E-learning Market Report Key Highlights

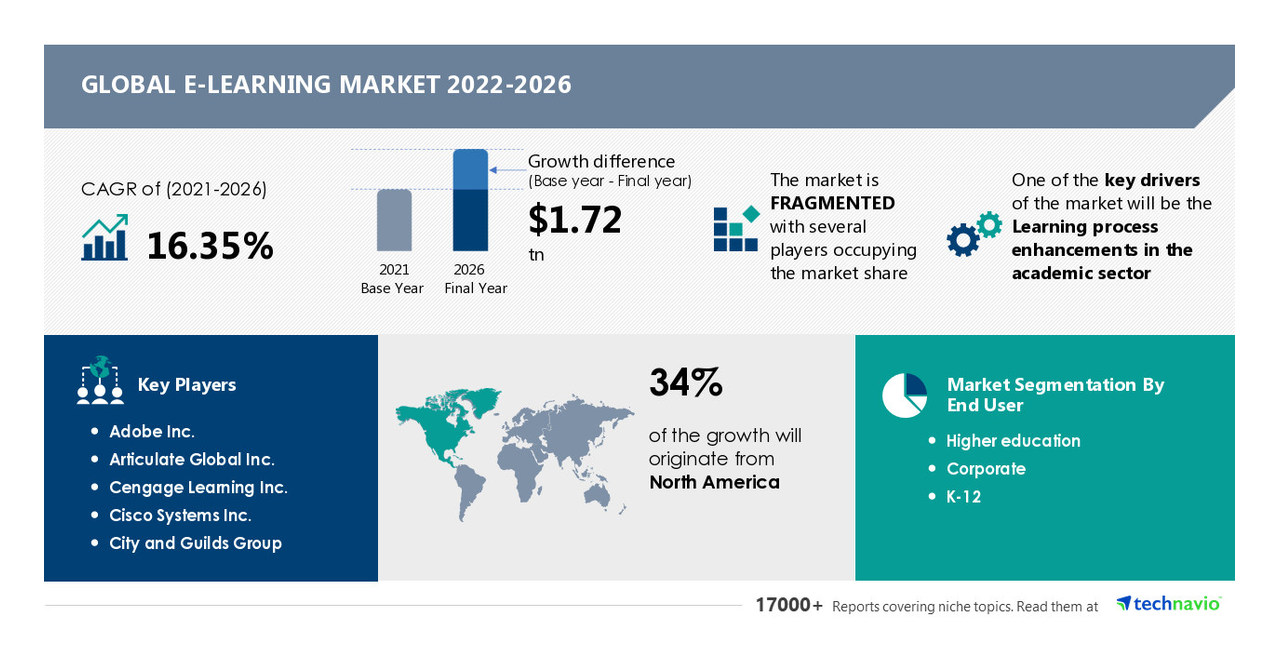

- Estimated year-on-year progress charge: 15.45%

- Key market segments: Finish-user (Larger schooling, Company, and Okay-12), and Geography (APAC, MEA, North America, South America, and Europe)

- Key Client Area & contribution: North America at 34%

|

E-learning Market Scope |

|

|

Report Protection |

Particulars |

|

Web page quantity |

120 |

|

Base yr |

2021 |

|

Forecast interval |

2022-2026 |

|

Development momentum & CAGR |

Speed up at a CAGR of 16.35% |

|

Market progress 2022-2026 |

$ 1.72 tn |

|

Market construction |

Fragmented |

|

YoY progress (%) |

15.45 |

|

Regional evaluation |

APAC, MEA, North America, South America, and Europe |

|

Performing market contribution |

North America at 34% |

|

Key shopper international locations |

US, Canada, China, Germany, and UK |

|

Aggressive panorama |

Main firms, Aggressive methods, Client engagement scope |

|

Key firms profiled |

Adobe Inc., Articulate World Inc., Cengage Studying Inc., Cisco Programs Inc., Metropolis and Guilds Group, GBS Company Coaching, World Well being eLearning Middle, iEnergizer, Infopro Studying Inc., Instructure Inc., John Wiley and Sons Inc., Studying Applied sciences Group Plc, MPS Ltd., New Horizons Laptop Studying Facilities Inc., NIIT Ltd., Oracle Corp., Pearson Plc, Skillsoft Ltd., Tesseract Studying Pvt. Ltd., and Thomson Reuters Corp. |

|

Market dynamics |

Guardian market evaluation, Market progress inducers and obstacles, Quick-growing and slow-growing phase evaluation, COVID 19 impression and restoration evaluation and future shopper dynamics, Market situation evaluation for the forecast interval |

|

Customization purview |

If our report has not included the information that you’re in search of, you possibly can attain out to our analysts and get segments personalized. |

Do attain out to our analysts for extra personalized report as per wants. Converse to our Analyst now!

E-learning Market Pattern

- Growing Adoption of Microlearning

Microlearning refers to studying utilizing bite-sized content material. In microlearning, all subjects of the course are break up into smaller items that include movies, audio, texts, or infographics. Microlearning presents concise and related content material and helps tackle the information hole of scholar. With the arrival of microlearning, educational eLearning distributors are more and more adopting microlearning course content material. College students discover exact content material attention-grabbing and interesting, and the knowledge is delivered inside a brief interval. Moreover, microlearning helps to study particular data in brief intervals via their system.

E-learning Market Problem

- Rising in-house content material growth

In-house content material builders create a couple of programs with instructors, add loads of photographs and movies, and modify in accordance with learner engagement and suggestions. Third-party content material suppliers are challenged due to the demand for courseware as content material may be developed by in-house subject material consultants. The rise within the growth of in-house content material is anticipated to have an effect on the worldwide eLearning market adversely. Moreover, blended eLearning requires on-line research supplies and associated companies to assist the web platforms. Faculties and universities are repeatedly wanting ahead to creating highly effective digital studying experiences for college students, which assist to guage scholar engagement, observe outcomes, and procure suggestions.

Get your report pattern copy for in depth insights on key market Drivers, Developments, and Challenges influencing the E-learning market.

Key market distributors insights

The E-learning market is fragmented, and the distributors are distributors are deploying progress methods equivalent to specializing in innovation to compete out there.

A few of the key market distributors are:

- Adobe Inc.

- Articulate World Inc.

- Cengage Studying Inc.

- Cisco Programs Inc.

- Metropolis and Guilds Group

- GBS Company Coaching

- World Well being eLearning Middle

- iEnergizer

- Infopro Studying Inc.

- Instructure Inc.

- John Wiley and Sons Inc.

- Studying Applied sciences Group Plc

- MPS Ltd.

- New Horizons Laptop Studying Facilities Inc.

- NIIT Ltd.

- Oracle Corp.

- Pearson Plc

- Skillsoft Ltd.

- Tesseract Studying Pvt. Ltd.

- Thomson Reuters Corp.

For extra detailed highlights on merchandise choices and the expansion methods adopted by different distributors, Obtain pattern report

- Key Phase Evaluation by Finish-user

- Larger Training

The upper schooling end-user phase held the most important e-learning market share in 2021. The phase will proceed to retain its dominance all through the forecast interval. Training know-how options have gotten standard in colleges and in increased schooling establishments to supply a digital platform for documenting and monitoring the supply of on-line schooling and coaching. The tutorial eLearning phase witnessed excessive progress in 2020 as a result of outbreak pandemic. A number of studying institutes adopted on-line studying platforms to show their college students. The pandemic resulted in each curriculum-based studying and check preparation for college students via eLearning. That is additional anticipated to drive the segments’ demand all through the forecast interval. - Company

- Okay-12

Regional Market Evaluation

34% of the market’s progress will originate from North America in the course of the forecast interval. US and Canada are the important thing markets for e-learning in North America. Market progress on this area can be quicker than the expansion of the market within the European, MEA, and South American areas.

The growing web connectivity and innovation on this area will facilitate the e-learning market progress in North America over the forecast interval.

Request our pattern report copy for added highlights and key segments which are anticipated to impression the market in the course of the forecast interval.

Associated Studies:-

Educational E-Studying Market by Finish-user and Geography – Forecast and Evaluation 2021-2025

Company E-Studying Market by Finish-user, Deployment, and Geography – Forecast and Evaluation 2021-2025

Okay-12 Blended E-Studying Market by Product and Geography – Forecast and Evaluation 2021-2025

Desk of Content material

1 Government Abstract

- 1.1 Market overview

- Exhibit 01: Government Abstract – Chart on Market Overview

- Exhibit 02: Government Abstract – Information Desk on Market Overview

- Exhibit 03: Government Abstract – Chart on World Market Traits

- Exhibit 04: Government Abstract – Chart on Market by Geography

- Exhibit 05: Government Abstract – Chart on Market Segmentation by Finish-user

- Exhibit 06: Government Abstract – Chart on Incremental Development

- Exhibit 07: Government Abstract – Information Desk on Incremental Development

- Exhibit 08: Government Abstract – Chart on Vendor Market Positioning

2 Market Panorama

- 2.1 Market ecosystem

- Exhibit 09: Guardian market

- Exhibit 10: Market Traits

Three Market Sizing

- 3.1 Market definition

- Exhibit 11: Choices of distributors included out there definition

- 3.2 Market phase evaluation

- Exhibit 12: Market segments

- 3.Four Market outlook: Forecast for 2021-2026

- Exhibit 13: Chart on World – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 14: Information Desk on World – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 15: Chart on World Market: 12 months-over-year progress 2021-2026 (%)

- Exhibit 16: Information Desk on World Market: 12 months-over-year progress 2021-2026 (%)

Four 5 Forces Evaluation

- 4.1 5 forces abstract

- Exhibit 17: 5 forces evaluation – Comparability between2021 and 2026

- 4.2 Bargaining energy of consumers

- Exhibit 18: Chart on Bargaining energy of consumers – Affect of key components 2021 and 2026

- 4.Three Bargaining energy of suppliers

- Exhibit 19: Bargaining energy of suppliers – Affect of key components in 2021 and 2026

- 4.Four Menace of latest entrants

- Exhibit 20: Menace of latest entrants – Affect of key components in 2021 and 2026

- 4.5 Menace of substitutes

- Exhibit 21: Menace of substitutes – Affect of key components in 2021 and 2026

- 4.6 Menace of rivalry

- Exhibit 22: Menace of rivalry – Affect of key components in 2021 and 2026

- 4.7 Market situation

- Exhibit 23: Chart on Market situation – 5 forces 2021 and 2026

5 Market Segmentation by Finish-user

- 5.1 Market segments

- Exhibit 24: Chart on Finish-user – Market share 2021-2026 (%)

- Exhibit 25: Information Desk on Finish-user – Market share 2021-2026 (%)

- 5.2 Comparability by Finish-user

- Exhibit 26: Chart on Comparability by Finish-user

- Exhibit 27: Information Desk on Comparability by Finish-user

- 5.Three Larger schooling – Market dimension and forecast 2021-2026

- Exhibit 28: Chart on Larger schooling – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 29: Information Desk on Larger schooling – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 30: Chart on Larger schooling – 12 months-over-year progress 2021-2026 (%)

- Exhibit 31: Information Desk on Larger schooling – 12 months-over-year progress 2021-2026 (%)

- 5.Four Company – Market dimension and forecast 2021-2026

- Exhibit 32: Chart on Company – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 33: Information Desk on Company – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 34: Chart on Company – 12 months-over-year progress 2021-2026 (%)

- Exhibit 35: Information Desk on Company – 12 months-over-year progress 2021-2026 (%)

- 5.5 Okay-12 – Market dimension and forecast 2021-2026

- Exhibit 36: Chart on Okay-12 – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 37: Information Desk on Okay-12 – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 38: Chart on Okay-12 – 12 months-over-year progress 2021-2026 (%)

- Exhibit 39: Information Desk on Okay-12 – 12 months-over-year progress 2021-2026 (%)

- 5.6 Market alternative by Finish-user

- Exhibit 40: Market alternative by Finish-user ($ million)

6 Buyer Panorama

- 6.1 Buyer panorama overview

- Exhibit 41: Evaluation of value sensitivity, lifecycle, buyer buy basket, adoption charges, and buy standards

7 Geographic Panorama

- 7.1 Geographic segmentation

- Exhibit 42: Chart on Market share by geography 2021-2026 (%)

- Exhibit 43: Information Desk on Market share by geography 2021-2026 (%)

- 7.2 Geographic comparability

- Exhibit 44: Chart on Geographic comparability

- Exhibit 45: Information Desk on Geographic comparability

- 7.3 North America – Market dimension and forecast 2021-2026

- Exhibit 46: Chart on North America – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 47: Information Desk on North America – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 48: Chart on North America – 12 months-over-year progress 2021-2026 (%)

- Exhibit 49: Information Desk on North America – 12 months-over-year progress 2021-2026 (%)

- 7.4 Europe – Market dimension and forecast 2021-2026

- Exhibit 50: Chart on Europe – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 51: Information Desk on Europe – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 52: Chart on Europe – 12 months-over-year progress 2021-2026 (%)

- Exhibit 53: Information Desk on Europe – 12 months-over-year progress 2021-2026 (%)

- 7.5 APAC – Market dimension and forecast 2021-2026

- Exhibit 54: Chart on APAC – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 55: Information Desk on APAC – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 56: Chart on APAC – 12 months-over-year progress 2021-2026 (%)

- Exhibit 57: Information Desk on APAC – 12 months-over-year progress 2021-2026 (%)

- 7.6 South America – Market dimension and forecast 2021-2026

- Exhibit 58: Chart on South America – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 59: Information Desk on South America – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 60: Chart on South America – 12 months-over-year progress 2021-2026 (%)

- Exhibit 61: Information Desk on South America – 12 months-over-year progress 2021-2026 (%)

- 7.7 Center East and Africa – Market dimension and forecast 2021-2026

- Exhibit 62: Chart on Center East and Africa – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 63: Information Desk on Center East and Africa – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 64: Chart on Center East and Africa – 12 months-over-year progress 2021-2026 (%)

- Exhibit 65: Information Desk on Center East and Africa – 12 months-over-year progress 2021-2026 (%)

- 7.Eight US – Market dimension and forecast 2021-2026

- Exhibit 66: Chart on US – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 67: Information Desk on US – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 68: Chart on US – 12 months-over-year progress 2021-2026 (%)

- Exhibit 69: Information Desk on US – 12 months-over-year progress 2021-2026 (%)

- 7.9 China – Market dimension and forecast 2021-2026

- Exhibit 70: Chart on China – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 71: Information Desk on China – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 72: Chart on China – 12 months-over-year progress 2021-2026 (%)

- Exhibit 73: Information Desk on China – 12 months-over-year progress 2021-2026 (%)

- 7.10 Germany – Market dimension and forecast 2021-2026

- Exhibit 74: Chart on Germany – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 75: Information Desk on Germany – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 76: Chart on Germany – 12 months-over-year progress 2021-2026 (%)

- Exhibit 77: Information Desk on Germany – 12 months-over-year progress 2021-2026 (%)

- 7.11 Canada – Market dimension and forecast 2021-2026

- Exhibit 78: Chart on Canada – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 79: Information Desk on Canada – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 80: Chart on Canada – 12 months-over-year progress 2021-2026 (%)

- Exhibit 81: Information Desk on Canada – 12 months-over-year progress 2021-2026 (%)

- 7.12 UK – Market dimension and forecast 2021-2026

- Exhibit 82: Chart on UK – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 83: Information Desk on UK – Market dimension and forecast 2021-2026 ($ million)

- Exhibit 84: Chart on UK – 12 months-over-year progress 2021-2026 (%)

- Exhibit 85: Information Desk on UK – 12 months-over-year progress 2021-2026 (%)

- 7.13 Market alternative by geography

- Exhibit 86: Market alternative by geography ($ million)

Eight Drivers, Challenges, and Developments

- 8.Three Affect of drivers and challenges

- Exhibit 87: Affect of drivers and challenges in 2021 and 2026

9 Vendor Panorama

- 9.2 Vendor panorama

- Exhibit 88: Overview on Criticality of inputs and Components of differentiation

- 9.Three Panorama disruption

- Exhibit 89: Overview on components of disruption

- 9.Four Business dangers

- Exhibit 90: Affect of key dangers on enterprise

10 Vendor Evaluation

- 10.1 Distributors coated

- Exhibit 91: Distributors coated

- 10.2 Market positioning of distributors

- Exhibit 92: Matrix on vendor place and classification

- 10.Three Adobe Inc.

- Exhibit 93: Adobe Inc. – Overview

- Exhibit 94: Adobe Inc. – Enterprise segments

- Exhibit 95: Adobe Inc. – Key information

- Exhibit 96: Adobe Inc. – Key choices

- Exhibit 97: Adobe Inc. – Phase focus

- 10.Four Articulate World Inc.

- Exhibit 98: Articulate World Inc. – Overview

- Exhibit 99: Articulate World Inc. – Product / Service

- Exhibit 100: Articulate World Inc. – Key choices

- 10.5 Cengage Studying Inc.

- Exhibit 101: Cengage Studying Inc. – Overview

- Exhibit 102: Cengage Studying Inc. – Product / Service

- Exhibit 103: Cengage Studying Inc. – Key choices

- 10.6 Cisco Programs Inc.

- Exhibit 104: Cisco Programs Inc. – Overview

- Exhibit 105: Cisco Programs Inc. – Enterprise segments

- Exhibit 106: Cisco Programs Inc. – Key information

- Exhibit 107: Cisco Programs Inc. – Key choices

- Exhibit 108: Cisco Programs Inc. – Phase focus

- 10.7 Metropolis and Guilds Group

- Exhibit 109: Metropolis and Guilds Group – Overview

- Exhibit 110: Metropolis and Guilds Group – Product / Service

- Exhibit 111: Metropolis and Guilds Group – Key choices

- 10.Eight Instructure Inc.

- Exhibit 112: Instructure Inc. – Overview

- Exhibit 113: Instructure Inc. – Product / Service

- Exhibit 114: Instructure Inc. – Key choices

- 10.9 John Wiley and Sons Inc.

- Exhibit 115: John Wiley and Sons Inc. – Overview

- Exhibit 116: John Wiley and Sons Inc. – Enterprise segments

- Exhibit 117: John Wiley and Sons Inc. – Key choices

- Exhibit 118: John Wiley and Sons Inc. – Phase focus

- 10.10 Pearson Plc

- Exhibit 119: Pearson Plc – Overview

- Exhibit 120: Pearson Plc – Enterprise segments

- Exhibit 121: Pearson Plc – Key choices

- Exhibit 122: Pearson Plc – Phase focus

- 10.11 Skillsoft Ltd.

- Exhibit 123: Skillsoft Ltd. – Overview

- Exhibit 124: Skillsoft Ltd. – Product / Service

- Exhibit 125: Skillsoft Ltd. – Key choices

- 10.12 Thomson Reuters Corp.

- Exhibit 126: Thomson Reuters Corp. – Overview

- Exhibit 127: Thomson Reuters Corp. – Enterprise segments

- Exhibit 128: Thomson Reuters Corp. – Key choices

- Exhibit 129: Thomson Reuters Corp. – Phase focus

11 Appendix

- 11.2 Inclusions and exclusions guidelines

- Exhibit 130: Inclusions guidelines

- Exhibit 131: Exclusions guidelines

- 11.Three Forex conversion charges for US$

- Exhibit 132: Forex conversion charges for US$

- 11.Four Analysis methodology

- Exhibit 133: Analysis methodology

- Exhibit 134: Validation methods employed for market sizing

- Exhibit 135: Info sources

- 11.5 Checklist of abbreviations

- Exhibit 136: Checklist of abbreviations

About Technavio

Technavio is a number one international know-how analysis and advisory firm. Their analysis and evaluation focuses on rising market traits and offers actionable insights to assist companies determine market alternatives and develop efficient methods to optimize their market positions.

With over 500 specialised analysts, Technavio’s report library consists of greater than 17,000 experiences and counting, protecting 800 applied sciences, spanning throughout 50 international locations. Their shopper base consists of enterprises of all sizes, together with greater than 100 Fortune 500 firms. This rising shopper base depends on Technavio’s complete protection, in depth analysis, and actionable market insights to determine alternatives in present and potential markets and assess their aggressive positions inside altering market eventualities.

Contacts

Technavio Analysis

Jesse Maida

Media & Advertising Government

US: +1 844 364 1100

UK: +44 203 893 3200

Electronic mail: [email protected]

Web site: www.technavio.com/

SOURCE Technavio