The Public Firm Accounting Oversight Board is on tempo for a record-setting yr for civil financial penalties. Via July 31, 2022, the PCAOB has levied penalties in opposition to registered accounting companies and people totaling $1.36 million. Whereas this determine doesn’t seem vital compared to different regulatory businesses’ reporting metrics, it’s vital for the PCAOB, which has signaled it’s ramping up monetary penalties in enforcement settlements. At this price, 2022 penalties will eclipse annual penalties levied in 2019, 2020 and 2021.

In a July 28, 2022 speech to the Council of Institutional Buyers, PCAOB Chair Erica Williams acknowledged that strengthening the PCAOB enforcement exercise is among the board’s three key focus areas. She famous the board has “greater than doubled [its] common penalties in opposition to people in comparison with the final 5 years” and that the board has “elevated [its] common penalties in opposition to companies by greater than 65%.” She additionally indicated that every one 2022 settled circumstances have included monetary penalties.

Monetary penalties are solely certainly one of many sanctions accessible to the board. The board can prohibit a registered agency from accepting PCAOB engagements, require the agency to undertake sure remedial actions, briefly droop or completely bar people from engaged on or holding sure roles on issuer engagements, and requiring people to take related persevering with skilled training. Revoking a agency’s registration is probably the most extreme nonfinancial penalty the board can impose because it completely eliminates a agency’s income stream from issuer engagements.

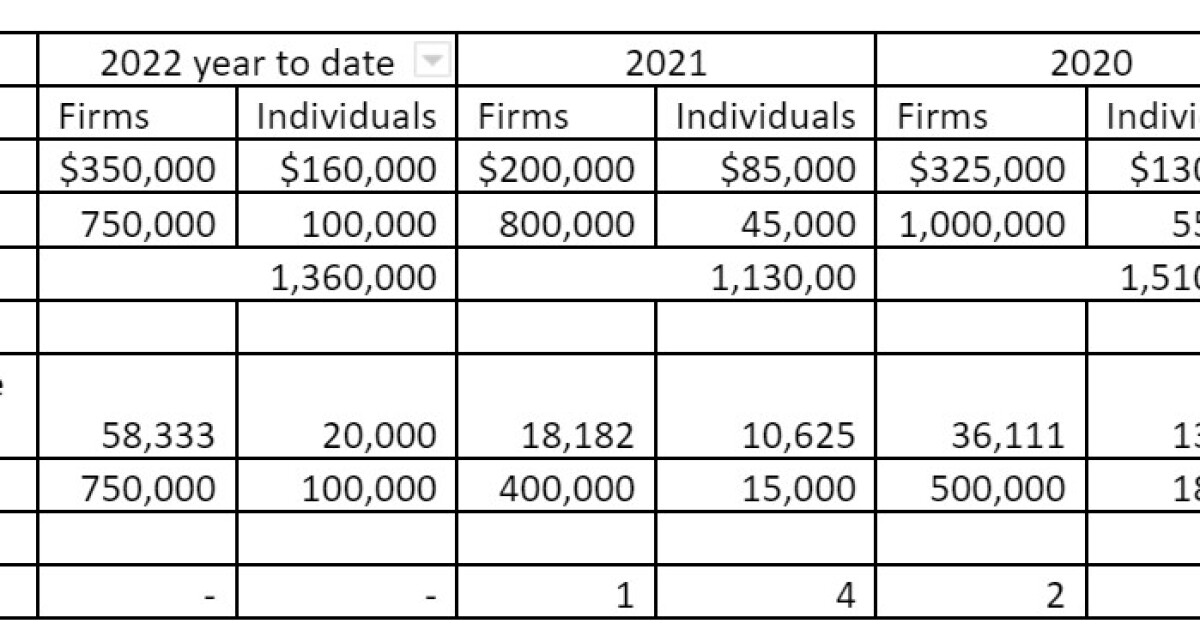

Traditionally, monetary penalties on companies and people ranged from vital to a mere slap on the wrist and assorted with the importance of the wrongdoing. An evaluation of economic penalties from 2019 to the current signifies that, when levied in any respect, penalties had been as little as $2,500. When imposing monetary penalties, the board considers the character of the agency and its operations. For the aim of this evaluation, companies not affiliated with worldwide networks (each home and worldwide), “non-affiliated companies,” had been segregated from these affiliated with giant, multinational companies or these inspected yearly, “affiliated companies.” The next desk summarizes monetary penalties in opposition to these companies or people related to them between Jan. 1, 2019 and July 31, 2022.

Be aware: For the six situations within the information included above wherein a single tremendous was attributed to each a non-affiliated agency and a person inside that agency, the desk divides the payment equally between the agency and the person.

On the present price, 2022 monetary penalties are projected to be $2.three million, virtually the worth of fines from 2021 and 2020 mixed.

Fines for affiliated companies and people related to these companies are persistently higher than these from non-affiliated companies and their personnel. That is probably because of the profiles of affiliated companies: They’ve extra sources; audit a considerably greater degree of market capitalization; and garner higher consideration to function a deterrent than do non-affiliated companies.

The rise in monetary penalties is probably going because of the change within the composition of the PCAOB board that passed off in late 2021 beneath the Biden administration. Excluding Duane DesParte, who turned a board member in April 2018, board members had been appointed in November 2021. In her feedback to the Council of Institutional Buyers, Chair Williams acknowledged she was “an enforcement lawyer at coronary heart.”

The PCAOB has been criticized for doling out paltry penalties. An evaluation revealed by the Challenge On Authorities Oversight in September 2019 indicated solely $6.5 million in fines had been levied in opposition to the Massive 4 accounting companies through the PCAOB’s first 16 years. POGO additionally discovered people at U.S Massive 4 companies had been fined solely $410,000 throughout that very same interval — a sum POGO indicated was lower than a single companion’s annual earnings at a Massive 4 agency.

In comparison with its counterpart in the UK, even the elevated monetary penalties in 2022 are nominal. On July 28, 2022, the Monetary Reporting Council revealed an enforcement evaluation disclosing document monetary sanctions of £46.5 million during the last yr.

Underneath PCAOB Rule 5303, all financial penalties are used to fund benefit scholarships for accounting college students and are usually not used to fund the PCAOB’s operations. On July 14, 2022, the board introduced the names of 250 accounting college students chosen for $10,000 scholarships for the upcoming educational yr.

Given the PCAOB’s elevated concentrate on enforcement exercise, Chairman Williams’ enforcement background and exterior strain to have monetary penalties function a extra significant deterrent, the upward development in monetary penalties shouldn’t be slowing anytime quickly.