Final Wednesday, the Nationwide Firm Legislation Appellate Tribunal (NCLAT) refused to halt a Competitors Fee of India order that requires Google to make adjustments to its Android ecosystem.

Now, the search big has requested the Supreme Court docket to halt the order, saying it might trigger “lasting and irreparable hurt” to Google, system producers, app builders, Indian customers, and the broader financial system.

Additionally on this letter:

■ Ola Monetary stops lending by Avail Finance app

■ Flipkart market arm will get $90 million money infusion

■ Byju’s asks collectors for extra time to recast $1.2-billion debt: report

CCI’s Android order would trigger ‘irreparable hurt’, Google tells Supreme Court docket

Google has informed the Supreme Court docket that the Competitors Fee of India’s October 2022 order concerning Android would require it to make “far-reaching adjustments to the cell platform which has been in place for the previous 14-15 years” and can result in “lasting and irreparable hurt” to Google, system producers, app builders, customers, and the broader Indian financial system.

The corporate has requested the Supreme Court docket to placed on maintain the remedial measures ordered by the CCI, which kick in from January 19, based on courtroom paperwork dated January 7.

Catch up fast: In October 2022, the CCI fined Google Rs 1,337 crore for exploiting its dominant place in Android, which powers 97% of smartphones in India and requested the corporate to take away restrictions imposed on smartphone makers associated to pre-installing apps.

Final Wednesday, the Nationwide Firm Legislation Appellate Tribunal declined to remain in opposition to the CCI order, pointing to the two-month hole between the order and Google’s enchantment in December.

One final likelihood: Google then petitioned the Supreme Court docket, difficult the NCLAT’s refusal to remain the CCI order. Google mentioned the remedial measures issued by the competitors regulator “function fully on hypothesis” and “pay no heed to the hurt” they might trigger stakeholders within the Android ecosystem.

Google mentioned the CCI order would power it to switch its current contracts, introduce new licence agreements and alter its current preparations with greater than 1,100 system producers and 1000’s of app builders.

“Great development in progress of an ecosystem of system producers, app builders and customers is on the verge of coming to a halt due to the remedial instructions,” learn the submitting.

Ola Monetary stops lending by Avail Finance app

Ola Monetary Providers has ceased lending to prospects, largely blue-collar employees, by the app of a not too long ago acquired entity Avail Finance, a supply conscious of the matter informed us.

We tried to take a mortgage by the app, however the service was unavailable.

Catch up fast: Ola acquired Avail Finance, based by Ola founder Bhavish Aggarwal’s brother Ankush Aggarwal, for about $50 million in April final 12 months.

“The corporate stopped disbursing loans in December. Solely the gathering of loans will happen all year long, which will probably be accomplished in December 2023, as Avail provided one-year loans,” an individual within the know mentioned.

Revamp: ET has learnt that the corporate is engaged on a brand new lending service that will probably be made obtainable to prospects by the Ola and Ola Cash apps.

“Avail’s providers have been built-in with Ola Monetary Providers. We at the moment are providing services and products to drivers and prospects by Ola Monetary Providers,” the corporate mentioned in response to ET’s queries.

What’s subsequent for Ola Monetary? In a not too long ago concluded city corridor, Bhavish Aggarwal informed workers that Ola Monetary Providers will assist different group entities like its cab service and electrical car (EV) enterprise.

It gives providers reminiscent of an e-wallet known as Ola Cash, permits loans for the acquisition of Ola’s EVs, gives insurance coverage merchandise for each EV patrons and ride-hailing prospects, and a buy-now-pay-later service known as Ola Cash Postpaid.

Fintech hobbled: The adjustments at Ola Monetary and within the broader fintech trade come at a time when RBI’s newest lending tips have diminished the position of fintech companies with out an lively non-banking finance firm (NBFC) licence to simply mortgage providers suppliers, placing extra duty within the arms of regulated entities.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Worthwhile, and ET Ecommerce Non-Worthwhile – to trace the efficiency of not too long ago listed tech companies. Right here’s how they’ve fared up to now.![]()

Flipkart market arm will get $90 million money infusion

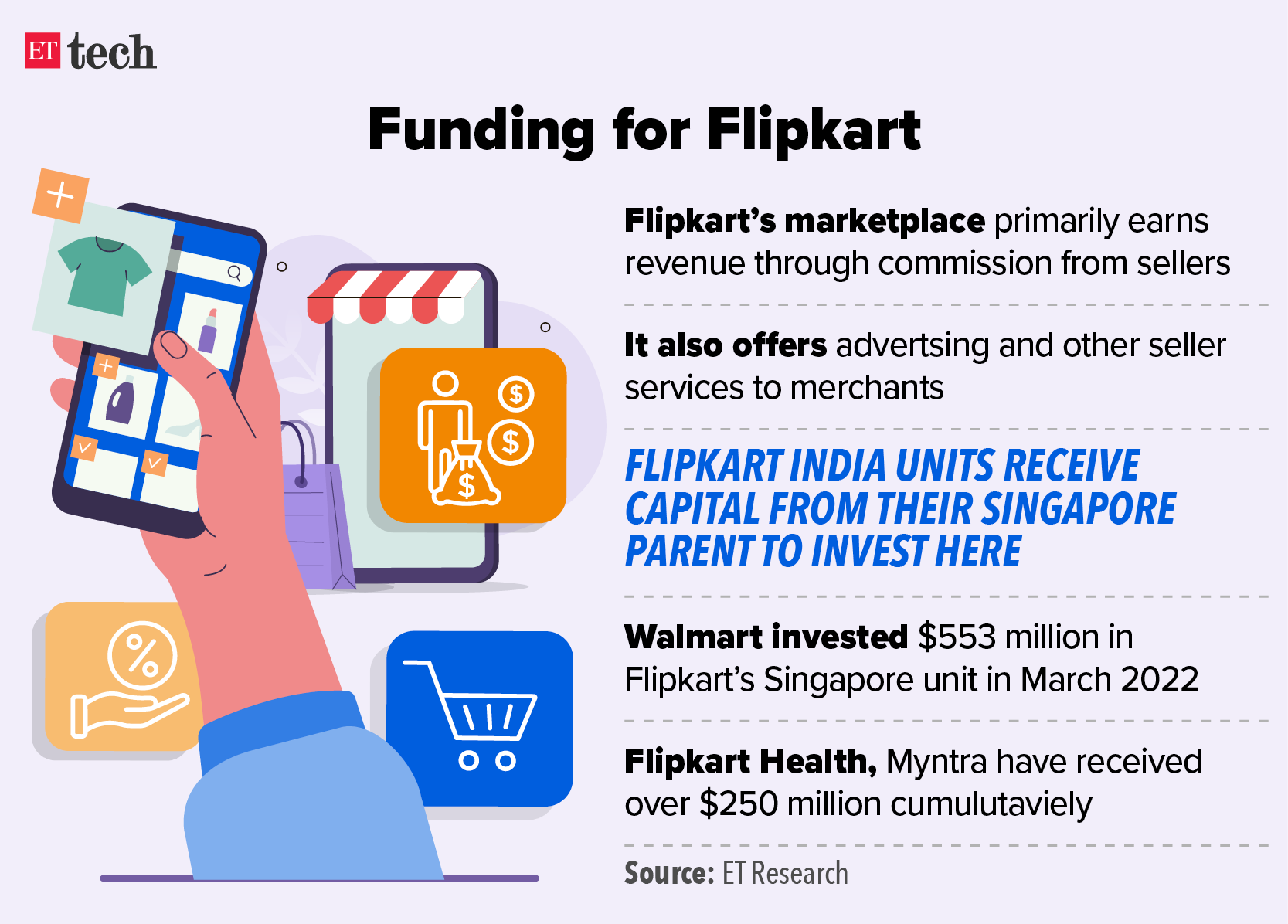

Flipkart Web, {the marketplace} arm of ecommerce agency Flipkart, has acquired a money infusion of near $90 million (Rs 722 crore) from its Singapore mum or dad, based on regulatory filings accessed by enterprise intelligence platform Tofler.

Particulars: The decision to infuse new capital was permitted on December 29, 2022. The brand new capital is from two Singapore-based entities – Flipkart Market Personal Restricted and Flipkart Personal Restricted.

Flipkart’s mum or dad agency is domiciled in Singapore and it has a number of items in India for numerous companies, together with logistics. Flipkart Web is among the key entities of the Walmart-owned etailer in India.

Amazon’s troubles: The event comes at a time when its rival Amazon India has shut down a number of companies in India, reminiscent of meals supply, edtech and its distribution items, and has fired workers from the native unit.

We reported in November 2022 the corporate plans to fireplace a minimum of a couple of hundred workers in India, and studies final week mentioned it has fired 1,000 workers within the nation as a part of its international layoffs.

PhonePe separation: Flipkart and PhonePe not too long ago introduced their separation after the funds agency shifted base from Singapore to India. PhonePe is elevating new capital from Walmart and different traders that will see the whole spherical dimension, together with main and secondary share gross sales, hit virtually $2 billion.

Byju’s asks collectors for extra time to recast $1.2-billion debt: report

Troubled edtech big Byju’s has sought extra time from its collectors to renegotiate an settlement pertaining to a $1.2-billion mortgage that’s in breach of covenants, Bloomberg reported, citing sources.

Catch up fast: In November 2021, we reported that Byju’s had raised $1.2 billion by way of a time period mortgage from the abroad market. The edtech agency, then valued at $18 billion, had earlier deliberate to boost $700 million, however the spherical was upsized.

Particulars: In accordance with the report, the collectors had till Tuesday to signal a forbearance settlement, which might give the corporate till February 10 to barter broader phrases for the mortgage.

Jargon buster: A forbearance settlement is a short lived postponement of mortgage funds a lender can grant as an alternative of forcing the borrower into foreclosures or default. The phrases of such an settlement are normally negotiated between the borrower and lender.

Present me the cash: Among the collectors are in search of a faster compensation of the mortgage utilizing money reserves of about $850 million from Byju’s US unit, Bloomberg reported in December. This was after the mum or dad agency missed a September deadline to reveal its FY21 earnings. The lenders then employed Houlihan Lokey Inc to advise the edtech agency on amending covenants.

TWEET OF THE DAY

Lok Capital completes first shut of fourth fund at $90 million

Lok Capital has made the primary shut of its fourth fund with commitments totalling $90 million, the impression funding agency mentioned on Tuesday.

The Chennai-based fund mentioned the ultimate shut – at $150-200 million – is predicted by September.

The fourth fund will put money into monetary providers, together with fintech, health-tech, meals and agri-tech, and local weather tech.

Traders: Traders in its first shut – which came about final month – included British Worldwide Funding (BII), Dutch growth financial institution FMO, Evolvence, and Blue Earth, in addition to new names just like the US Worldwide Growth Finance Company (DFC) and OeEB (Austrian Growth Financial institution).

Quote unquote: “Monetary inclusion is entrance and centre for us. It’s crucial sector for our fund. Sustainability is an rising house, and we’re taking a look at themes that concentrate on decarbonisation just like the electrification of automobiles, renewable vitality and even various proteins”, Venky Natarajan, co-founder and associate at Lok Advisory Providers, which advises the funds of Lok Capital, informed ET.

ETtech Achieved Offers

- Actyv.ai has raised $7 million extra as a part of its pre-series A funding spherical from Dubai-based 1Digi Funding administration agency, the household workplace of Raghunath Subramanian, its international CEO, the corporate mentioned in an announcement.

- On-line development market Brick&Bolt mentioned on Tuesday it has raised $10 million from international enterprise capital companies Accel and Celesta Capital. The startup mentioned it plans to make use of the fund to increase to 12 cities within the subsequent 15 months. It additionally plans to boost its tech stack and strengthen its management workforce.

- Tremendous app for automotive homeowners Park+ has raised $17 million (about Rs 140 crore) in its Sequence C spherical, led by current traders Epiq Capital, Sequoia Capital and Matrix Companions India.

- Studying administration system startup Toddle has raised $17 million in its Sequence A funding spherical, led by Sequoia Capital India. Tenacity Ventures and Trifecta Capital, together with current traders Matrix Companions, Beenext, and Higher Capital, additionally participated within the funding spherical, the corporate mentioned.

Different Prime Tales By Our Reporters

Relevel to pivot to check merchandise, Gaurav Munjal tells workers: Unacademy-owned upskilling platform Relevel, which helps job seekers qualify for numerous roles, is present process a significant pivot and can focus utterly on check merchandise and its new app NextLevel, based on an inner memo founder Gaurav Munjal despatched to workers on Tuesday.

BharatPe will get RBI nod to function as on-line fee aggregator: Fintech unicorn BharatPe has acquired in-principle approval from the Reserve Financial institution of India to function as a web-based fee aggregator, becoming a member of fintech platforms reminiscent of Open, Infibeam, Cashfree, Paysharp and Worldline ePayments, which have already got such approvals in place.

World Picks We Are Studying

■ Vigilantes for views: The YouTube pranksters harassing suspected rip-off callers in India (Remainder of World)

■ Is it human or AI? New instruments aid you spot the bots (WSJ)

■ Iran says face recognition will ID ladies breaking hijab legal guidelines (Wired)