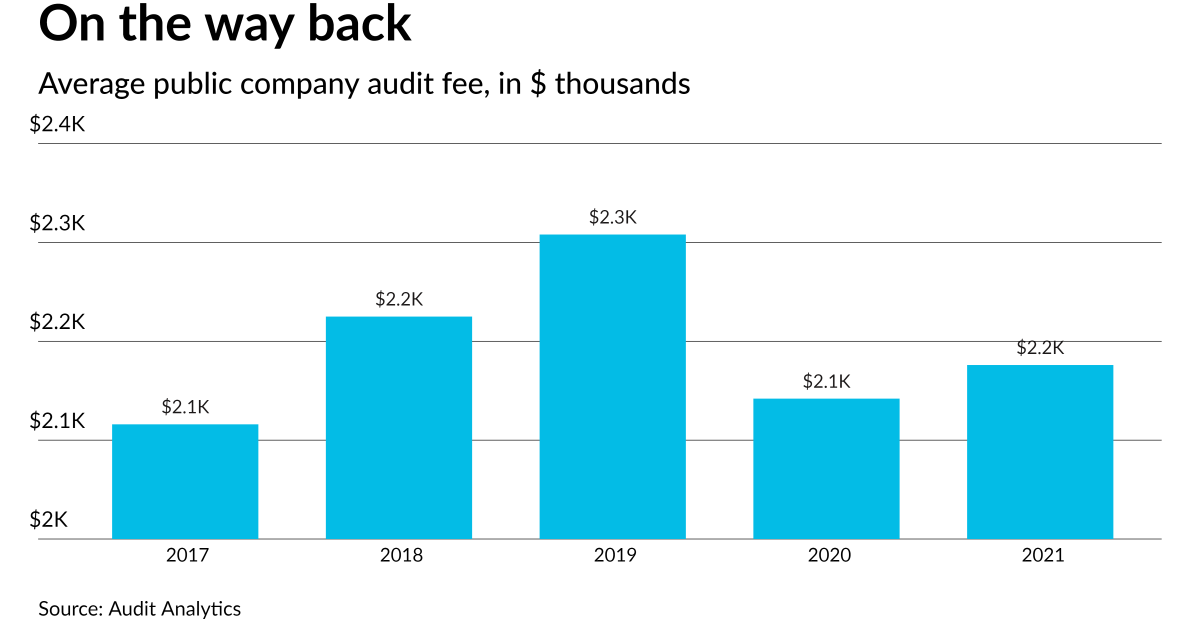

After dropping in 2020, audit charges bounced again in 2021, in accordance with a latest examine, however they nonetheless have not reached their pre-COVID highs.

The report — a 20-year assessment of audit and different charges from Audit Analytics — stated that whole audit and different charges has risen 3.3% in 2021 to $18.9 billion, in alignment with a rise within the variety of Securities and Trade Fee registrants between 2020 and 2021. Audit charges alone rose 2.9% in 2021.

The examine additionally discovered that the ratio of audit charges to revenues continued a five-year decline from 0.063% to 0.059%, which it attributed principally to income drops as a result of pandemic.

Over the long-term, whole audit charges charged have virtually tripled since 2002, when the Sarbanes-Oxley Act was handed. There was a near-doubling in 2004 because the ramifications of the act have been felt, and declines in 2009 and 2010 throughout the Nice Recession, however in any other case the climb has been reasonable and regular.

Audit charges as a proportion of whole charges have additionally risen since SOX, with non-audit charges declining yearly since 2012, decline from 11.8% of all charges to eight.9% in 2021.

Among the many report’s different takeaways:

- Massive 4 agency PwC tops the league tables when it comes to audit charges in 2021, with $4.5 billion, adopted by Ernst & Younger with $4.04 billion, Deloitte with $3.Three billion, and KPMG with $2.6 billion.

- After declining steadily since 2006 from 10,114 down to six,382 in 2019, the inhabitants of public firms rose within the first two years of the pandemic, hitting 7,133 in 2021.

- The variety of non-accelerated filers jumped considerably over 2020 and 2021, although their combination audit charges decreased.

For extra particulars, see Audit Analytics’ report.