Simply days after American officers arrived in Hong Kong to evaluate the audit work papers of Chinese language corporations, Washington’s watchdog has a stern warning for Beijing: U.S. inspectors should get full entry.

Public Firm Accounting Oversight Board Chair Erica Williams reiterated Thursday that her company is anticipating to have the ability to “fully” examine and examine the paperwork tied to corporations that commerce in New York. Something much less, she mentioned, would violate an settlement that the U.S. and China reached final month.

PCAOB officers landed in Hong Kong final week to start the inspections, which are supposed to stave off the delisting of about 200 corporations from US exchanges. Beijing and Washington reached a preliminary deal on Aug. 26 to let American officers evaluate the audit paperwork.

“I wish to be very clear: The time for negotiations is over,” she mentioned in remarks ready for an occasion hosted by the Council of Institutional Buyers. “The settlement has been signed. And it have to be adopted fully.”

The potential removing stems from Beijing’s longstanding refusal to let American officers evaluate the audit work papers of corporations based mostly in China and Hong Kong, as they will with corporations based mostly elsewhere.

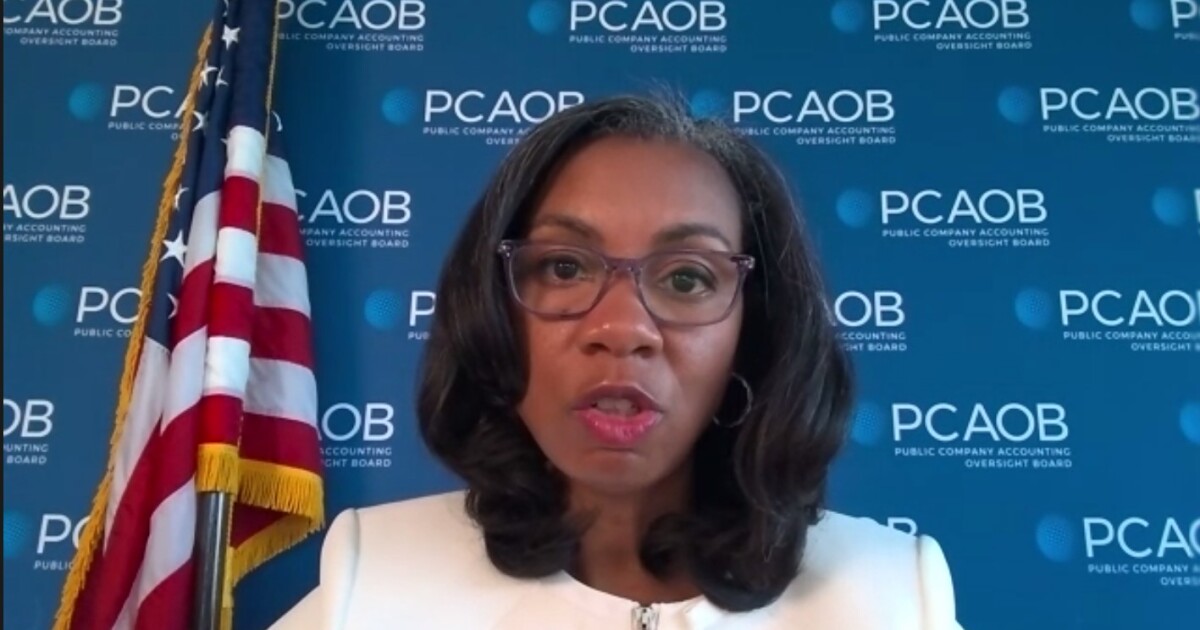

PCAOB chair Erica Williams

A 2020 U.S. legislation set a three-year timeframe for booting public corporations from American markets if PCAOB inspectors cannot evaluate their audit paperwork as required by the 2002 Sarbanes-Oxley Act. That laws was handed within the wake of the Enron Corp. accounting scandal and it is meant to forestall fraud and wrongdoing that might wipe out shareholders.

China and Hong Kong are the lone two jurisdictions worldwide that have not allowed the PCAOB inspections, with officers there citing nationwide safety and confidentiality issues.