To know in regards to the contribution of every section – Obtain a pattern now!

Segmentation Evaluation:

The e-learning market within the UK report is segmented by Product (Packaged content material and Options) and Finish-user (Ok-12, Greater training, and Company). Technavioreport supplies an correct prediction of the contribution of all of the segments to the expansion of the e-learning market measurement within the UK and actionable market insights on every section.

Key Market Dynamics:

- Market Driver – The training course of enhancements within the educational sector are the important thing driver supporting the UK e-learning market progress. Digital studying instruments like e-learning options and techniques are enabling customized studying for college kids, thereby boosting their engagement and abilities. Academic know-how options have gotten fashionable amongst larger training establishments to offer a digital platform for documenting and monitoring the supply of on-line training and coaching. Several types of evaluation strategies in academic establishments have been launched, and the student-centric studying mannequin has gained wider recognition and adoption. Consequently, developments such because the personalization of studying processes and adaptive studying have gained momentum. E-learning has allowed college students to pursue programs past the standard curriculum necessities as e-learning programs provide a versatile means of studying quite a few topics. College students can pursue the required programs in keeping with their timeline. The versatile timeline of e-learning programs supplies learners with prompt entry to course supplies as per their necessities. Such elements will escalate UK e-learning market progress through the forecast interval.

- Market Challenges – Rising in-house content material improvement is likely one of the elements difficult the UK e-learning market progress. Faculties and universities are repeatedly wanting ahead to creating highly effective digital studying experiences for his or her college students, which assist to judge scholar engagement, observe outcomes, and procure suggestions. In-house content material builders create just a few programs together with instructors, add loads of photographs and movies, and modify them in keeping with learner engagement and suggestions. E-learning authoring instruments can hyperlink courseware to Google analytics to obtain information about learners and the way they entry and use programs. The instruments also can export course content material to e-learning requirements, such because the Shareable Content material Object Reference Mannequin (SCORM) and the Tin Can utility program interface (API). Thus, the rise within the improvement of in-house course content material is predicted to have an effect on the e-learning market within the UK through the forecast interval.

To study further key drivers, traits, and challenges -. Learn our Pattern Report

proper now!

Vendor Evaluation:

The e-learning market within the UK is fragmented and the distributors are deploying progress methods comparable to specializing in high quality and reliability to compete available in the market. The report analyzes the market’s aggressive panorama and provides info on a number of market distributors, together with:

- Adobe Inc.

- Metropolis and Guilds Group

- Cornerstone OnDemand Inc.

- D2L Corp.

- Day One Applied sciences Ltd.

- John Wiley and Sons Inc.

- JPMorgan Chase and Co.

- McGraw Hill

- SAP SE

- Skillsoft Ltd.

- First Media Options Ltd.

- Studying Pool

- Studying Applied sciences Group Plc

- Looop On-line Ltd.

- Sponge Group Holdings Ltd.

- Thoma Bravo LP

- Totara Studying Options Ltd.

- Digital Faculty Ltd.

- Walkgrove Ltd.

- WillowDNA

- To achieve entry to extra vendor profiles with their key choices accessible with

Technavio, Click on Right here

The aggressive situation offered within the E-learning Market within the UK report analyzes, evaluates, and positions corporations based mostly on varied efficiency indicators. Among the elements thought of for this evaluation embrace the monetary efficiency of corporations over the previous few years, progress methods, product improvements, new product launches, investments, progress in market share, and many others. Do not wait, Make a strategic strategy & enhance your online business targets with our E-learning Market within the UK Forecast Report – Purchase Now!

Associated Reviews:

- The training market share in UAE is predicted to extend to USD 718 million by 2026, at a progressing CAGR of 5.03%. Obtain a pattern now!

- The web language studying market share is predicted to extend to USD 29.96 billion from 2021 to 2026, at a progressing CAGR of 18.77%. Obtain a pattern now!

|

E-learning Market In The UK Scope |

|

|

Report Protection |

Particulars |

|

Web page quantity |

120 |

|

Base yr |

2021 |

|

Forecast interval |

2022-2026 |

|

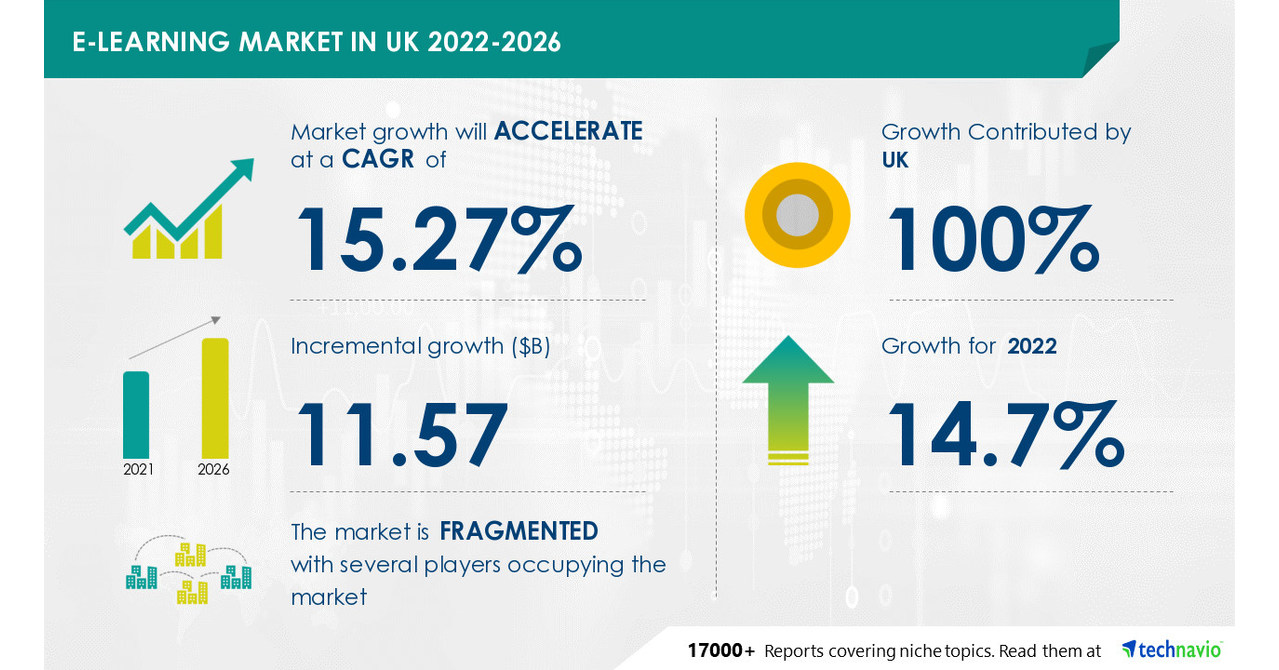

Progress momentum & CAGR |

Speed up at a CAGR of 15.27% |

|

Market progress 2022-2026 |

USD 11.57 billion |

|

Market construction |

Fragmented |

|

YoY progress (%) |

14.7 |

|

Regional evaluation |

UK |

|

Aggressive panorama |

Main corporations, aggressive methods, shopper engagement scope |

|

Firms profiled |

Adobe Inc., Metropolis and Guilds Group, Cornerstone OnDemand Inc., D2L Corp., Day One Applied sciences Ltd., John Wiley and Sons Inc., JPMorgan Chase and Co., McGraw Hill, SAP SE, Skillsoft Ltd., First Media Options Ltd., Studying Pool, Studying Applied sciences Group Plc, Looop On-line Ltd., Sponge Group Holdings Ltd., Thoma Bravo LP, Totara Studying Options Ltd., Digital Faculty Ltd., Walkgrove Ltd., and WillowDNA |

|

Market Dynamics |

Father or mother market evaluation, Market progress inducers and obstacles, Quick-growing and slow-growing section evaluation, COVID 19 impression and future shopper dynamics, market situation evaluation for forecast interval. |

|

Customization purview |

If our report has not included the info that you’re searching for, you possibly can attain out to our analysts and get segments custom-made. |

Key Subjects Lined:

1 Government Abstract

- 1.1 Market overview

- Exhibit 01: Government Abstract – Chart on Market Overview

- Exhibit 02: Government Abstract – Information Desk on Market Overview

- Exhibit 03: Government Abstract – Chart on Nation Market Traits

- Exhibit 04: Government Abstract – Chart on Market Segmentation by Product

- Exhibit 05: Government Abstract – Chart on Market Segmentation by Finish-user

- Exhibit 06: Government Abstract – Chart on Vendor Market Positioning

2 Market Panorama

- 2.1 Market ecosystem

- Exhibit 07: Father or mother market

- Exhibit 08: Market Traits

Three Market Sizing

- 3.1 Market definition

- Exhibit 09: Choices of distributors included available in the market definition

- 3.2 Market section evaluation

- Exhibit 10: Market segments

- 3.Four Market outlook: Forecast for 2021-2026

- Exhibit 11: Chart on UK – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 12: Information Desk on UK – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 13: Chart on UK: 12 months-over-year progress 2021-2026 (%)

- Exhibit 14: Information Desk on UK: 12 months-over-year progress 2021-2026 (%)

Four 5 Forces Evaluation

- 4.1 5 forces abstract

- Exhibit 15: 5 forces evaluation – Comparability between 2021 and 2026

- 4.2 Bargaining energy of patrons

- Exhibit 16: Chart on Bargaining energy of patrons – Influence of key elements 2021 and 2026

- 4.Three Bargaining energy of suppliers

- Exhibit 17: Bargaining energy of suppliers – Influence of key elements in 2021 and 2026

- 4.Four Risk of latest entrants

- Exhibit 18: Risk of latest entrants – Influence of key elements in 2021 and 2026

- 4.5 Risk of substitutes

- Exhibit 19: Risk of substitutes – Influence of key elements in 2021 and 2026

- 4.6 Risk of rivalry

- Exhibit 20: Risk of rivalry – Influence of key elements in 2021 and 2026

- 4.7 Market situation

- Exhibit 21: Chart on Market situation – 5 forces 2021 and 2026

5 Market Segmentation by Product

- 5.1 Market segments

- Exhibit 22: Chart on Product – Market share 2021-2026 (%)

- Exhibit 23: Information Desk on Product – Market share 2021-2026 (%)

- 5.2 Comparability by Product

- Exhibit 24: Chart on Comparability by Product

- Exhibit 25: Information Desk on Comparability by Product

- 5.Three Packaged content material – Market measurement and forecast 2021-2026

- Exhibit 26: Chart on Packaged content material – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 27: Information Desk on Packaged content material – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 28: Chart on Packaged content material – 12 months-over-year progress 2021-2026 (%)

- Exhibit 29: Information Desk on Packaged content material – 12 months-over-year progress 2021-2026 (%)

- 5.Four Options – Market measurement and forecast 2021-2026

- Exhibit 30: Chart on Options – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 31: Information Desk on Options – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 32: Chart on Options – 12 months-over-year progress 2021-2026 (%)

- Exhibit 33: Information Desk on Options – 12 months-over-year progress 2021-2026 (%)

- 5.5 Market alternative by Product

- Exhibit 34: Market alternative by Product ($ million)

6 Market Segmentation by Finish-user

- 6.1 Market segments

- Exhibit 35: Chart on Finish-user – Market share 2021-2026 (%)

- Exhibit 36: Information Desk on Finish-user – Market share 2021-2026 (%)

- 6.2 Comparability by Finish-user

- Exhibit 37: Chart on Comparability by Finish-user

- Exhibit 38: Information Desk on Comparability by Finish-user

- 6.Three Ok-12 – Market measurement and forecast 2021-2026

- Exhibit 39: Chart on Ok-12 – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 40: Information Desk on Ok-12 – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 41: Chart on Ok-12 – 12 months-over-year progress 2021-2026 (%)

- Exhibit 42: Information Desk on Ok-12 – 12 months-over-year progress 2021-2026 (%)

- 6.Four Greater training – Market measurement and forecast 2021-2026

- Exhibit 43: Chart on Greater training – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 44: Information Desk on Greater training – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 45: Chart on Greater training – 12 months-over-year progress 2021-2026 (%)

- Exhibit 46: Information Desk on Greater training – 12 months-over-year progress 2021-2026 (%)

- 6.5 Company – Market measurement and forecast 2021-2026

- Exhibit 47: Chart on Company – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 48: Information Desk on Company – Market measurement and forecast 2021-2026 ($ million)

- Exhibit 49: Chart on Company – 12 months-over-year progress 2021-2026 (%)

- Exhibit 50: Information Desk on Company – 12 months-over-year progress 2021-2026 (%)

- 6.6 Market alternative by Finish-user

- Exhibit 51: Market alternative by Finish-user ($ million)

7 Buyer Panorama

- 7.1 Buyer panorama overview

- Exhibit 52: Evaluation of value sensitivity, lifecycle, buyer buy basket, adoption charges, and buy standards

Eight Drivers, Challenges, and Developments

- 8.Three Influence of drivers and challenges

- Exhibit 53: Influence of drivers and challenges in 2021 and 2026

9 Vendor Panorama

- 9.2 Vendor panorama

- Exhibit 54: Overview on Criticality of inputs and Components of differentiation

- 9.Three Panorama disruption

- Exhibit 55: Overview on elements of disruption

- 9.Four Business dangers

- Exhibit 56: Influence of key dangers on enterprise

10 Vendor Evaluation

- 10.1 Distributors lined

- Exhibit 57: Distributors lined

- 10.2 Market positioning of distributors

- Exhibit 58: Matrix on vendor place and classification

- 10.Three Adobe Inc.

- Exhibit 59: Adobe Inc. – Overview

- Exhibit 60: Adobe Inc. – Enterprise segments

- Exhibit 61: Adobe Inc. – Key information

- Exhibit 62: Adobe Inc. – Key choices

- Exhibit 63: Adobe Inc. – Section focus

- 10.Four Metropolis and Guilds Group

- Exhibit 64: Metropolis and Guilds Group – Overview

- Exhibit 65: Metropolis and Guilds Group – Product / Service

- Exhibit 66: Metropolis and Guilds Group – Key choices

- 10.5 Cornerstone OnDemand Inc.

- Exhibit 67: Cornerstone OnDemand Inc. – Overview

- Exhibit 68: Cornerstone OnDemand Inc. – Product / Service

- Exhibit 69: Cornerstone OnDemand Inc. – Key choices

- 10.6 D2L Corp.

- Exhibit 70: D2L Corp. – Overview

- Exhibit 71: D2L Corp. – Product / Service

- Exhibit 72: D2L Corp. – Key information

- Exhibit 73: D2L Corp. – Key choices

- 10.7 Day One Applied sciences Ltd.

- Exhibit 74: Day One Applied sciences Ltd. – Overview

- Exhibit 75: Day One Applied sciences Ltd. – Product / Service

- Exhibit 76: Day One Applied sciences Ltd. – Key choices

- 10.Eight John Wiley and Sons Inc.

- Exhibit 77: John Wiley and Sons Inc. – Overview

- Exhibit 78: John Wiley and Sons Inc. – Enterprise segments

- Exhibit 79: John Wiley and Sons Inc. – Key choices

- Exhibit 80: John Wiley and Sons Inc. – Section focus

- 10.9 JPMorgan Chase and Co.

- Exhibit 81: JPMorgan Chase and Co. – Overview

- Exhibit 82: JPMorgan Chase and Co. – Enterprise segments

- Exhibit 83: JPMorgan Chase and Co. – Key choices

- Exhibit 84: JPMorgan Chase and Co. – Section focus

- 10.10 McGraw Hill

- Exhibit 85: McGraw Hill – Overview

- Exhibit 86: McGraw Hill – Product / Service

- Exhibit 87: McGraw Hill – Key choices

- 10.11 SAP SE

- Exhibit 88: SAP SE – Overview

- Exhibit 89: SAP SE – Enterprise segments

- Exhibit 90: SAP SE – Key information

- Exhibit 91: SAP SE – Key choices

- Exhibit 92: SAP SE – Section focus

- 10.12 Skillsoft Ltd.

- Exhibit 93: Skillsoft Ltd. – Overview

- Exhibit 94: Skillsoft Ltd. – Product / Service

- Exhibit 95: Skillsoft Ltd. – Key choices

11 Appendix

- 11.2 Inclusions and exclusions guidelines

- Exhibit 96: Inclusions guidelines

- Exhibit 97: Exclusions guidelines

- 11.Three Foreign money conversion charges for US$

- Exhibit 98: Foreign money conversion charges for US$

- 11.Four Analysis methodology

- Exhibit 99: Analysis methodology

- Exhibit 100: Validation strategies employed for market sizing

- Exhibit 101: Info sources

- 11.5 Listing of abbreviations

- Exhibit 102: Listing of abbreviations

About Us

Technavio is a number one international know-how analysis and advisory firm. Their analysis and evaluation focuses on rising market traits and supplies actionable insights to assist companies establish market alternatives and develop efficient methods to optimize their market positions. With over 500 specialised analysts, Technavio’s report library Their consumer base consists of enterprises of all sizes, together with greater than 100 Fortune 500 corporations. This rising consumer base depends on Technavio’s complete protection, in depth analysis, and actionable market insights to establish alternatives in current and potential markets and assess their aggressive positions inside altering market eventualities.

Contact

Technavio Analysis

Jesse Maida

Media & Advertising and marketing Government

US: +1 844 364 1100

UK: +44 203 893 3200

E-mail:[email protected]

Web site: www.technavio.com/

SOURCE Technavio