U.S. earnings stay sturdy

It appears increasingly seemingly that firms in North America will begin to see their earnings decline sooner or later within the subsequent 12 months or so. By and enormous although, it doesn’t seem we’re at that time simply but. (All values are in U.S. foreign money except in any other case acknowledged.)

Pepsi (PEP/NASDAQ) kicked off the earnings season with a considerable earnings beat, cashing in to the tune of $1.97 in earnings per share (versus $1.84 predicted). Revenues had been additionally sturdy at $21.97 billion (versus $20.84 billion predicted). Shares had been up 4% on Wednesday after the earnings report.

Delta’s earnings (DAL/NYSE) arrived on time, coming at $1.51 per share (versus $1.53 predicted) on $12.84 billion in revenues (versus $12.87 billion predicted). The huge airline credited a robust worldwide demand (particularly to Europe) for its elevated earnings. Given the elevated worth of the U.S. greenback versus the euro and the pound, that development ought to proceed. Delta introduced that its pre-pandemic capability must be absolutely restored by subsequent summer time. Delta inventory completed Thursday up 4%.

Because the world’s greatest asset supervisor (at one level managing $10 trillion, or roughly 1 / 4 of all the planet’s belongings), BlackRock’s (BLK/NYSE) monetary well being is usually checked out as a bellwether for the broader economic system.

Whereas BlackRock introduced a really stable quarter, it did forecast some sturdy financial headwinds. Earnings per share had been $9.55 (versus $7.93 predicted). Whereas the corporate was clearly glad to announce such a robust earnings report amidst declining bills, revenues had been down 14.6% on a year-over-year foundation. Critics will be aware the worth of belongings below administration slid to $Eight trillion (beneath the $8.three trillion predicted by analysts). Falling equities markets have evidently taken their toll on Blackrock traders, however administration can’t be too frightened as they introduced greater than $375 million in share buybacks for the quarter. Shares had been up 6.63% at market shut on Thursday after the earnings announcement.

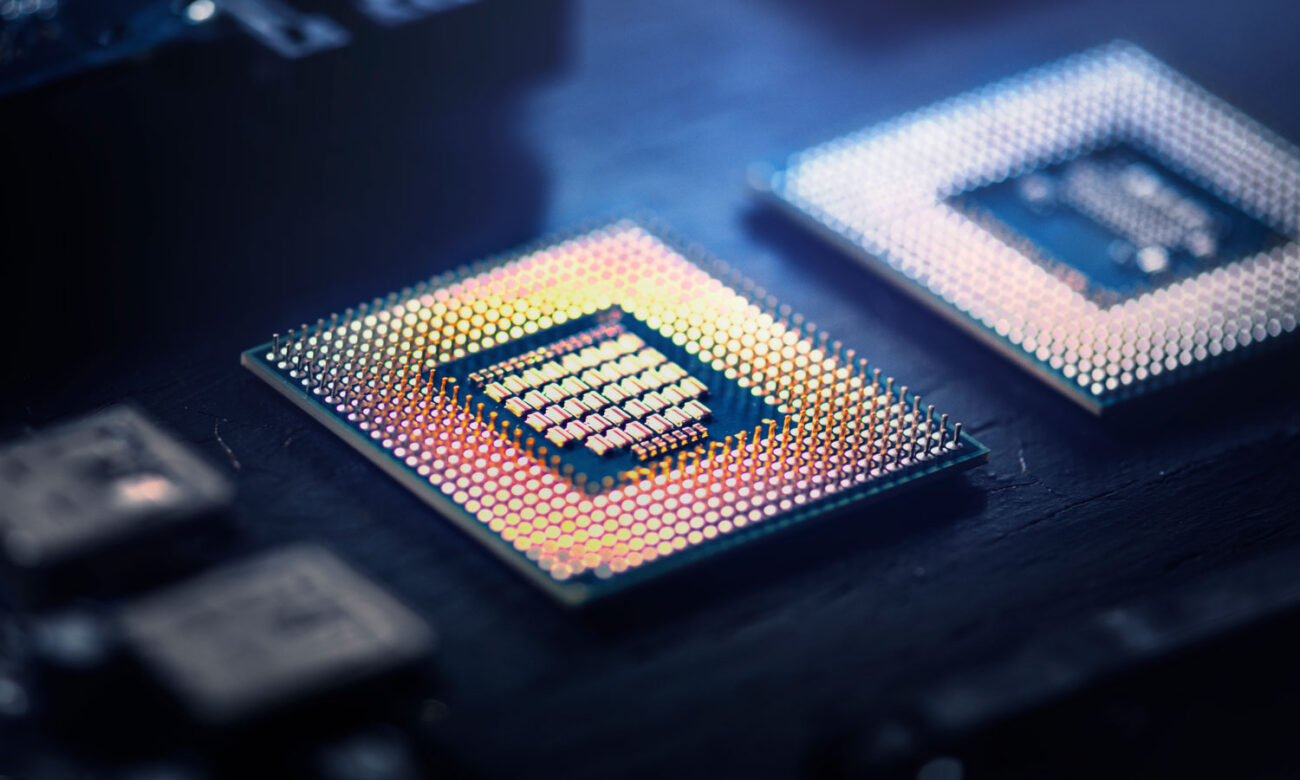

Taiwan semiconductor beats estimates however forecasts a shaky future

Taiwan Semiconductor Manufacturing Firm (2330/TWSE) is without doubt one of the most unusual firms on the planet. (You learn that proper, 2330 is the ticker. It additionally trades as an ADR on the NYSE below the ticker TSM.) Because the king of semiconductors, this world behemoth provides the world’s tech heavyweights (ahem, Apple, Intel, Nvidia and Qualcomm) with the chips wanted to create {hardware}.

TSMC isn’t simply the most important chipmaker, it’s just about an island, as there isn’t even an actual competitor for the corporate. It’s notable that the third greatest chipmaker, UMC, can be Taiwanese.

TSMC is totally dominant on the subject of probably the most superior processing methods. The corporate has roughly 55% of the worldwide marketplace for contract chip fabrication.