yorkfoto/iStock through Getty Photographs

HBT Monetary

HBT Monetary, Inc. (NASDAQ:HBT) obtained on my radar within the third quarter once I recognized banks greatest positioned for rising rates of interest. I coated a few of this analysis with Looking for Alpha readers in an article entitled, “Have and Have Not Banks.”

HBT is an under-recognized and an under-appreciated “Have Financial institution.”

This text will do two issues.

First, it gives a “large image” view of Small- and Mid-Cap financial institution sector valuation knowledge. It reveals that the sector is affordable in comparison with historical past. And, previously, comparable valuations have confirmed to a positive time for long-term buyers to develop positions in Excessive-High quality Small- and Mid-Cap banks.

Second, it describes why I’ve added HBT to my long-term buy-and-hold financial institution portfolio.

Small- and Mid-Cap Financial institution Sector Valuation Historical past

Let me start by revisiting an article I posted on Looking for Alpha on March 18, 2020: “12 Charts: The Case for Buffett Shopping for Financial institution Shares at As we speak’s Valuations.”

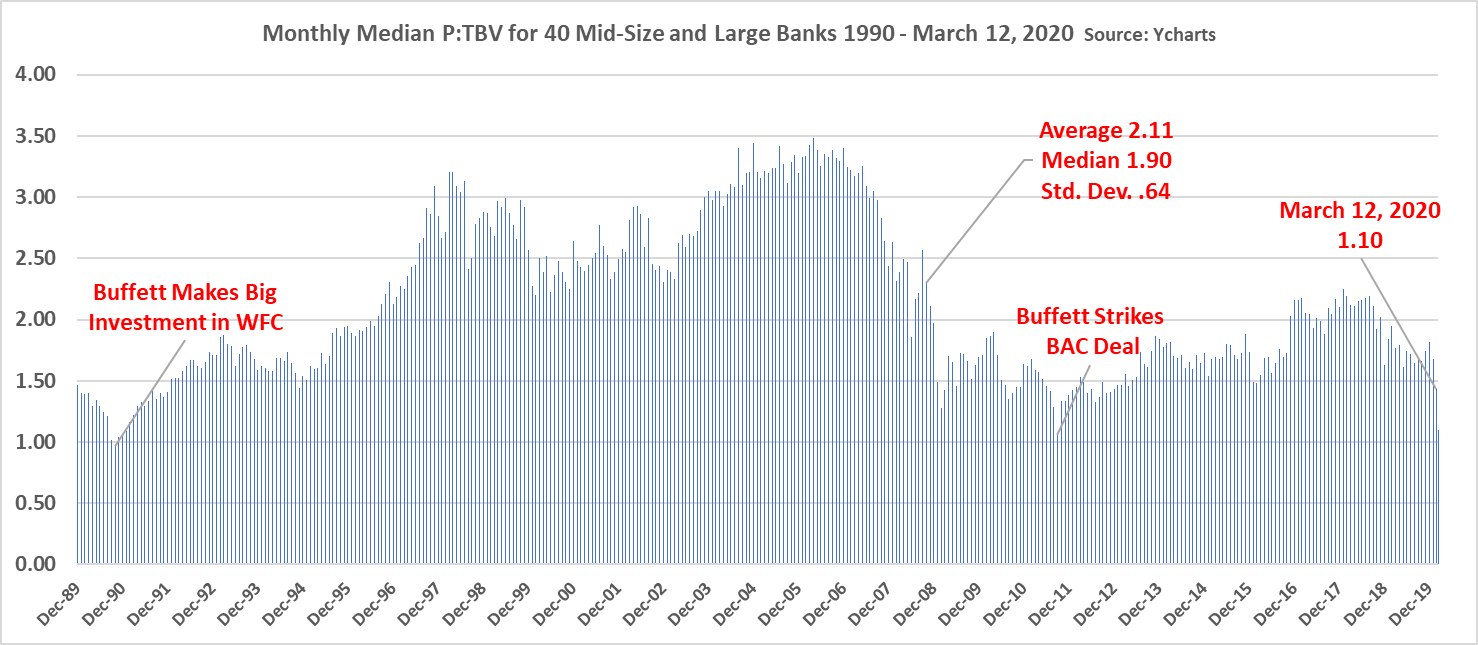

The article revealed twelve fantastic charts that each critical financial institution investor must know. Listed below are two charts drawn from the article.

This one reveals the median Value to Tangible Guide Worth by month for 40 US Massive- and Mid-Cap banks from 1990 to 2020. The message on the time was clear: Banks have been low-cost in March 2020 at a median P/TBV of 1.10x. That mentioned, banks have been low-cost for a purpose: COVID fears. As my poker buddies say, no guts no glory.

Median PE Ratios 40 Banks (YCharts)

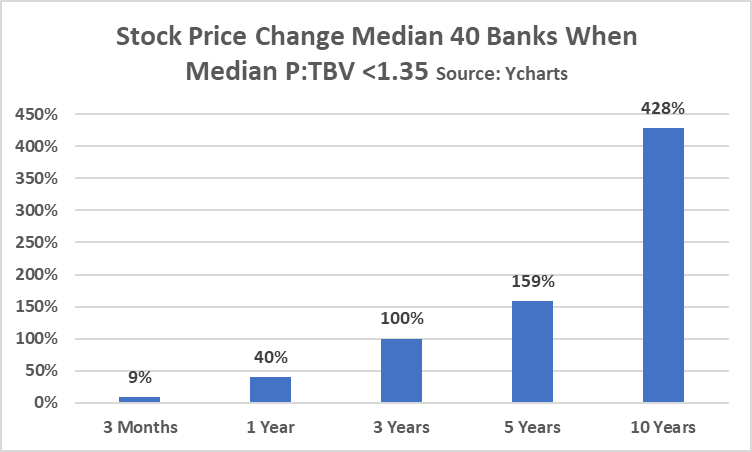

Right here is one other chart from the article. This one reveals the typical median value change over varied timeframes when Massive- and Mid-Cap banks are low-cost:

Value Change <1.35 P/TBV (YCharts)

As we speak banks usually are not as low-cost as again in March 2020, however Small- and Mid-Cap banks seem attractively valued for long-term buy-and-hold buyers like me.

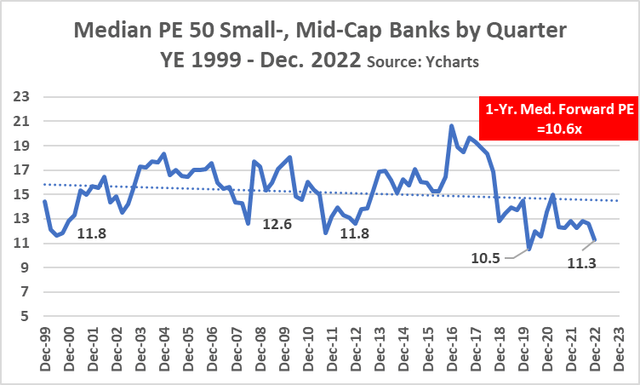

This subsequent chart examines the median quarterly PE of 50 Small- and Mid-Cap banks since YE 1999. Over the previous 20+ years these banks have had a mean median PE of about 15x. As we speak that median PE is 11.3x.

Even higher, the median one-year ahead PE for the banks reveals a 10.6x PE. Clearly, the ahead PE should be taken with a grain of salt, however I just like the path because it tells me buyers in a few of these banks have an honest margin of security.

50 Banks’ Median PE (YCharts)

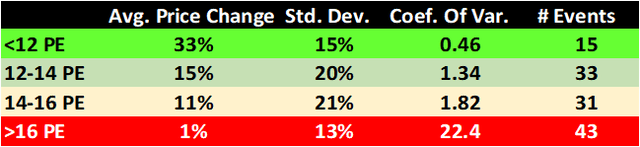

Traders have earned out-sized complete returns previously when shopping for Small- and Mid-Cap banks at traditionally low valuations.

Listed below are 4 observations about inventory value efficiency of the 50 Small- and Mid-Cap banks at varied PE valuations.

- When the median PE of the banks is lower than 12x, traditionally there was a mean value change of 33% one 12 months later. When PEs are better than 16x, the worth returns are on common 1%. (Dividends, after all, present extra return.)

- Curiously, because the commonplace deviation column signifies, one-year inventory value variation is lowest on the extremes.

- The third column exhibiting Coefficient of Variance provides buyers a way of threat (variance to the typical); the bottom Coefficient of Variance is related to occasions when PEs are low, which shouldn’t be shocking to long-time buyers.

- Lastly, a cautionary phrase: Since YE 1999, there have been solely 15 quarters when the median PE for the 50 banks was beneath 12x as it’s right now (12/22/2022). The truth that there have been so few occasions tells us that we can’t think about the info statistically vital. In different phrases, the info informs our view, however we should be cautious to not get overly sure that previous is predictive.

Value Return Historical past by PE Ratio (YCharts)

I could publish an article within the close to future about my present analysis, however for the rest of this text, I plan to concentrate on HBT. Whereas a number of of the Small- and Mid-Caps banks look engaging right now, I discover HBT particularly engaging for causes to be described beneath.

HBT: IPO October 10, 2019/Insider Purchase

HBT did an preliminary public providing on October 10, 2019: 9.Four million shares at $16.00 per share.

The financial institution is over 100-years outdated and operates in Central and Northeastern Illinois and Jap Iowa.

Administrators and officers personal 65% of HBT.

Fred L. Drake serves as Chairman of the Board and CEO, and Chairman of the Board of Heartland Financial institution. He has been a director of the corporate since 1984 and a director of Heartland Financial institution since 1982. He owns 59% of HBT.

HBT is a “managed firm,” a time period outlined by Rule 5615(c) of the Nasdaq Itemizing Guidelines. Drake has greater than 50% of voting energy.

I liken HBT’s family-controlled standing to that of three banks which I’ve lengthy revered: Commerce Bancshares Inc (CBSH), First Interstate BancSystem, Inc. (FIBK), and First Residents BancShares, Inc. (FCNCA). I’ve owned shares within the first two since at the very least 2016 and want I had purchased FCNCA again then.

It’s value noting that Fred Drake made two open market buys of HBT in February 2021 at $15.20 (complete 3,670 shares).

HBT Key Statistics at a Look

Supply: YCharts, Looking for Alpha, Firm 3Q 2022 Press Launch

- December 23 closing value: $19.57

- Market Cap: $562 million

- Share rely: 28.75 million

- One month value: -3.2%

- YTD value: +8.1%

- One 12 months value: +8.5%

- YTD value vary: $16.09-$22.48

- Analyst one-year value goal $22.88. (5 analysts, 1 Purchase, 1 Outperform, 2 Holds, 1 Underperform, Consensus 2.6, Value Targets: $19.00 – $26.00).

- P/E: 9.9x

- Ahead P/E: 9.6x

- Mortgage/Deposit Ratio: 70%

- Return on Fairness Q3: 16.5%. (79th percentile publicly traded banks)

- ROA Q3: 1.47% (83rd percentile)

- Value of Funds Q3: 7 foundation factors Q3 (95th percentile)

- Internet Curiosity Margin Q3: 365 foundation factors, +47 BP Y/Y

- Effectivity Ratio Q3: .52 (85th percentile)

- Dividend yield: 3.27%

- Payout Ratio: 32%.

- Beta (3-year): .95

Why I Like HBT for My Lengthy-Time period Purchase-and Maintain Portfolio

Profitability

My chief curiosity in HBT is it is producing dependable profitability exceeding the financial institution’s value of capital. Although the corporate solely went public in 4Q 2019, FDIC knowledge for HBT’s financial institution sub, Heartland Financial institution & Belief, goes again to 2003.

Heartland Financial institution’s rolling 4 quarter ROE has averaged 18% and ROA 1.9% since 2003.

By my calculations, the financial institution’s Danger-Adjusted Return on Fairness (RAROE) since 2003 is ~12% and roughly the identical over the previous decade. (RAROE calculation: Common ROE – Commonplace Deviation of ROE.)

HBT’s superior RAROE locations it among the many nation’s elite banks that I maintain as long-term investments.

Administration

I like being a small proprietor of a financial institution that’s managed by a seasoned banker with an extended historical past of superior efficiency. The board has deep trade expertise and native market information.

A threat that’s not addressed in HBT’s current 10-Okay is succession planning. It’s unclear how the board will/would reply if Mr. Drake isn’t able to supervise the financial institution.

In November, HBT introduced a number of govt administration modifications. It’s unclear if these modifications deal with my issues about successors to Mr. Drake.

Low Value of Funds/Sturdy Core Deposits

At 7 foundation factors in Q3, HBT is among the many nation’s lowest value producers of funding. This can be a big aggressive benefit for the financial institution in a time of rising charges.

The financial institution’s most up-to-date 10Q signifies rising charges will additional profit the financial institution’s web curiosity margin as follows.

+400 bp = +10.8% NII 12 months one, 16.9% 12 months two.

+200 bp = 5.9% 12 months one, 9.6% 12 months two.

+100 bp = 3.0% 12 months one, 5.1% 12 months two.

Liquidity/Average Mortgage to Deposit Ratio

I like the present mortgage to deposit ratio at 70%. It has been as excessive as 80%, a ratio I think about on the prime finish of my threat tolerance. The financial institution has a pending merger that may put reasonable upward stress on the mortgage to deposit ratio.

Rising charges, whereas doubtless favorable to web curiosity earnings, may very well be a double-edged sword ought to charges rise so excessive as to place stress on deposit retention. This threat is most pronounced amongst “Have Not” banks. As a “Have” financial institution, nonetheless, HBT isn’t insulated from this threat.

Credit score High quality

HBT meets my standards for being a high-quality lender. In keeping with FDIC knowledge, the financial institution has had web charge-offs of $79 million since 2003, $30.6 million over the previous ten years, and $6.Four million previously 5 years. My tough calculation reveals the financial institution’s rolling web charge-offs ratio to be .10%, a quantity I think about superior for the trade.

That mentioned, the financial institution took extra losses from Q2 2009 to Q2 2011 than I wish to see from a superior lender. My guess is that the board has gone to high school on these losses. Since then, the financial institution has reduce publicity to 1-Four Household from 20% in 2010 to 10% within the 3Q 2022 quarter.

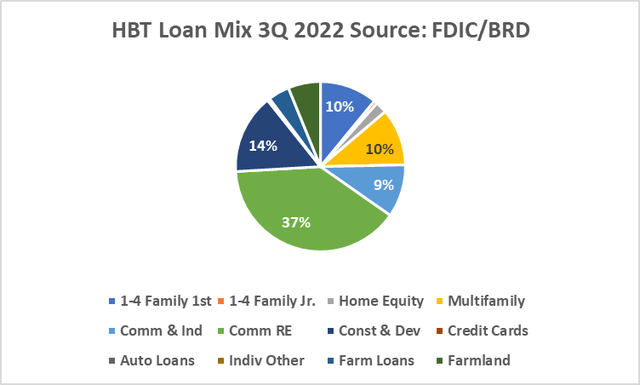

Mortgage Combine

I just like the mortgage combine. The financial institution doesn’t present egregious concentrations.

The majority of HBT’s credit score publicity is business (70% = CRE, C&I, Multi-fam, and C&D). Ten % is farm-related lending, a quantity I like rather a lot because it is without doubt one of the highest ratios amongst publicly traded banks. I just like the low publicity to 1-Four Household (10%), a mortgage class I keep away from given its commodity pricing and terrible cyclical peaks and valleys; banks engaged in heavy 1-Four Household lending hardly ever earned again their value of capital over financial cycles.

The watch merchandise for regulators is business actual property at 37% of loans, up from 26% in 2010. I’m snug with such a excessive publicity when group banks have an extended historical past of superior credit score administration.

Mortgage Combine HBT (FDIC, BRD)

Buybacks/Controlling Shareholder

HBT buys again shares.

HBT has introduced three repurchase authorizations since 2020:

In 4Q 2021, the financial institution 147,383 shares at a mean value of $17.52. Complete repurchases: $4.9 million.

10-Qs for the primary three quarters of 2022 present the next repurchase exercise:

Q1 50,062 shares @ $18.84

Q2 136,746 @ $17.61/share

Q3 78,571 shares @ $18.22/share

Repurchase Information:

- The current 10-Q signifies HBT has $10.2 million remaining beneath the present repurchase program.

- Quarterly vary in costs paid for repurchases: $17.61 – $18.84.

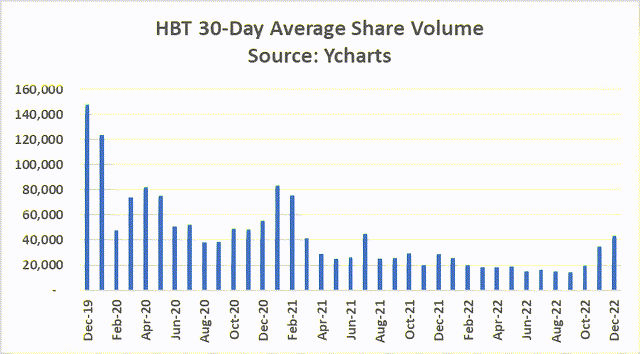

My greatest guess is that the spike in share commerce quantity in November and December is related to accelerated buybacks as the newest $15 million repurchase authorization expires 12/31/2022. The run-up in inventory value through the previous two months is probably going tied to the surge in buybacks. I might not be shocked to see the inventory value decline as soon as buybacks sluggish which I presume is not going to decide again up till someday in 1Q.

A transparent good thing about a controlled-interest financial institution is that the financial institution’s controlling shareholder (Mr. Drake) is not going to purchase again shares when share costs are too excessive. In impact, the controlling shareholder acts in a fashion much like Warren Buffett who has lengthy made it recognized that he’ll solely purchase Berkshire shares when valuations warrant.

Share Vol. (YCharts)

Accretive Acquisitions

I’ve a easy rule of thumb: Keep away from banks engaged in large mergers. My definition of “large” is any merger the place the acquired financial institution is greater than 50% of the asset measurement of the acquirer. I’ve in depth knowledge exhibiting such mergers persistently wrestle short-term (Three years) with income retention and creation.

Small, tack-on mergers can usually make sense for banks that function with a transparent revenue mindset. Small, tack-on mergers achieved for “strategic” or “political” causes usually don’t make financial sense.

Rural market banks, and even massive city market group banks for that matter, usually wrestle growing successors to family-controlled banks. A principal driver behind financial institution gross sales is the CEO’s recognition that an in a position successor doesn’t exist. Consequently, a sale is required to create a liquidity occasion for shareholders.

HBT has been, and will proceed to be, able to profit from this M&A development in rural markets. Ideally, sellers see HBT, now that the financial institution is publicly traded, as a lovely purchaser who can present not solely money however fairness for sellers.

In October 2021, HBT introduced the acquisition of Iowa’s $238 million NXT Bancorporation. Like many banks its measurement, NXT’s profitability underperformed bigger banks. Whereas it confirmed first rate credit score high quality, NXT suffered from excessive effectivity ratio related to lack of scale and asset value pressures.

In August 2022, HBT introduced a merger with Springfield, IL financial institution, $894 million City and Nation Monetary Company (OTCPK:TWCF). This merger has all of the earmarks of a profitable merger:

- Drake and HBT are skilled acquirers.

- On the time of the acquisition, HBT indicated that the board expects the merger to be accretive in 12 months one. Per the press launch: “Sturdy EPS accretion of 17% anticipated in 2023 (excluding transaction bills, assuming transaction closes in first quarter of 2023).”

- TWCF is about 20% the dimensions of HBT.

- It operates in central Illinois, a market HBT is aware of nicely.

- I like TWCF’s credit score historical past and price of funds.

- TWCF has an extended historical past of first rate however not excellent profitability (Danger-adjusted Return on Fairness of ~5% which is lower than the financial institution’s value of capital.

- Effectivity is about common for banks of its measurement ($894 million), suggesting HBT has room for prudent expense cuts and income enhancement.

- Massive optimistic: TWCF has engaging value of funds suggesting robust core deposits.

It could be useful if the press launch offered extra perception into HBT’s anticipated transaction bills. Absent such knowledge, it’s obscure payback. I’m certain such perception is obtainable to present shareholders who will get M&A documentation with the intention to vote for the merger.

Geography

HBT gives publicity to rural and smaller city markets in Illinois and Iowa, two states through which I’ve no funding publicity this present day.

HBT has about one-third of its deposits and loans in Chicago. Not loads of knowledge is obtainable within the 10-Okay as to the character of those belongings and liabilities. As I doc in my 2016 e book, “Investing in Banks,” Chicago along with Los Angeles and New York Metropolis, are the three least worthwhile markets int the nation for group banks. My analysis reveals that the low profitability stems from two elements:

- Massive banks crowd out small banks in deposit-gathering.

- To draw loans, small banks are inclined to compete in larger threat business actual property, in addition to the extremely aggressive, low-margin commodity 1-Four household lending.

Valuation Comparisons

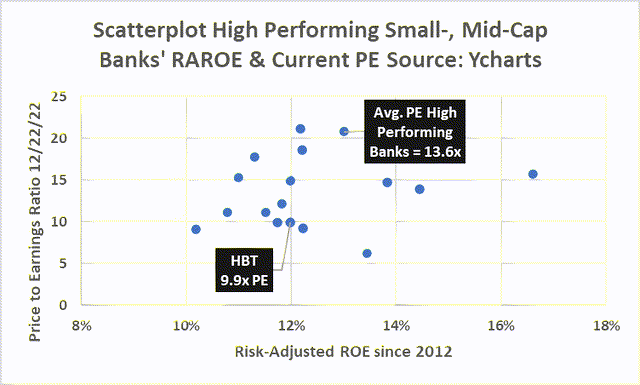

The scatterplot beneath compares HBT’s present Value to Earnings ratio to PEs of different Small- and Mid-Cap banks with superior Danger-Adjusted Returns on Fairness.

What stands out is that the group’s common PE is 13.6x, a ratio about 36% larger than that of HBT as of December 22, 2022. On this foundation, a case might be made for HBT’s shares to be priced right now at ~$26.50.

I might go additional and counsel that HBT’s RAROE and historical past of constructing accretive acquisitions justify comparisons to 4 different small-cap banks I respect, every with ~12% RAROE:

- Inventory Yards Bancorp Inc (SYBT) in Kentucky 21.0x PE

- Lakeland Monetary Corp (LKFN) in Indiana 18.5x PE

- Metropolis Holding Co (CHCO) in West Virginia 14.9x PE

- Arrow Monetary Corp (AROW) in New York 12.1x PE

The common PE of this elite group of banks is ~16.5x. A 16.5x PE for HBT strikes the financial institution’s inventory value to ~$32. Whereas I don’t suppose a $30+ value is probably going in 2023, assuming credit score high quality stays sound, attending to $30 seems cheap in 2024-2025.

PE Ratios Excessive High quality Banks (YCharts)

Remaining Ideas: Worth Creation Catalysts

I see HBT having a number of catalysts for worth creation:

- Rising charges enhance NII

- Buybacks present margin of security

- Accretive acquisition in 2023

- Valuation “normalization” to prime friends.

- Bettering valuations for the sector.

Shares I’ve acquired up to now have been at costs between $17.80 and $19.50. I’ll proceed to accumulate HBT shares ambitiously <$20 and selectively <$23.

Dangers that stand out for HBT:

- Illinois as a state has an extended historical past of uneven banking efficiency; although it appears that evidently downside banks have been eradicated, solely a deep recession will reveal the reality.

- Illinois is a troublesome state to do enterprise in right now given excessive company taxes and the fixed battle between rural/small city markets and Chicago (HBT has present tax charge of 26.5% which is larger than most US group banks); Illinois’s pension gaps and monetary challenges are so vital that the state might increase taxes additional on corporations and people, jeopardizing jobs and native economies.

- Whereas rising rates of interest might help HBT, if charges rise too excessive, debtors might wrestle repaying loans.

- As with all banks, a deep recession might require HBT to considerably improve Provision expense.

- I stay keen on studying extra in regards to the financial institution’s CEO succession plan.

- A financial institution like HBT relies upon considerably on third celebration processors like Constancy Nationwide Data Providers Inc (FIS), Fiserv, Inc. (FISV), and Jack Henry & Associates, Inc. (JKHY). Adversity dealing with these processors (e.g., cyber) is a direct threat to HBT and different group banks.

- Liquidity (potential to promote HBT shares) is a priority given the thin market cap and low buying and selling quantity.

- Liquidity issues are exacerbated by the chance that the controlling shareholder (or successors) may wish or want to boost money by promoting shares and decreasing financial institution funding publicity; buyers in First Interstate noticed this threat play out over the previous two years.

In recognition of those dangers, I don’t see HBT turning into a prime 5 holding in my long-term buy-and-hold portfolio financial institution portfolio.

My objective for the portfolio is to proceed to carry a well-diversified (geography, credit score, enterprise fashions, buyer segments) group of high-quality banks. Banks at the moment on this portfolio are:

Readers can discover my most up-to-date articles on these banks by going to the hyperlink highlighted within the financial institution identify.

Caveat

The foregoing is my opinion which I share for the aim of getting suggestions and questions that problem my concepts and assumptions.

Each investor must do his/her personal due diligence earlier than investing in addition to decide their threat profile. I’m risk-averse, preferring to spend money on the nation’s greatest banks which reliably earn returns exceeding value of capital.

Editor’s Be aware: This text was submitted as a part of Looking for Alpha’s Prime 2023 Decide competitors, which runs by December 25. This competitors is open to all customers and contributors; click on right here to seek out out extra and submit your article right now!