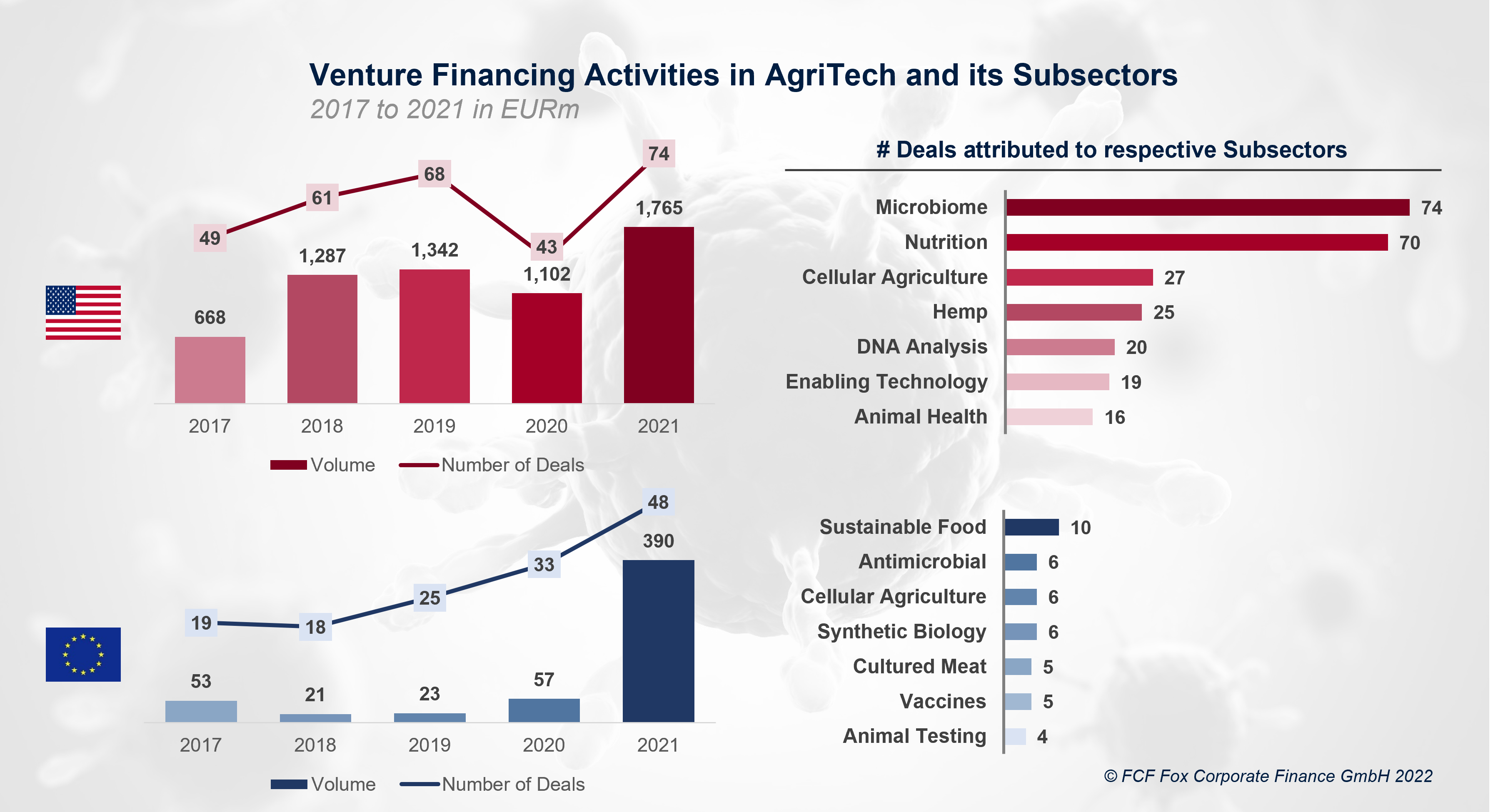

Transaction volumes and the variety of closed offers within the AgriTech area continued their regular progress within the US and massively surged in Europe.

Within the US, VC financing volumes in AgriTech greater than doubled from EUR 668m to EUR 1.8bn since 2017. In Europe, the curiosity within the AgriTech sector considerably gained in significance in 2021 as financing volumes grew sevenfold from EUR 53m (2017) to EUR 390m (2021).

This leap in 2021 is partly because of the first financing spherical of 21st.Bio, a producer of proteins and peptides for sustainable meals and agriculture options (EUR 89m), backed by Novo Holdings.

Most offers within the US had been attributed to the microbiome and diet subsector, whereas the sustainable meals and antimicrobial subsector dominated European AgriTech offers.

SOSV has been essentially the most energetic investor in European and US AgriTech offers. Apparently, EIT Meals, a Belgian accelerator, has been the second most energetic investor in Europe.