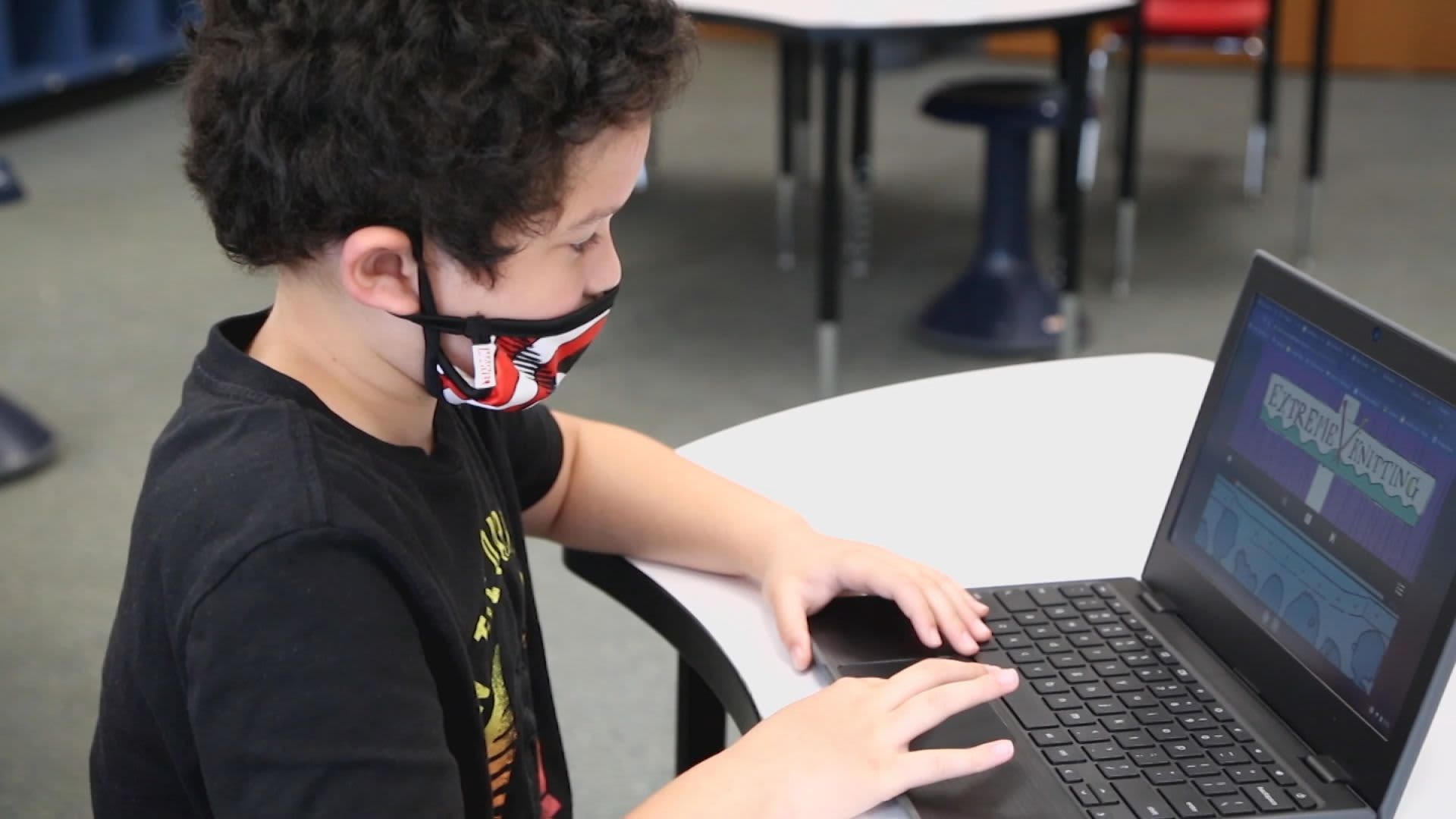

9-year-old scholar Roberto Nieves Fernandez research private finance matters on his laptop computer utilizing on-line useful resource middle SmartPath.

SMARTPATH

Extra states are requiring college students to take private finance training programs earlier than they graduate highschool.

There are at present 23 states that mandate a private finance course for college kids, in response to the 2022 Survey of the States launched Thursday from the Council for Financial Schooling.

Since 2020, the final time the survey was printed, two states — Nebraska and New Mexico — have handed laws guaranteeing that every one college students will take a private finance course earlier than they graduate highschool.

Extra from Spend money on You:

Need to give your funds a spring cleansing? First, get organized

Here is what to learn about managing your debt in retirement

Need to discover monetary success? Here is the right way to get began

“Whereas we’re inspired by some progress in our newest survey, all younger individuals throughout the nation want extra and deserve higher,” stated Nan Morrison, president and CEO of the Council for Financial Schooling.

Unequal progress

There’s been constant momentum in states including private finance training in numerous methods for greater than 20 years. The variety of states that embrace private finance of their training requirements has jumped to 47 in 2022, from 21 in 1998.

In fact, what is obtainable and required in these 47 states varies extensively, the report discovered. Whereas 27 states provide a private finance course in highschool, solely 23 mandate that college students should take one to graduate.

And, of these, solely 9 programs are a stand-alone private finance course — the remaining ones are built-in into one other class.

“The state of monetary training provided to college students within the U.S. varies considerably,” stated Worku Gachou, head of North America, inclusive impression & sustainability, at Visa, which at this time with the Council for Financial Schooling launched FinEd50, a coalition of personal, public and nonprofit leaders that may promote assured entry in all places to those important programs.

“The place college students dwell mustn’t impression whether or not they have entry to data that may assist them learn to make knowledgeable monetary choices of their lives,” Gachou added.

These variations matter as a result of with out broader pointers, college students from lower-income households and other people of shade typically haven’t got the identical entry to private finance training, stated Morrison.

“If we do not get necessities handed, it simply exasperates the gaps which might be already there,” Morrison stated.

Economics programs falling behind

The report additionally discovered that whereas there’s been constant momentum in including private finance training and necessities to highschool curriculums lately, pointers for economics programs have stagnated.

Since 2011, solely three states have added a requirement that college students should take an economics course to graduate.

Whereas economics generally overlaps with private finance training, each are necessary programs of research, Morrison stated. Learning economics offers college students the chance to consider and analyze lots of matters related to the world such because the atmosphere, housing and employment.

Private finance programs, then again, assist college students study to handle their very own cash and make strong decisions, given what’s occurring on this planet.

“In my superb world, each child would have not less than a semester of econ and not less than a semester of non-public finance to provide them set of expertise,” she stated.

SIGN UP: Cash 101 is an 8-week studying course to monetary freedom, delivered weekly to your inbox. For the Spanish model Dinero 101, click on right here.

CHECK OUT: 74-year-old retiree is now a mannequin: ‘You do not have to fade into the background’ with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are buyers in Acorns.