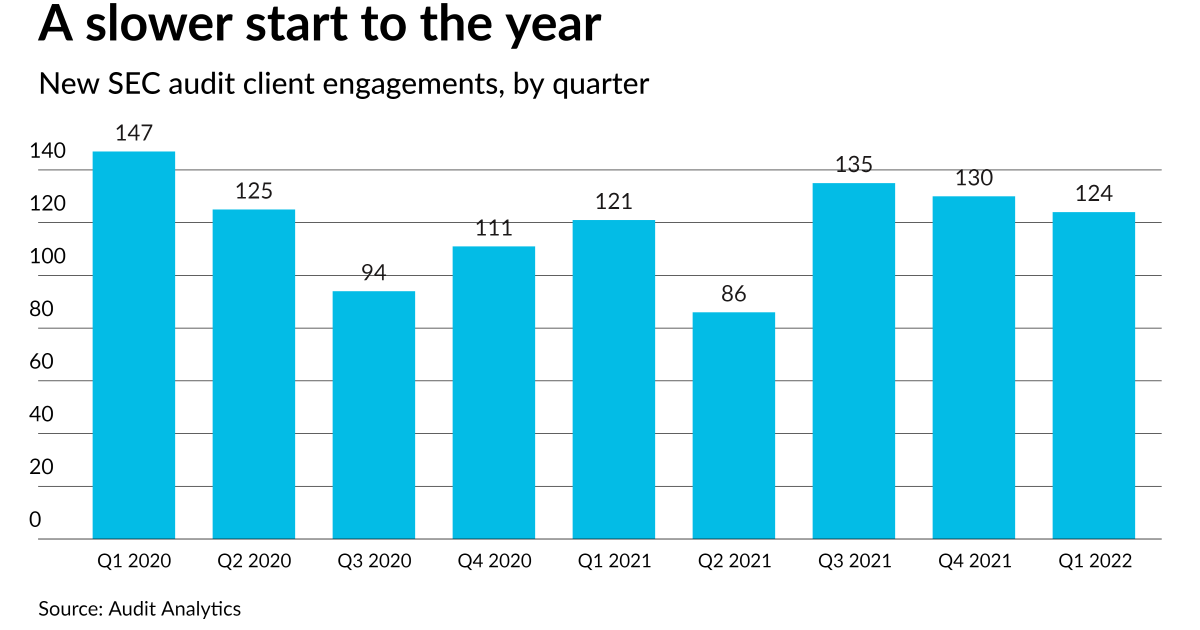

In a barely slower interval for brand spanking new Securities and Change Fee audit purchasers, a small Malaysian agency netted essentially the most new engagements within the first quarter of 2022.

Kuala Lumpur-based J&S Affiliate introduced on 5 new purchasers, with three of them coming from one other Malaysian agency, Whole Asia Associates, which has steadily appeared in these quarterly rankings, however is deregistering from the Public Firm Accounting Oversight Board.

Various corporations added extra new purchasers — together with BF Borgers, Deloitte & Touche and Ernst & Younger, which all introduced on seven apiece, and Marcum, which introduced on six — however netted fewer than J&S. (See “Web engagement leaders”).

It was a very sluggish interval for bigger corporations, with solely 4 exhibiting a internet acquire of SEC purchasers. Deloitte topped the charts by netting three, whereas EY, PricewaterhouseCoopers and BKD all netted a single new shopper every. (See “Consumer positive aspects & losses”).

Purchasers by submitting standing, and extra

Breaking the brand new engagements down by submitting standing, J&S Affiliate took the highest spot for non-accelerated filers and smaller reporting corporations, whereas PricewaterhouseCoopers led amongst accelerated filers and SRCs, and EY ranked first for giant accelerated filers. (See “Audit leaders”).

Lastly, Ernst & Younger led the league tables for each new market capitalization audited and new audit charges, thanks in no small half to cancer-focused biotechnology firm BeiGene Ltd., with a $12.34 billion market cap (and $3.eight million in audit charges), whereas PRA Group Inc. added $5.Three million in audit charges. (See “New shopper leaders.”)

Deloitte, in the meantime, took the lead in new belongings audited, with California-based financial institution holding firm Pacific Premier Bancorp offering $21.1 billion of its whole of $30.6 billion. It additionally got here second when it comes to new market cap, due to Pacific Premier’s $3.37 billion, and $2.25 billion from Ohio-based {hardware} options supplier Hillman Options Corp.

And PwC took second place in each new belongings audited and new audit charges, due to $24.four billion and $9.39 million, respectively, from Bermuda-based insurer Enstar Group.

Knowledge for the quarterly rankings are supplied by Audit Analytics, a premium on-line intelligence service delivering audit, regulatory and disclosure evaluation. Attain them at (508) 476- 7007, information@auditanalytics.com or www.auditanalytics.com.