The Treasury Division and the Inner Income Service issued last laws to remove a so-called “household glitch” within the guidelines for qualifying for premium tax credit to subsidize the price of well being protection below the Reasonably priced Care Act.

The Democrats main the primary tax committees in Congress hailed the transfer, however a Republican chief mentioned the transfer ran counter to the regulation, most likely exposing it to authorized challenges. The adjustments amend the laws concerning eligibility for the premium tax credit score to supply that affordability of employer-sponsored minimal important protection for members of the family of an worker is set based mostly on the worker’s share of the price of protecting the worker and people members of the family, not the price of protecting solely the worker.

The ultimate laws additionally add a minimal worth rule for members of the family of workers based mostly on the advantages offered to the members of the family. The foundations have an effect on taxpayers who enroll, or enroll a member of the family, in particular person medical insurance protection via a medical insurance trade and who could also be allowed a premium tax credit score for the protection.

Home Methods and Means Committee chairman Richard Neal. D-Massachusetts, and Senate Finance Committee chairman Ron Wyden, D-Oregon, applauded the ultimate regulation, predicting that it might decrease medical insurance prices for Individuals with unaffordable employer-sponsored protection by fixing the “household glitch.” That they had pushed for the adjustments again in Might.

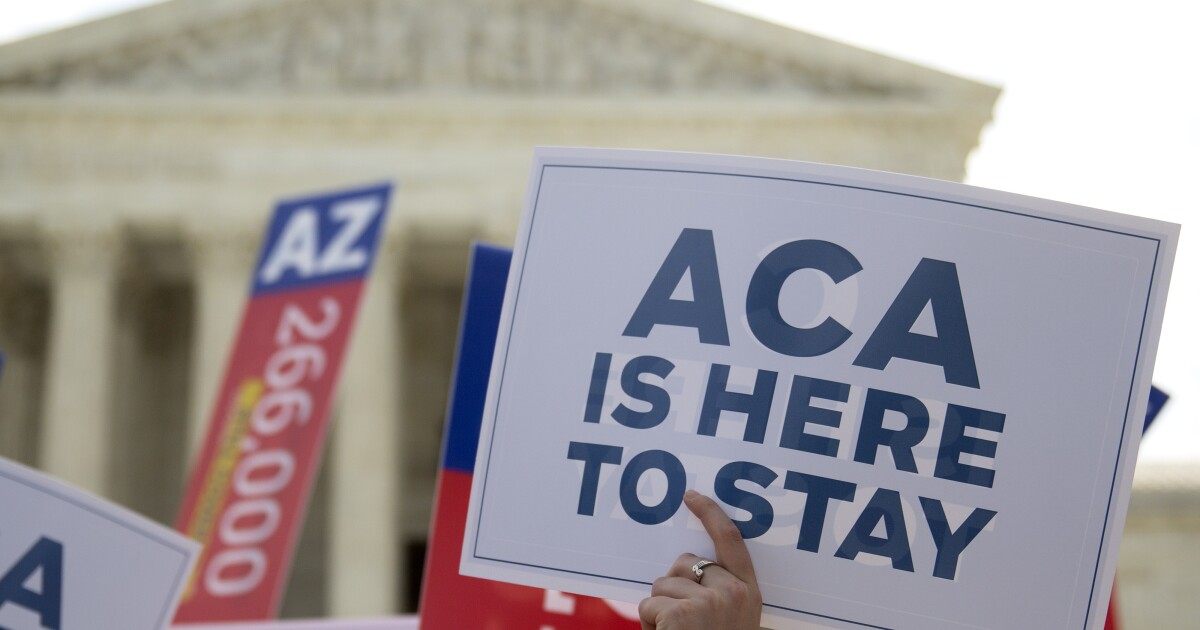

“The Reasonably priced Care Act ushered in a brand new period for our well being care system, and the premium tax credit have made means for the bottom uninsured price on document,” Neal and Wyden mentioned in a joint assertion Tuesday. “As we highlighted in our Might 2022 letter to Treasury and IRS, we now have lengthy believed that eliminating the ‘household glitch’ is the rightful interpretation of the textual content, construction, and objective of the ACA. With a specific highlight on low-income, small enterprise, and repair staff, an extra 1 million Individuals will now be capable to entry insurance coverage or have decrease prices. An unbiased estimate suggests a household of 4, making $53,000 per 12 months, would have roughly $4,150 again of their pockets.”

Underneath the change they urged again in Might, as an alternative of figuring out the affordability of an employer plan, and the related eligibility for the premium tax credit score, based mostly solely on the price of self-only protection, the regulation would look to the price of protection that features the worker’s members of the family. That means, it might be certain that these members of the family with out inexpensive household protection via an employer may gain advantage from the premium tax credit score to buy high-quality medical insurance market plans. They mentioned they believed that was the suitable studying of the 2010 well being care reform regulation, also referred to as Obamacare.

Nevertheless, Rep. Kevin Brady, R-Texas, the rating Republican on the Home Methods and Means Committee, contended that the adjustments violated the textual content of the statute. “President Biden’s harmful and unlawful choice to unilaterally rewrite Obamacare with out Congress is deeply troubling,” he mentioned in an announcement Tuesday. “That is no ‘household glitch.’ It is the letter of the regulation Democrats handed, which is why the Obama-Biden Treasury rejected this exact same strategy as not authorized only some years in the past. Just like the unlawful faculty debt bailout, the Biden Administration is pursuing tens of billions in new taxpayer spending that can solely worsen 40-year excessive inflation. With well being care insurance coverage inflation rising 17%, Democrats needs to be working with Republicans reasonably than persevering with to throw cash on the downside.”