The American Institute of CPAs proposed a set of revisions Monday to its Statements on Requirements for Tax Providers and individually despatched the Inside Income Service its suggestions for revising the digital forex query and directions on the Kind 1040, asking it to not change the time period to “digital asset.”

The proposed modifications to the Statements on Requirements for Tax Providers embody revisions to the present SSTSs together with three new requirements and an invite to touch upon the general problem of high quality administration and tax. The updates are aimed toward higher reflecting the present and future wants of AICPA members with excessive moral requirements.

“Revising the requirements is a robust step ahead to enhancing companies supplied by AICPA members in order that they proceed to be perceived because the premier suppliers of tax companies,” mentioned AICPA Tax Govt Committee chair Jan Lewis in a press release.

The AICPA is asking for feedback by Dec. 31, 2022. They are often submitted via an internet kind or emailed to SSTScomments@aicpa-cima.com. The modifications are anticipated to be included in a revised SSTS doc that will likely be accredited no later than Could 31, 2023, and efficient Jan. 1, 2024. For extra info, click on right here.

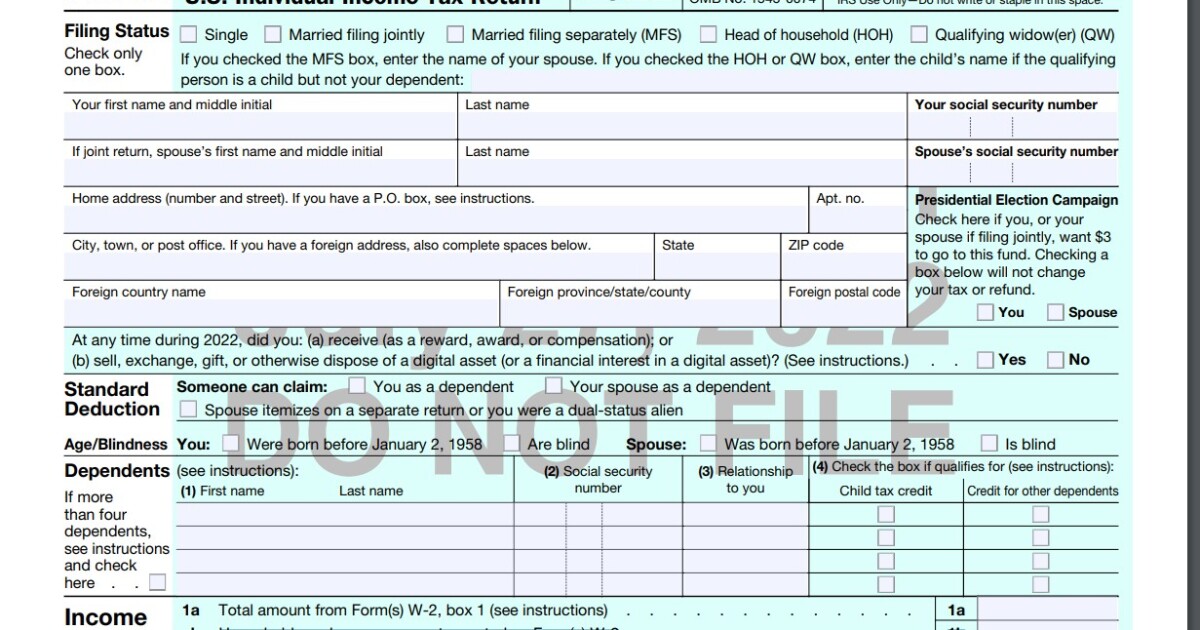

Individually on Monday, the AICPA additionally submitted its feedback to the IRS in regards to the digital forex query on the 2021 Kind 1040, U.S. Particular person Earnings Tax Return, and directions (and its variations together with the 2021 1040-SR, U.S. Tax Return for Seniors, and 1040-NR, U.S. Nonresident Alien Earnings Tax Return) together with the draft 2022 Kind 1040 as of July 27, 2022.

On the draft kind, the IRS is planning to alter the query from one about “digital forex” to “digital asset” (see story). The present wording is “At any time throughout 2021, did you obtain, promote, alternate, or in any other case eliminate any monetary curiosity in any digital forex?” On the draft kind for subsequent tax season, the IRS has altered the query to ask, “At any time throughout 2022, did you: (a) obtain (as a reward, award, or compensation); or (b) promote, alternate, reward, or in any other case eliminate a digital asset (or a monetary curiosity in a digital asset)?”

The query may probably be interpreted as asking about varieties of cryptocurrency comparable to nonfungible tokens, or NFTs.

The AICPA is asking for the query to be clarified earlier than the 2022 types are finalized with the intention to present higher certainty to taxpayers and tax preparers and to assist them adjust to the query and total reporting necessities for digital forex.

It’s asking the IRS to make clear the which means of digital forex. It recommends the IRS modify the definition of digital forex as described within the first paragraph of the Kind 1040 directions to make it according to the definition in Rev. Rul 2019-24 and Discover 2014-21. The definition within the directions ought to state that the IRS makes use of the time period “digital forex” to refer solely to convertible digital forex. As well as, it instructed examples of convertible digital forex needs to be included.

The AICPA additionally desires additional clarification on whether or not the phrases “unit of account,” “retailer of worth” and “medium of alternate” all have to be current or if only one have to be current. Every of the phrases needs to be outlined, and the AICPA believes the reference to any asset with the “traits of digital forex” needs to be eliminated as a result of it is not a part of IRS official and binding steerage, creates confusion and is probably broad past the definition of digital forex supplied by the IRS.

As for altering the time period from “digital forex” to “digital asset,” the AICPA believes the IRS shouldn’t ask about “digital property” till the time period has been outlined in remaining rules below Part 6045 of the Tax Code and that the shape ought to proceed to make use of the time period “digital forex” till remaining rules are issued to formally outline the time period “digital asset” as added to Part 6045 by the Infrastructure Funding and Jobs Act.

The AICPA as a substitute recommends that the digital forex query be modified to say, “At any time throughout 2022, did you have got a taxable occasion involving digital forex? See directions. ___ Sure ___ No”

The AICPA additionally desires extra info to be added to the directions, together with a definition of digital forex and examples of taxable and nontaxable occasions in step with new wording. The IRS additionally ought to clarify if a taxpayer must reply “sure” if a dependent had a digital forex occasion however would not have a submitting requirement. The AICPA really useful the directions specify {that a} digital forex occasion of a kid or dependent claimed on the return doesn’t require the person filer to reply “sure.” The directions also needs to say a person filer who in any other case would not have a submitting obligation is not required to file Kind 1040 simply to reply “sure” to the digital forex query.

“Taxpayers and their advisors need to adjust to IRS steerage on digital forex, however they lack sufficient directions to take action,” mentioned Annette Nellen, chair of the AICPA Digital Foreign money Process Pressure, in a press release. “We strongly urge the IRS to think about our suggestions, which is able to facilitate compliance from taxpayers on these essential points that have an effect on a rising variety of taxpayers.”