As of spring 2022, the AUM (property below administration) have been valued at $15 billion, and its on-line funding administration instruments have received a number of awards. In March 2019, Wealthsimple launched Wealthsimple Commerce, a self-directed funding platform. It instantly attracted a number of consideration for its means to permit Canadians to purchase and promote particular person shares and ETFs (exchange-traded funds) with zero fee charges. A couple of year-and-a-half later, Wealthsimple made one other splash when it added cryptocurrencies to its Commerce choices.

Questioning if Wealthsimple Commerce is best for you? Right here, we current the professionals and cons of Wealthsimple Commerce, in addition to take a deeper dive into its options. Learn on for the way it works and the price construction, so you may resolve for your self.

Wealthsimple Commerce execs and cons

The professionals

- Wealthsimple Commerce was one of many first commission-free buying and selling platforms in Canada. Most of its rivals cost a minimal of $4.95 and as much as $9.95 (or extra) per commerce.

- There are not any annual account charges or account minimums.

- You get free entry to 1000’s of shares and ETFs listed on North America’s largest exchanges, such because the New York Inventory Change (NYSE) and the Toronto Inventory Change (TSX). Plus, it additionally provides dozens of cryptocurrencies, together with bitcoin and ethereum, too.

- You should buy fractional shares in firms akin to Microsoft, Netflix, Tesla, Shopify, Royal Financial institution of Canada, Toronto Dominion Financial institution, and the Canadian Nationwide Railway Co. With fractional shares, you may personal a bit of those firms even in the event you don’t have some huge cash to take a position.

- You may open tax free financial savings accounts (TFSAs) and registered retirement financial savings plans (RRSPs) in addition to non-registered accounts. (Cryptocurrencies have to be held in a non-registered account as they aren’t TFSA or RRSP eligible)

- You may deposit as much as $1,500 immediately to start buying and selling instantly.

- Actual-time, on-demand quotes and limitless value alerts at the moment are free to all Wealthsimple Commerce purchasers.

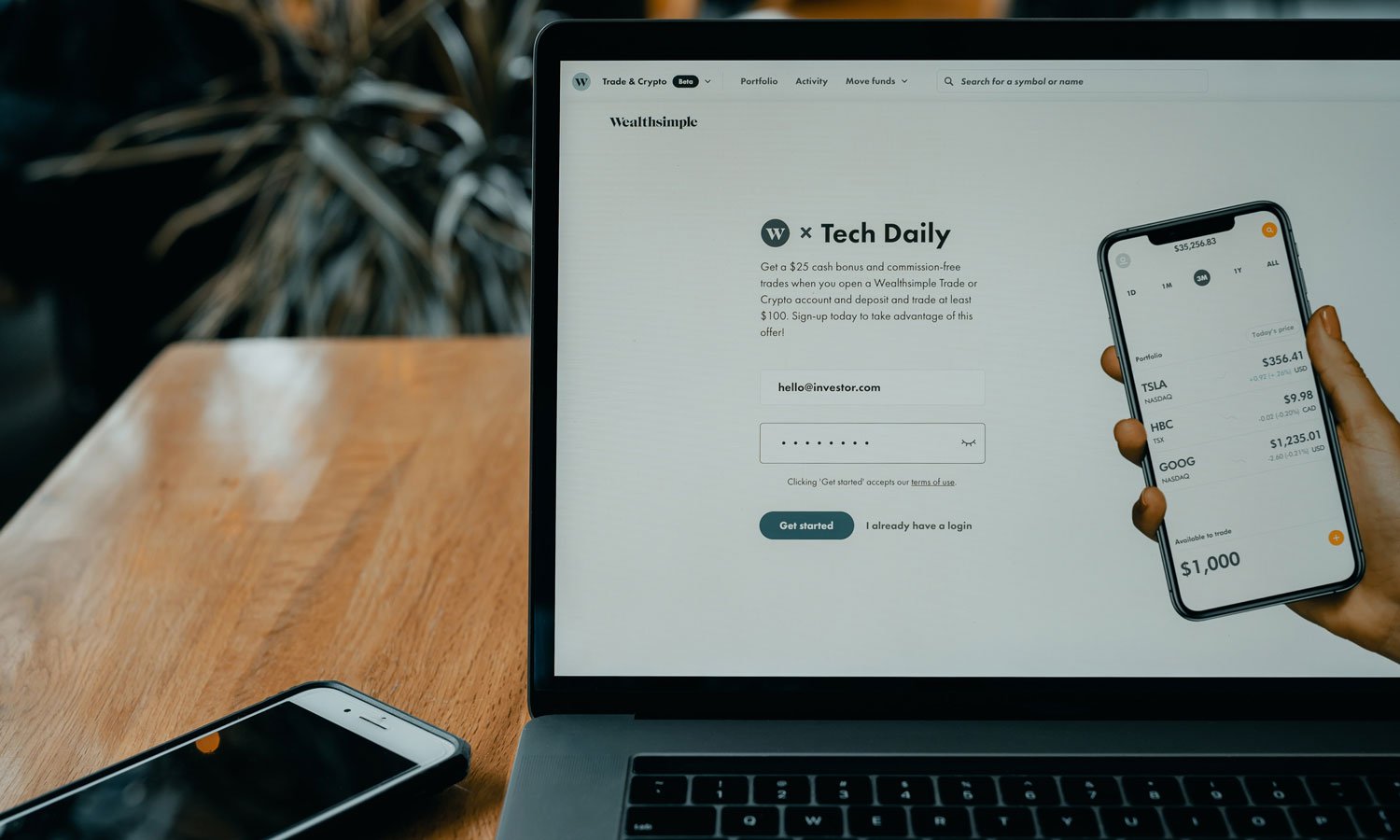

- The Wealthsimple Commerce app is enticing, clear and intuitive; even first-time buyers will discover it straightforward to make use of. The “browse” characteristic on the app kinds trending shares by totally different markets and classes. There may be additionally now an internet platform for customers preferring to commerce on their laptop computer or desktop moderately than a cellular system.

- Wealthsimple is a reliable monetary model. As talked about above, its property below administration are at present valued at $15 billion, and it has an estimated 2 million prospects. Wealthsimple can be regulated by the IIROC (Funding Business Regulatory Group of Canada) and the CIPF (Canadian Investor Safety Fund)—similar to the large banks.

The cons

- At present, Wealthsimple Commerce is solely for the buying and selling of shares, ETFs and choose cryptocurrencies. Different actions, akin to buying and selling mutual funds or buying IPOs, should not accessible.

- Wanting into shopping for U.S. shares? Know that you just received’t be capable of keep away from international trade charges within the fundamental no-fee account, since you may’t leverage “Norbert’s gambit” or maintain U.S. {dollars}. To carry U.S. investments in U.S. forex with out the fear of international trade charges, you’ll have to subscribe to the Commerce Plus plan, which prices $10 a month.

- There’s a lack of in-depth funding analytics and academic instruments, which may make issues tougher on some beginner buyers.

- Be warned in the event you’re in a rush to entry your funds. New deposits in extra of $1,500 (or over $5,000, in the event you subscribe to the Commerce Plus plan) might take as much as three enterprise days to course of. And customers can’t automate recurring deposits.

- The platform additionally doesn’t permit customers to automate dividend reinvestments. Having mentioned that, it’s straightforward to take action manually. That’s as a result of dividends are merely added to your money funds, which you’ll be able to then use to purchase extra shares, together with fractional shares, in only a few clicks.

Is Wealthsimple Commerce good?

Whether or not you’re a first-time investor or a seasoned one—passive or energetic—Wealthsimple Commerce is the best, most cheap instrument accessible for getting and promoting Canadian shares and ETFs. For these with extra closely diversified funding pursuits (akin to bonds, worldwide equities or treasured metals), Questrade or one other on-line brokerage could also be a greater different. Identical goes for many who want entry to buying and selling instruments and analytics

Open a Wealthsimple Commerce account* >

Wealthsimple Commerce detailed evaluation

Making a Wealthsimple Commerce account

Whether or not you’re signing up in your cellphone or laptop, it’s quite simple and it takes only a few minutes. Enter your electronic mail tackle and a password of your selecting. If you have already got a Wealthsimple account, simply use your current login data. Then the app/web site will information you thru the remainder. You could have the choice of making an unregistered account, a TFSA and/or an RRSP. Sadly, you may’t open registered retirement earnings fund (RRIF) or locked-in retirement account (LIRA) accounts with Wealthsimple Commerce.)

Easy methods to add funds

When you’ve ever used PayPal or accomplished an Interac e-Switch, you’ll discover this simply as straightforward. You hyperlink your checking account to your Wealthsimple Commerce account and enter the quantity you need to transfer (as much as $50,000 per switch).

As talked about above within the “cons” part, it will possibly take as much as three enterprise days to course of massive deposits, and there’s no characteristic to automate your deposits. So that you’ll need to manually set calendar reminders/notifications if you wish to recurrently arrange deposits to profit from dollar-cost averaging.

On the plus aspect, if you wish to transfer cash from one Wealthsimple platform to a different—say, from Wealthsimple Make investments to Wealthsimple Commerce—there’s now an automatic characteristic for this. You’ll have to switch your funding funds within the type of money, nevertheless.