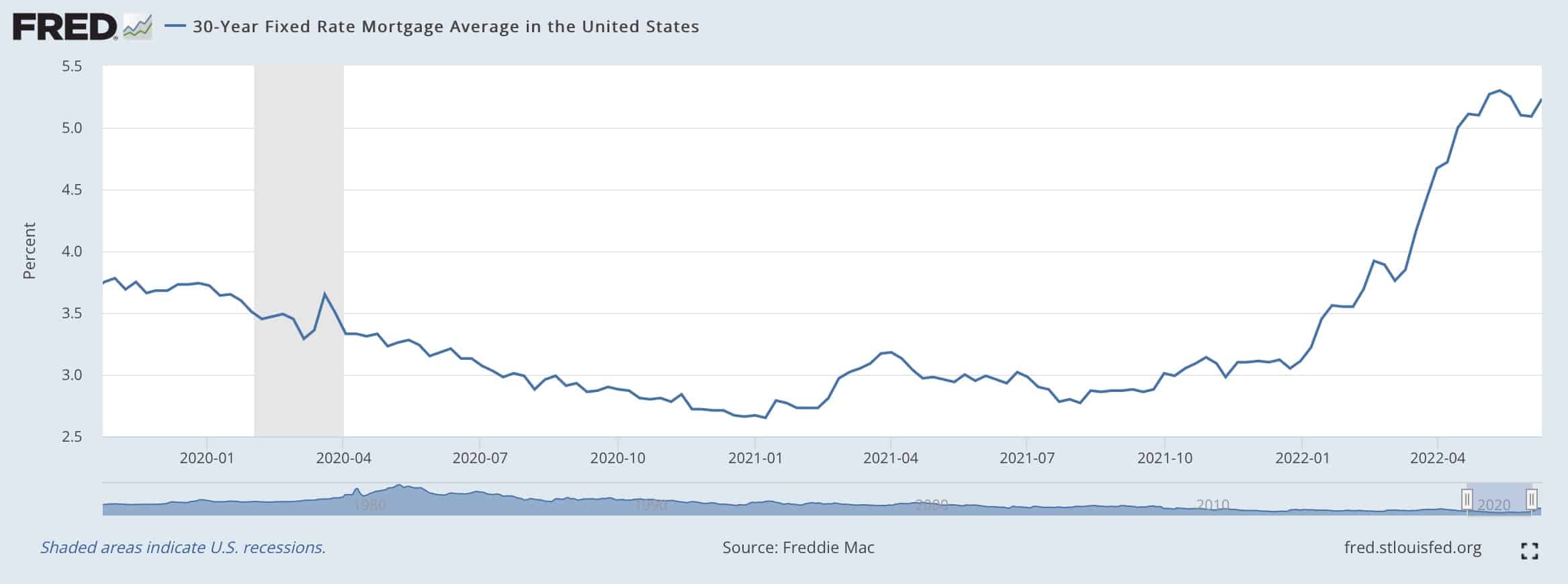

This is a chart from the Federal Reserve that reveals mortgage charges from the previous 2.5 years.

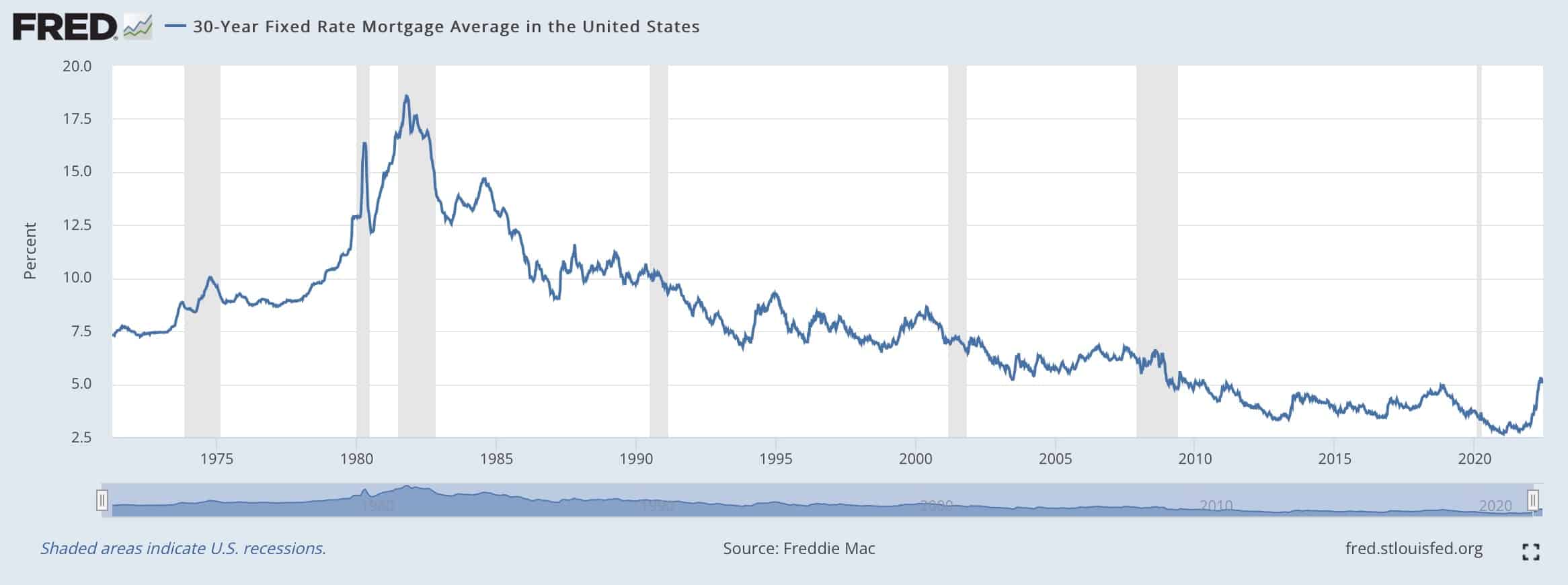

And here is a chart that reveals mortgage charges for the previous 50+ years:

Mortgage charges have hovered at historic lows because the Nice Recession of 2007-2009. And charges fell even additional throughout the COVID pandemic. (These low charges are partly chargeable for the blazing-hot housing market of the previous two years.)

What do these rising mortgage charges imply to precise house patrons? Let’s use our scenario as a consultant instance.

Rising Charges Lower Shopping for Energy

Final August, Kim and I closed on our house right here in Corvallis. It is a 1964 behemoth for which we paid $680,000. With a $200,000 down cost, we managed to get a 2.625% APR on a 30-year mortgage. We pay $1929.33 every month for principal and curiosity. (Our precise mortgage cost, together with taxes and insurance coverage, is $2528.43 per 30 days.)

At this time, that very same mortgage would value us 6.245%. If we needed to purchase this similar home on the similar worth with the identical down cost, our month-to-month funds for principal and curiosity can be $2956.04 — a rise of over $1000 per 30 days in comparison with shopping for a 12 months in the past!

If we have been purchasing for properties immediately and needed to maintain our mortgage cost the identical — $1929.33 per 30 days — we would must decrease our sights. As a substitute of taking out a $480,000 mortgage on a $680,000 house, we would be taking a look at a $313,500 mortgage on a $513,500 house.

However wait! That is not all! Residence costs in our city have risen 10% throughout the previous 12 months, so that might additional compromise our purchasing energy. If we had waited till now to purchase and needed to maintain our mortgage cost at $1929.33, we would be purchasing for properties that value $467,000. Delaying a 12 months would have decreased our purchasing energy by $213,000 — over 30%.

Whereas low mortgage charges did not spur us to maneuver final 12 months, they actually gave us an incentive to behave shortly. Conversely, if we had waited till this 12 months, I am unsure what we might have carried out. Understanding me and my aversion to onerous debt, I in all probability would have been reluctant to take out a mortgage. I’d have tried to discover a house to purchase with money, limiting my choices even additional.

When mortgage charges are at loopy lows like 2.625%, I do not assume twice about carrying a mortgage. It is a no-brainer. I desire a mortgage on my house each single time, and I by no means wish to pay it off. A charge of two.625% is not free cash (and I do not wish to fake that it’s), nevertheless it’s fairly rattling low cost. The hole between anticipated long-term inventory returns (6.8%) and our mortgage charge (2.625%) is large. There’s a number of room there, a giant margin for error.

However, there’s virtually no hole between a charge of 6.245% and anticipated market returns of 6.8%. There is not any margin for error. I am cautious of borrowing cash at this charge, particularly such a big quantity. I might fairly not have a mortgage with charges this excessive.

What Does the Future Maintain?

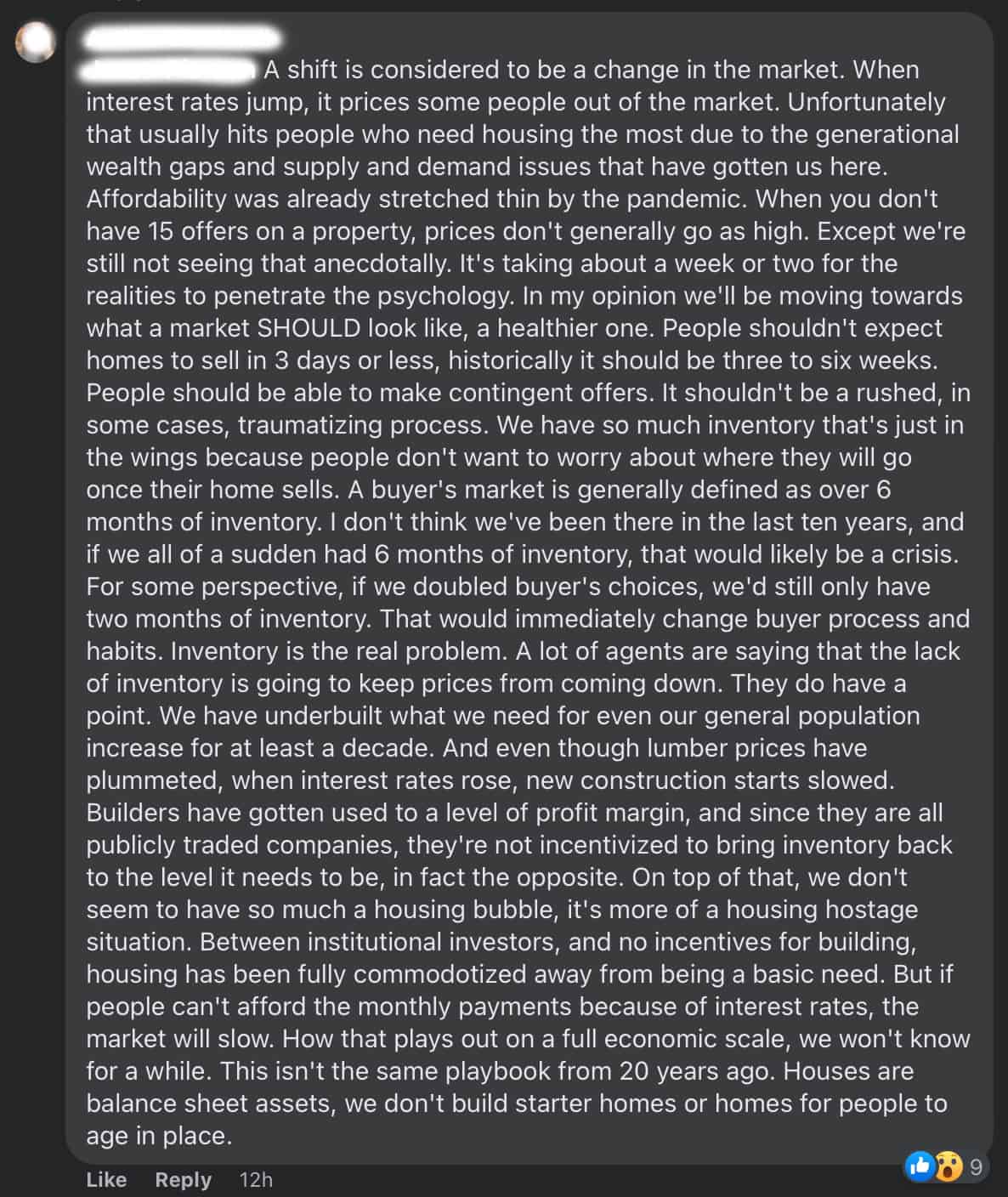

I anticipate that rising rates of interest may have their meant impact: They’re going to cool the blazing-hot housing market. Will costs drop? Most likely. However who is aware of? It is clear, although, {that a} shift is coming.

I’ve a handful of associates who’re real-estate brokers. Should you too have real-estate agent associates, then you understand that they are usually permabulls in terms of their trade. They’ve an unflagging perception in the way forward for house costs. However even my real-estate associates consider some kind of shift has begun.

This is an extended (and attention-grabbing) Fb remark from certainly one of my real-estate associates:

Final 12 months, house costs have been excessive, however these excessive costs have been mitigated by super-low rates of interest on house loans. Now you have received a double whammy: excessive costs and excessive charges. At this time looks as if an particularly poor time to buy a house. That is not a superb combo.

I really feel sorry for people who completely should transfer proper now. They’re getting screwed.