lavin pictures

Expensive readers/followers,

Revisiting Cincinnati Monetary (NASDAQ:CINF) after my final article is a pleasing train as a result of the funding has outperformed the market by near 18%. The corporate is a P&C insurer with an august historical past – my second article on the corporate will concentrate on the current set of outcomes for the enterprise, and the way we needs to be enjoying this chance on this market.

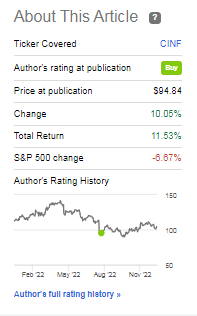

Check out how issues have carried out since my first article, and since I purchased shares of the corporate’s frequent.

Looking for Alpha CINF article (Looking for Alpha)

Now, that’s clearly RoR and the time has come to revisit the upside right here.

Cincinnati Monetary – Revisiting the enterprise

CINF is an insurance coverage enterprise – and it really works primarily with life, incapacity, and P&C. The corporate operates via numerous subsidiaries throughout the nation. Now, the P&C enterprise is an extremely fragmented market – by far one of many extra fragmented markets on the market when evaluating to issues like healthcare insurance coverage or the like.

The corporate has a 1% market share of US P&C, and this single proportion level makes CINF one of many 20th largest insurance coverage companies by market share within the US. The corporate has a strong historical past going again round 70 years and works with 1000’s of company relationships throughout the nation in over 2,750 areas. Its largest market share is clearly in Ohio, however CINF is represented in loads of areas.

The corporate is commercial-heavy versus private. It is agency-focused – that means native decision-making is predicated on native experience, with a centralized group on the similar time contributing to a low expense ratio in comparison with a department workplace construction.

CINF is among the greatest monetary firms on file if we glance strictly on the dividend progress custom. The corporate has provided 61 years of consecutive will increase within the dividend, making this one of many strongest dividend kings on the market, and solely seven public US firms can match this dividend payout file.

The corporate has been a powerful grower of dividends as properly both, with a double-digit form of progress historical past. Final time I wrote concerning the firm, we had nearly 3% – now that is right down to round 2.6%.

Now, insurance coverage often yields much more. The rationale this one would not is clearly the dividend king custom of over 60 years of progress. There are many causes you wish to be investing in insurance coverage and in finance within the atmosphere we’re at present in, however you must be sure that once you do, among the fundamentals are fulfilled.

You wish to ensure that of some issues. First, you wish to be sure that the corporate has the flexibility, primarily based on historic and forecasts, to outperform the market-average premium progress price over time. CINF does this. Its 7%+ premium progress price on an annual base for five years is increased than the business common of round 5.9%.

Mixed ratio growth has been strong as properly – and for a US insurer, the sub-90% mixed ratio on common over the previous few years is sufficient to actually get me right here.

The most recent outcomes are as follows – and listen right here, as a result of it is an illustrative quarter so far as P&C firms go.

Cincinnati Monetary had an impacted quarter. The corporate’s losses from Hurricane Ian pushed the corporate’s quarterly mixed ratio to over 100% – 103.9% to be actual, and the main target wasn’t on this, however on servicing claims coming in throughout that quarter. Nevertheless, regardless of that quarter and Hurricane Ian, the corporate’s insurance coverage operations stay worthwhile for YTD22, with a mixed ratio of 99.2%, and a year-end aim within the 95-100% vary.

These mixed ratios actually bear watching, as a result of they inform the story of the corporate’s underlying operations.

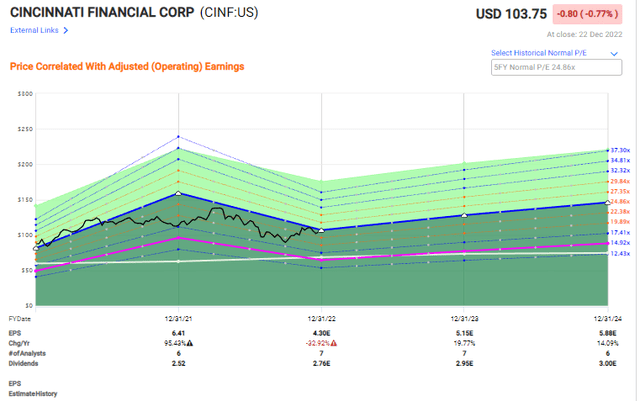

That is not to say that there aren’t actual challenges although. The mixture of inflation, macro, and extreme climate is a form of excellent storm for the corporate’s backside line, which is anticipated to materialize in a large ~33% adjusted EPS drop for 2022 earlier than gradual restoration will convey it again as much as 2023-2024E.

CINF Valuation/EPS (F.A.S.T graphs)

I view this sample as very lifelike given the earnings circulate we have seen over the previous few quarters – and keep in mind, the corporate has an funding portfolio that delivers security and returns in a approach that precludes the corporate from any actual foundational points. The corporate noticed an 8% improve in its 3Q22 YoY EBIT for the funding portfolio of the enterprise, and CINF held a $3.8B liquidity in its mum or dad firm when it comes to money and marketable securities. That is down for the 12 months, however loads of money to cowl any present or near-term shortfall.

The bullish case for CINF hinges on believing that the corporate is ready to proceed to ship good returns. This consists of dealing with inflation – which historically, CINF and different insurers do via expertly-calculated pricing fashions. Here is a small perception in what the corporate does when it comes to this.

When contemplating new or renewal enterprise, our underwriters are targeted on danger choice and pricing self-discipline. Our continued sturdy internet written premium progress of 14% on each a quarterly and nine-month foundation displays our administration of each publicity progress and internet price will increase that consider anticipated inflation results. Premium progress additionally advantages from 162 new company appointments to this point this 12 months and our efforts to achieve a bigger share of every company’s enterprise.

(Supply: CINF 3Q22 Outcomes feedback)

The corporate’s present scenario implies that CINF has to incorporate in its calculation the prices of inflation throughout the board for issues like constructing supplies when calculating P&C protection. CINF does use inflation elements for its coverage renewals, so the housing/constructing is less complicated, however CINF has already communicated that the auto strains are going to see price will increase throughout your complete board. Inflation ranges for insurance coverage have not seen this form of improve in many years, and the results shall be felt for years as issues appear now.

Clearly, CINF is way from the one store seeing these tendencies, and we should always count on different firms within the area, particularly in P&C, to begin reporting and rising their pricing as properly. I am maintaining an in depth eye on firms each on the EU and NA facet of the pond to see how numbers are coming in for friends of CINF and different insurance coverage firms in different sub-sectors.

CINF fundamentals stay strong – and that is the place the corporate shines. We mix this with valuation, and there’s a state of affairs the place an upside is feasible regardless of an 11% climb in a number of months, opposite to the market.

Cincinnati Monetary Valuation

In my authentic article on CINF, the corporate’s valuation was fairly rattling good, if we take a look at historic premiums – and when taking a look at a dividend king, I believe a premium is an efficient factor to permit. This firm’s common is near 24x for the previous 5 years P/E, and the present common weighted valuation is round 23x P/E.

In comparison with the place the corporate was in my final article, that implies that nearly the entire premium right here is just about “caught up”. 11% RoR implies that there’s not a lot upside to my near-term PT left.

The corporate is anticipated to make good ends in the approaching two years. If accepting a 24x P/E premium, this may indicate a double-digit 20.79% complete potential RoR, which once more is fairly rattling good. However I will not pay 24-25x P/E in an atmosphere the place high quality insurance coverage trades down in single digits.

It not is sensible. I gave the corporate a PT of $105/share in my final article. This was a worthwhile value goal. The corporate is technically nonetheless beneath that, and regardless of the earnings crash for the total 12 months we’ve not seen any form of large deterioration, which leads me to imagine that it in all probability will not occur early subsequent 12 months earlier than the end-year report both.

So, I will not change my PT – however I will not improve it both. There’s an excessive amount of of a premium right here for me to be comfy elevating it additional, even with the corporate’s high quality as it’s.

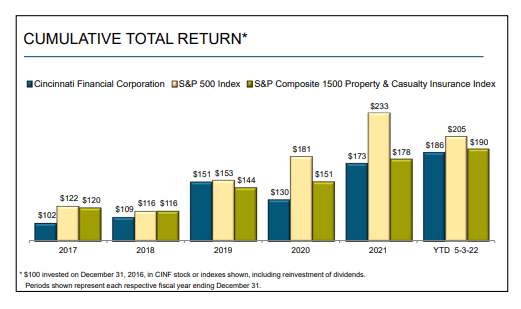

The important thing to investing in CINF is valuation. Whereas the corporate does carry out very properly over time, it isn’t the form of firm to massively outperform the S&P500 index. What this implies is that you may’t purchase this firm at any value and count on to do properly.

CINF TSR (CINF IR)

You won’t consider this as overly thrilling, however let me remind you that that is the top-Eight dividend king on your complete US inventory market. It’d nonetheless be value it on that foundation, for you.

S&P International has 5 analysts following the corporate – just one has a “BUY” score right here. The analysts have been decreasing their PTs for over a 12 months now, from round $140 right down to a mean of present $108.60, from a spread of $98 to $130/share. I imagine these targets to principally be honest, however I might nonetheless reduce it down a number of extra {dollars} to $105/share.

Right here is my total thesis and goal for CINF as they at present stand.

Thesis for Cincinnati Monetary’s Widespread Shares

- This can be a conservative, interesting insurance coverage firm and one of many market leaders in insurance coverage within the USA. The corporate has among the most qualitative portfolios and monitor information on the market, being a dividend king with greater than 60 years’ value of dividend will increase underneath its belt.

- On the proper valuation, this firm turns into a “must-buy”. Even at right this moment’s valuation, CINF has a good total upside to a conservative valuation primarily based on common historic valuations.

- Primarily based on this, I contemplate CINF to be a “Purchase” right here. However the valuation dictates that the upside is not any increased than 2% right here.

Bear in mind, I am all about :

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – firms at a reduction, permitting them to normalize over time and harvesting capital positive aspects and dividends within the meantime.

2. If the corporate goes properly past normalization and goes into overvaluation, I harvest positive aspects and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them. (italicized)

- This firm is total qualitative.

- This firm is basically secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at present low-cost.

- This firm has a sensible upside primarily based on earnings progress or a number of enlargement/reversion.

The Choices Play for Cincinnati Monetary

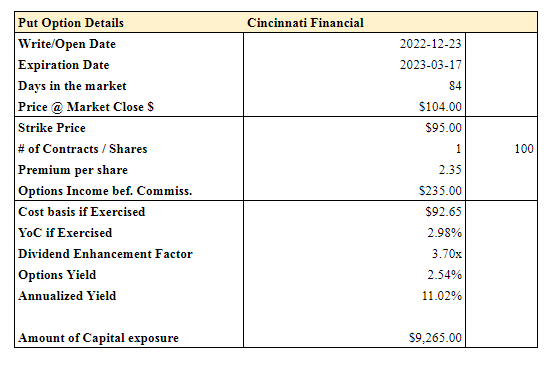

We’ll additionally work with Cincinnati Monetary as an choices play. The present valuation and buying and selling preclude any really large annualized charges of return, particularly with the corporate being a dividend king, however we are able to eke out some positive aspects which are superior to the corporate’s at present meager dividends whereas guaranteeing a decrease buy-in value.

Right here is one such risk I discovered that I personally am contemplating at market bell if the premiums keep at comparable ranges. The near-term choices for January and February provide too small returns – however we are able to get double digits from the March places.

Choices Knowledge (Creator’s Knowledge)

It is a hefty capital outlay, however it’s a secure yield, and you would be shopping for a dividend king properly beneath par, the place it yields almost 3%, and at a price foundation that is extraordinarily engaging, all issues thought-about. The one drawbacks of this put is that it is almost Three months ahead, and the over $9000 publicity. Apart from that, it is a strong play that one may go for.