VioletaStoimenova

Pricey readers/followers,

Since I final wrote about Principal Monetary Group (NASDAQ:PFG), the corporate has outperformed the market by round 20%. Because of this my place of “HOLD” was “unsuitable” – no less than for those who purchased on the time and bought as we speak. That is not how most investments go, however nonetheless.

Nonetheless, I’ve been following this firm and related companies for a number of years, and I keep on with my targets on account of multi-year traits, not momentary ups and downs. A number of years in the past I made the very aware resolution to not enable worry of lacking out to dictate my funding resolution in both path.

That is why I bought out of what remained in my PFG place when the corporate hit $90/share, which was the best I might justify holding this A-rated firm at. I now haven’t any place in PFG, and no plan to provoke one.

Right here is why.

Principal Monetary Group – An replace

I have been writing about PFG all the best way again since 2019 once I was one of many few contributors following the enterprise and calling for it to be a “BUY” within the wake of unbelievable undervaluation. The identical factor was true throughout 2020, and most of 2021, all the best way till the top of the yr. Whenever you take a look at the corporate’s share worth traits, apply valuation logic, and use a fantastic device, whether or not it’s excel spreadsheets or one thing like F.A.S.T. Graphs, you possibly can rapidly inform the place the corporate tends to go and the place it would not are likely to go for very lengthy.

Principal Monetary Group is a superb enterprise. The corporate has been round for roughly 140 years and has been providing insurance coverage for many of that point. It has been via a number of depressions, and lots of monetary waves of panic, and was round when the US banking system didn’t have its present banking system. The corporate is a storied survivor, and such corporations make for excellent investments, supplied you will get them at a fantastic worth.

The present firm segments will be summarized into three issues: World Asset Administration, Retirement, and Advantages/Safety.

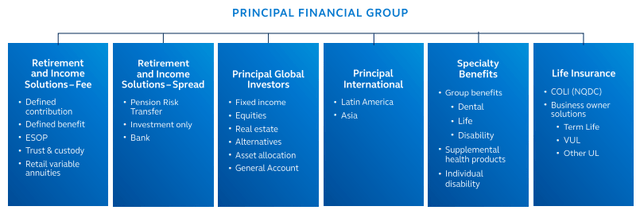

Shifting into extra granularity, we discover this.

PFG IR (PFG IR)

So it is an attention-grabbing combine that requires understanding what these numerous companies do, and what impacts their P&Ls over time.

On a excessive stage, PFG is a store with $1.4T in AUM and is the Prime-Three retirement supplier in the entire United States. It is a chief in advantages and safety for small/medium-sized companies, with a contemporary platform focusing on prospects throughout the nation and the world over.

Its working earnings is over 55% fee-based, with one other 18% in threat (straight insurance coverage, within the type of life/specialty) and 26% unfold from RIS. It is made the journey from extra conventional, into a number one monetary companies firm, and that is precisely what I need to see from corporations corresponding to this. Specialization, and going from A into B, streamlining and specializing in what they’re good at.

PFG has a world-class administration crew, the place the C-suite and the CEO particularly have over 38 years of expertise at PFG – that means he is been at PFG since he began working. The identical is true for a number of of the presidents, executives, and others. Administration high quality right here is high tier.

What’s additionally high tier is the corporate credit standing.

PFG IR (PFG IR)

…and we won’t neglect the best way the corporate leads the market not solely within the US however in enticing progress areas which are prone to contribute to longer-term efficiency.

PFG IR (PFG IR)

The corporate’s transformation has been a narrative of 10 years, ever since buying Claritas, Cuprum, and First Dental – and is a narrative that I’ve studied since beginning to cowl the corporate. It “closed” the books by divesting its Indian asset administration arm, the Mexico life section, and a few unattractive blocks in life throughout 2022, resulting in the present fundamentals, expectations, and the place the corporate at present “is”.

The corporate’s outcomes for 2022 and for 3Q22 particularly had been “so-so”. Working earnings are down round 7%, and EPS is flat. This hasn’t impacted the basics – 22.3% debt to cap and loads of liquidity at Holdco and subsidiaries, with a beautiful and secure dividend. My yield right here was as soon as over 6% – it is now barely 3%, which is the primary “strike” by way of valuation right here.

Nonetheless, the corporate has deployed its capital successfully through the yr, paying dividends and shopping for again shares, albeit at not that enticing ranges if we take a look at historicals. The corporate’s long-term targets embrace a 9-12% annual EPS progress, an RoE goal of 15%+, and FCF conversion of 75-85%. The corporate may be very unlikely to realize this for this fiscal, with present estimates at a unfavourable 4.5% for the yr, adopted by round 8% in 2023 and double-digits in 2024.

Do not get me unsuitable – there aren’t any “worries” within the quarterly outcomes, not as such. The unfavourable op. earnings and flat EPS is predicted in as we speak’s risky market, and funding efficiency hasn’t actually been stellar – however the firm’s funds nonetheless have largely a 4-5 star score from Morningstar.

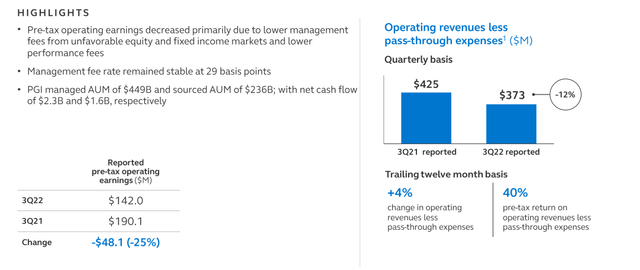

Additionally, the corporate’s effectivity targets are working – which is an effective factor, as a result of this can be a time the place income is definitely down in a number of segments, even when recurring deposits in RIS are up 10%. There have been vital variances in RIS in 3Q22 YoY, that means with out these variances, the corporate’s RIS earnings is down virtually 10%. Related traits are true for the World investor section…

PFG IR (PFG IR)

Once more, when the market is down, most individuals are sad. It means decrease efficiency charges, decrease administration charges, and different performance-related earnings which were largely rising for the previous few years.

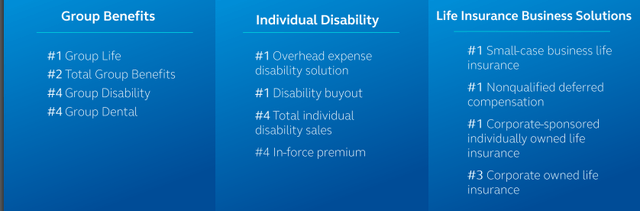

The corporate’s balanced portfolio and general broad choices make it a first-rate alternative for a lot of companies in addition to for a lot of people – and I need to emphasize once more – market management.

PFG IR (PFG IR)

The worldwide asset administration arm is the icing on the cake, as I see it, with substantial property below administration, including worth via its different companies by accumulation distribution and different synergistic drivers. It permits the corporate to broaden its relationships with institutional and rich traders, growing its general market share, and permitting it to capitalize on rising market investing.

This store hasn’t seen any critical issues in 3Q both, and a 4-5% drop in EPS is not sufficient for me to name PFG a nasty or an uninvestable enterprise.

However in the case of insurance coverage companies, what I would like is affordable high quality. PFG was very low-cost high quality at one time, however I imagine this has considerably modified as we speak given the state of the corporate’s valuation.

Right here is the place that state is at present at.

Principal Monetary Group – The Valuation

The market has a powerful tendency to undervalue or put a reduction on this firm in relation to precise earnings potential.

What this implies is we have to consider the corporate’s present valuation relative to this low cost, versus precise potential, because the inventory worth is unlikely to remain there ( historic values). This goes for upsides in addition to downsides and is doubly true once we’re overvaluations to that low cost – as we’re as we speak.

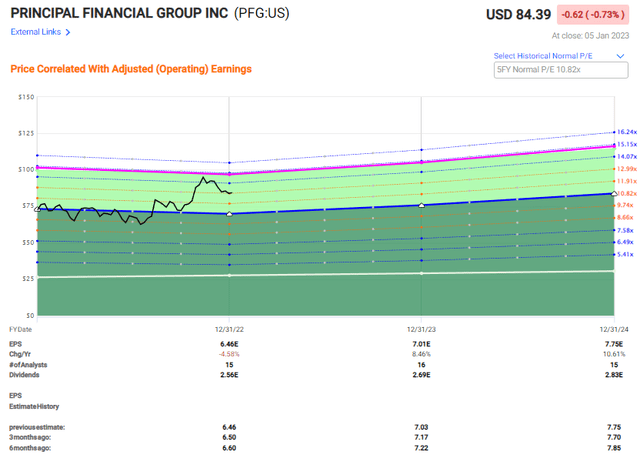

Right here is the valuation because it stands as we speak.

PFG valuation (F.A.S.T. Graphs)

So you possibly can see why my stance at the moment is that issues have modified, and why I bought out at round $90 with what little remained in my portfolio of the corporate. The conservatively adjusted upside based mostly on a 10-11x vary, which is the very well-established 20-year common for this enterprise, was not even constructive.

Because it stands as we speak, that upside, based mostly on a 10.8x a number of, is round 3% per yr, or 5.91% till 2024E.

Might the corporate climb greater and preserve keep there, based mostly on their new fundamentals as a stable monetary firm?

Sure, in fact, it might. There have been intervals of a number of years when the corporate traded pretty excessive, over 15x P/E, by way of multiples, although this was earlier than the monetary disaster.

However the issues with which are that it is a speculative assumption and that there are many high-rated financials out there at a lot decrease multiples and higher yields whereas having arguably nice general upsides to go by. So the comparative upside you will get from equally protected – or safer – corporations is best than some 3%-yield and 2-5% upside that PFG at present presents.

Valuation is essential – particularly in a conservative and recession-prone market just like the one we’re at present in. That’s the reason I say to you, expensive readers, this isn’t the time to put money into Principal Monetary Group.

S&P World analysts give the corporate common targets of $78/share, which signifies that they’re really agreeing with my stance – which is in fact uncommon. Just one out of 13 analysts at present has a “BUY” score on PFG, and the overvaluation as we speak is doubtlessly as a lot as 7% based mostly on these targets. The vary goes from $61 as much as $90/share at most, and for as soon as I’m in virtually 100% settlement with the analysts of an organization right here.

In my earlier article, I gave the corporate a share worth of $65/share. In gentle of as we speak’s market and state of affairs and what we discover by way of enticing corporations, this isn’t a goal I’m going to be shifting to right here.

Somewhat, I am repeating and emphasizing it – it is $65/share.

Traditionally talking, these analysts, and that by the best way contains me, have been fairly correct in the case of the enterprise. I might additionally argue that the corporate has a reasonably well-established custom of buying and selling between particular worth ranges – and as soon as the worth goes above the worth vary we’re seeing right here, then it normally comes again down once more pretty rapidly.

Due to that, that is my present thesis.

Thesis for the Widespread

I contemplate my present thesis on PFG as follows:

- Principal Monetary Group is a fully stable insurance coverage play that is generated alpha in my portfolio for a few years – and was rotated at a time when it had generated that alpha again across the $70/share mark. I might be joyful to purchase it again when it is low-cost, however not at over 11X P/E.

- The insurance coverage sector is filled with stable, world corporations providing a 4%+ yield at glorious credit score safeties – and PFG is among the costlier ones of the bunch.

- PFG is a “HOLD” right here. A worth goal that I might contemplate enticing for funding based mostly on my objectives can be round $65/share – although each investor in fact wants to take a look at their very own targets, objectives, and techniques. I might additionally all the time seek the advice of with a finance skilled earlier than making funding choices corresponding to this.

Bear in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is general qualitative.

This firm is essentially protected/conservative & well-run.

This firm pays a well-covered dividend. This firm is at present low-cost.

This firm has a sensible upside based mostly on earnings progress or a number of enlargement/reversion.

A terrific firm, nevertheless it doesn’t fulfill my standards for investing by way of valuation.

The choices play

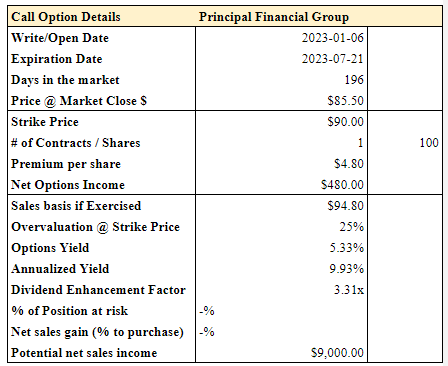

By way of choices, the present valuation signifies that we won’t actually put cash to work at enticing put choices costs. If you happen to’ve elected to carry onto your PFG shares, however have 100+ shares and need to take a look at a CALL possibility, I’ve this to give you.

PFG Name Choice (Writer’s Knowledge)

It is a long-dated name possibility with a low Strike, that means a better premium. That is what I normally do once I “need” to promote an fairness at a particular worth. I would like the kind of yield that makes it price not promoting straight if the corporate drops again down. Near 10% annualized offers that. If I had 100 shares of PFG, that is what I might do.