Company e-learning Market: Discount in worker coaching value for employers to drive progress

The important thing issue driving progress within the company e-learning market is the discount in worker coaching prices for employers. Organizations search for methods to chop down the working value and enhance their revenue. Worker coaching is one space the place organizations spend considerably. e-learning helps organizations to scale back the fee related to worker coaching. For example, the Financial institution of Eire is estimated to have lowered its L&D prices considerably after the variation of Studying zone, a company e-learning system. Such situations of a discount in coaching value encourage end-users to undertake company e-learning programs, thereby driving market progress.

Company E-learning Market: Rising adoption of cloud computing to be a significant pattern

The adoption of microlearning is without doubt one of the key traits supporting the company e-learning market share progress. Micro-learning offers with using bite-sized studying modules and short-term studying actions. The concentrate on personalization and adaptive studying is growing the recognition of microlearning. In a fast-paced world with quick consideration spans of people, it turns into tough to maintain individuals interested by coaching modules for longer durations. Because of this, company e-learning distributors are transferring from long-duration coaching programs to microlearning. The thought of microlearning is to assist individuals study higher and quicker by means of quick studying modules.

To know extra in regards to the drivers & traits -Request a Free Pattern Report

Company E-learning Market: Segmentation Evaluation

The market analysis report segments the company e-learning market by Finish-user (Providers, Manufacturing, Retail, and Others), Deployment (On-premise and Cloud-based), and Geography (APAC, North America, Europe, South America, and MEA).

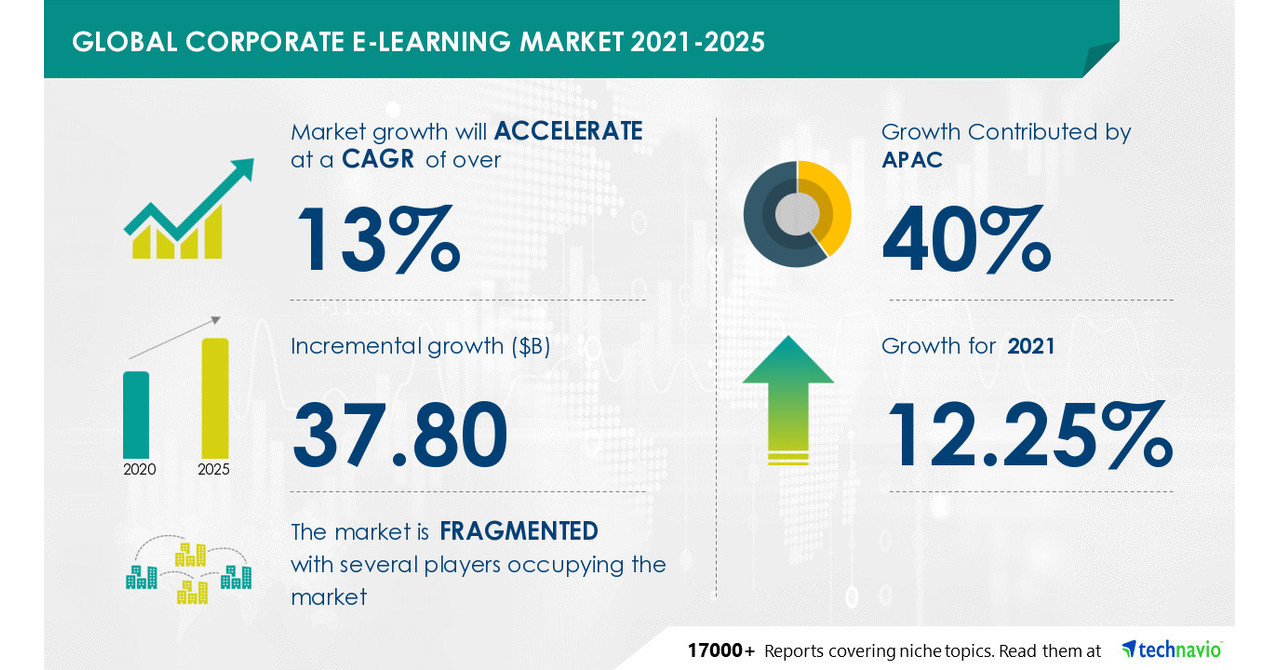

- 40% of the market’s progress will originate from APAC throughout the forecast interval. India and Japan are the important thing markets for company e-learning in APAC. Market progress in APAC can be quicker than the expansion of the market in different areas. The proliferation and adoption of the newest applied sciences in present techniques will facilitate the company e-learning market progress in APAC over the forecast interval.

- The company e-learning market share progress by the providers phase can be important for income era. Within the hospitality business, staff should work together with clients very regularly. Right now, clients demand a excessive stage of service. Therefore, staff have to be properly educated and properly knowledgeable for the utmost buyer satisfaction. Subsequently, organizations within the hospitality business have to coach their staff frequently to keep up service high quality. This drives the demand for e-learning options as a result of their cost-effectiveness.

To achieve additional insights in the marketplace contribution of assorted segments – Request a free pattern report

Associated Reviews:

Textual content-to-Speech Market -The text-to-speech market share is predicted to extend by USD 3.14 billion from 2020 to 2025, at a CAGR of 16.81%. Obtain a free pattern now!

Private Growth Market -The non-public growth market share ought to rise by USD 557.89 million from 2021 to 2025 at a CAGR of seven.75%. Obtain a free pattern now!

|

Company E-learning Market Scope |

|

|

Report Protection |

Particulars |

|

Web page quantity |

120 |

|

Base yr |

2020 |

|

Forecast interval |

2021-2025 |

|

Development momentum & CAGR |

Speed up at a CAGR of 13% |

|

Market progress 2021-2025 |

USD 37.80 billion |

|

Market construction |

Fragmented |

|

YoY progress (%) |

12.25 |

|

Performing market contribution |

APAC at 40% |

|

Aggressive panorama |

Main firms, aggressive methods, shopper engagement scope |

|

Firms profiled |

Articulate International Inc., Metropolis and Guilds Group, CommLab India, D2L Corp., Designing Digitally Inc., EI Design Pvt Ltd., G Dice Webwide Software program Pvt. Ltd., GP Methods Corp., PeopleFluent Holdings Corp., and Skillsoft Ltd. |

|

Market Dynamics |

Mother or father market evaluation, Market progress inducers and obstacles, Quick-growing and slow-growing phase evaluation, COVID-19 influence and future shopper dynamics, market situation evaluation for the forecast interval, |

|

Customization purview |

If our report has not included the info that you’re in search of, you possibly can attain out to our analysts and get segments custom-made. |

Desk of Content material

1. Govt Abstract

2. Market Panorama

2.1 Market ecosystem

Exhibit 01: Mother or father market

Exhibit 02: Market traits

2.2 Worth chain evaluation

Exhibit 03: Worth Chain Evaluation: Training providers

2.2.1 Inputs

2.2.2 Operations

2.2.2.1 Pitching and profiling

2.2.2.2 Resourcing and speaking

2.2.2.Three Supply and help

2.2.2.Four Connecting and innovating

2.2.Three Advertising and marketing and gross sales

2.2.Four Help actions

2.3.5 Innovation

3. Market Sizing

3.1 Market definition

Exhibit 04: Choices of distributors included available in the market definition

3.2 Market phase evaluation

Exhibit 05: Market segments

3.3 Market measurement 2020

3.4 Market outlook: Forecast for 2020 – 2025

Exhibit 06: International – Market measurement and forecast 2020 – 2025 ($ billion)

Exhibit 07: International market: Yr-over-year progress 2019 – 2024 (%)

4. 5 Forces Evaluation

4.1 5 Forces Abstract

Exhibit 08: 5 forces evaluation 2019 & 2024

4.2 Bargaining energy of consumers

Exhibit 09: Bargaining energy of consumers

4.Three Bargaining energy of suppliers

Exhibit 10: Bargaining energy of suppliers

4.Four Risk of latest entrants

Exhibit 11: Risk of latest entrants

4.5 Risk of substitutes

Exhibit 12: Risk of substitutes

4.6 Risk of rivalry

Exhibit 13: Risk of rivalry

4.7 Market situation

Exhibit 14: Market situation – 5 forces 2020

5. Market Segmentation by Finish Consumer

5.1 Market segments

The segments coated on this chapter are:

- Providers

- Manufacturing

- Retail

- Others

The 2 segments have been ranked primarily based on their market share in 2020. The providers constituted the most important phase in 2020, whereas the smallest phase was others

Exhibit 15: Distribution Channel – Market share 2020-2025 (%)

5.2 Comparability by Finish Consumer

Exhibit 16: Comparability by Finish person

5.Three Providers- Market measurement and forecast 2020-2025

Exhibit 17: Providers – Market measurement and forecast 2020-2025 ($ million)

Exhibit 18: Providers – Yr-over-year progress 2020-2025 (%)

5.Four Manufacturing – Market measurement and forecast 2020-2025

Exhibit 19: Manufacturing – Market measurement and forecast 2020-2025 ($ million)

Exhibit 20: Manufacturing – Yr-over-year progress 2020-2025 (%)

5.5 Retail – Market measurement and forecast 2020-2025

Exhibit 21 Retail – Market measurement and forecast 2020-2025 ($ million)

Exhibit 22: Retail – Yr-over-year progress 2020-2025 (%)

5.6 Others – Market measurement and forecast 2020-2025

Exhibit 23: Others – Market measurement and forecast 2020-2025 ($ million)

Exhibit 24: Others – Yr-over-year progress 2020-2025 (%)

5.7 Market alternative by

Exhibit 25: Market alternative by Product

6. Market Segmentation by Deployment

6.1 Market segments

The segments coated on this chapter are:

Exhibit 26: Deployment – Market share 2020-2025 (%)

6.2 Comparability by Deployment

Exhibit 27: Comparability by Deployment

6.Three On-Premise- Market measurement and forecast 2020-2025

Exhibit 28: On Premise – Market measurement and forecast 2020-2025 ($ million)

Exhibit 29: On Premise – Yr-over-year progress 2020-2025 (%)

6.Four Cloud Based mostly – Market measurement and forecast 2020-2025

Exhibit 30: Cloud Based mostly – Market measurement and forecast 2020-2025 ($ million)

Exhibit 31: Cloud Based mostly – Yr-over-year progress 2020-2025 (%)

6.5 Market alternative by Distribution Channel

Exhibit 32: Market alternative by Distribution Channel

7. Buyer panorama

Exhibit 33: Buyer panorama

8. Geographic Panorama

8.1 Geographic segmentation

The areas coated within the report are:

- APAC

- North America

- Europe

- South America

- MEA

North America ranked first as the most important market globally, whereas MEA accounted for the smallest market share in 2020

Exhibit 34: Market share by geography 2020-2025 (%)

8.2 Geographic comparability

Exhibit 35: Geographic comparability

8.Three APAC – Market measurement and forecast 2020-2025

Exhibit 36: APAC- Market measurement and forecast 2020-2025 ($ million)

Exhibit 37: APAC – Yr-over-year progress 2020-2025 (%)

8.4 North America – Market measurement and forecast 2020-2025

Exhibit 38: North America – Market measurement and forecast 2020-2025 ($ million)

Exhibit 39: North America – Yr-over-year progress 2020-2025 (%)

8.5 Europe – Market measurement and forecast 2020-2025

Exhibit 40: Europe – Market measurement and forecast 2020-2025 ($ million)

Exhibit 41: Europe– Yr-over-year progress 2020-2025 (%)

8.6 South America – Market measurement and forecast 2019-2024

Exhibit 42: South America – Market measurement and forecast 2019-2024 ($ billion)

Exhibit 43: South America – Yr-over-year progress 2020-2024 (%)

8.7 Center East and Africa – Market measurement and forecast 2019-2024

Exhibit 44: Center East and Africa – Market measurement and forecast 2019-2024 ($ billion)

Exhibit 45: Center East and Africa – Yr-over-year progress 2020-2024 (%)

8.Eight Key main nations

Exhibit 46: Key main nations

8.9 Market alternative by geography

Exhibit 47: Market alternative by geography ($ million)

9. Drivers, Challenges, and Developments

9.1 Market drivers

9.1.1 Discount in worker coaching value for employers

9.1.2 Growing penetration of smartphones and tablets

9.1.3 Rising adoption of cloud computing

9.2 Market challenges

9.2.1 Designing e-learning course

9.2.2 Technological boundaries in growing nations

9.2.3 Knowledge safety and privateness points

Exhibit 48: Affect of drivers and challenges

9.Three Market traits

9.3.1 Adoption of microlearning

9.3.2 Elevated use of wearable devices

9.3.3 Cellular studying in growing nations

10. Vendor Panorama

10.1 Overview

Exhibit 45: Vendor panorama

10.2 Panorama disruption

The potential for the disruption of the market panorama was average in 2020, and its risk is predicted to stay unchanged by 2025.

Exhibit 46: Panorama disruption

Exhibit 47: Business dangers

11. Vendor Evaluation

11.1 Distributors coated

Exhibit 48: Distributors coated

11.2 Market positioning of distributors

Exhibit 49: Market positioning of distributors

11.3 Articulate International Inc.

Exhibit 54: Articulate International Inc. – Overview

Exhibit 55: Articulate International Inc. – Product and repair

Exhibit 56: Articulate International Inc. – Key choices

11.4 Metropolis and Guilds Group

Exhibit 57: Metropolis and Guilds Group – Overview

Exhibit 58: Metropolis and Guilds Group – Product and repair

Exhibit 59: Metropolis and Guilds Group – Key information

Exhibit 60: Metropolis and Guilds Group – Key choices

11.5 CommLab India

Exhibit 61: CommLab India – Overview

Exhibit 62: CommLab India – Product and repair

Exhibit 63: CommLab India – Key information

Exhibit 64: CommLab India – Key choices

11.6 D2L Corp.

Exhibit 65: D2L Corp. – Overview

Exhibit 66: D2L Corp. – Product and repair

Exhibit 67: D2L Corp. – Key choices

11.7 Designing Digitally Inc.

Exhibit 68: Designing Digitally Inc. – Overview

Exhibit 69: Designing Digitally Inc. – Product and repair

Exhibit 70: Designing Digitally Inc. – Key choices

11.8 EI Design Pvt Ltd.

Exhibit 71: EI Design Pvt Ltd. – Overview

Exhibit 72: EI Design Pvt Ltd. – Product and repair

Exhibit 73: EI Design Pvt Ltd. – Key choices

11.9 G Dice Webwide Software program Pvt. Ltd.

Exhibit 74: G Dice Webwide Software program Pvt. Ltd. – Overview

Exhibit 75: G Dice Webwide Software program Pvt. Ltd. – Product and repair

Exhibit 76: G Dice Webwide Software program Pvt. Ltd. – Key choices

11.10 GP Methods Corp.

Exhibit 77: GP Methods Corp. – Overview

Exhibit 78: GP Methods Corp. – Enterprise segments

Exhibit 79: GP Methods Corp. – Key choices

Exhibit 80: GP Methods Corp. – Phase focus

11.11 PeopleFluent Holdings Corp.

Exhibit 81: PeopleFluent Holdings Corp. – Overview

Exhibit 82: PeopleFluent Holdings Corp. – Product and repair

Exhibit 83: PeopleFluent Holdings Corp. – Key choices

11.12 Skillsoft Ltd.

Exhibit 84: Skillsoft Ltd. – Overview

Exhibit 85: Skillsoft Ltd. – Product and repair

Exhibit 86: Skillsoft Ltd. – Key choices

12. Appendix

12.1 Scope of the report

12.1.1 Market definition

12.1.2 Aims

12.1.Three Notes and caveats

12.2 Foreign money conversion charges for US$

Exhibit 87: Foreign money conversion charges for US$

12.Three Analysis Methodology

Exhibit 88: Analysis Methodology

Exhibit 89: Validation methods employed for market sizing

Exhibit 90: Data sources

12.Four Record of abbreviations

Exhibit 91: Record of abbreviations

About Technavio

Technavio is a number one international know-how analysis and advisory firm. Their analysis and evaluation focuses on rising market traits and supplies actionable insights to assist companies establish market alternatives and develop efficient methods to optimize their market positions.

With over 500 specialised analysts, Technavio’s report library consists of greater than 17,000 experiences and counting, masking 800 applied sciences, spanning throughout 50 nations. Their consumer base consists of enterprises of all sizes, together with greater than 100 Fortune 500 firms. This rising consumer base depends on Technavio’s complete protection, in depth analysis, and actionable market insights to establish alternatives in present and potential markets and assess their aggressive positions inside altering market eventualities.

Contacts

Technavio Analysis

Jesse Maida

Media & Advertising and marketing Govt

US: +1 844 364 1100

UK: +44 203 893 3200

E mail: [email protected]

Web site: www.technavio.com/

SOURCE Technavio