The panorama of non-public finance administration has developed considerably lately. Previously, holding tabs in your monetary well being usually concerned stacks of paperwork, handbook information entry, and loads of number-crunching. This not solely consumed worthwhile time however may additionally result in errors, inflicting undue stress for people striving to take care of their monetary well-being.

Nevertheless, Simplifi by Quicken has emerged as a breath of recent air within the realm of monetary administration. It seamlessly bridges the hole between conventional monetary administration instruments and the calls for of our fashionable, digitally-connected lives.

This revolutionary app takes the grunt work out of non-public finance, because it mechanically connects to your financial institution accounts, bank cards, and financial savings, offering a real-time and complete snapshot of your monetary well being. In doing so, Simplifi simplifies the complicated and sometimes daunting activity of monetary administration.

Simplifi’s mission is obvious: to empower people with the instruments and insights they should make knowledgeable monetary selections, set and obtain financial savings targets, and navigate their monetary journey with confidence and ease. Now, let’s delve into the main points of Simplifi’s key options and advantages that make it a standout alternative on this planet of non-public finance apps.

Study Extra About Simplifi

Simplifi’s Key Options

Simplifi gives a variety of key options that make it a standout cash administration app:

- Complete Spending Monitoring – Simplifi gives customers with a strong device to know their spending habits. It breaks down spending into numerous classes, providing worthwhile insights into the place your discretionary earnings goes. With this data, you can also make knowledgeable selections about the way to modify your spending habits to align together with your monetary targets.

- Financial savings Objectives – Setting and attaining financial savings targets is a vital side of monetary well being. Simplifi permits you to create and observe your financial savings targets, whether or not you’re saving for a big buy, planning a vacation, or constructing an emergency fund. This function helps you keep motivated and on observe.

- Syncs with Your Monetary Establishments – Certainly one of Simplifi’s standout options is its direct synchronization together with your monetary establishments. This implies you possibly can entry all of your monetary accounts, together with financial institution accounts, financial savings accounts, and bank cards, in a single place. This complete view of your monetary well being simplifies the method of managing a number of accounts throughout completely different platforms.

- Seamless Syncing – Simplifi’s cellular app syncs seamlessly with the desktop model, making certain that any modifications made on one platform immediately mirror on the opposite. This real-time synchronization retains your monetary image updated, regardless of the place you’re.

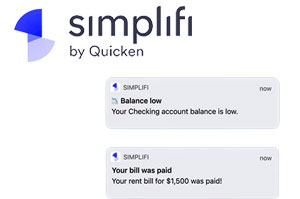

- Actual-Time Alerts – The cellular app gives real-time alerts about upcoming payments, spending targets, and financial savings targets, serving to you keep on high of your funds. This function is especially helpful in stopping late funds and making certain you keep inside your month-to-month spending plan.

- Complete Spending Stories – Like its desktop counterpart, the cellular app gives complete spending reviews, breaking down bills into numerous classes. This lets you shortly observe your spending habits and determine areas the place you can also make modifications.

- Simple Entry to Financial savings Objectives – The cellular app makes it straightforward to trace your progress towards your financial savings targets, making certain that your monetary aspirations are at all times inside attain, even once you’re on the go.

Simplifi Advantages

- Person-Pleasant Interface – Simplifi gives a clear and easy-to-understand interface that makes it a user-friendly alternative. Navigating and deciphering your monetary data is a breeze, making it accessible to a variety of customers.

- Customization Choices – Simplifi understands that private finance is, effectively, private. With in depth customization choices, you possibly can tailor the app’s options to your particular wants. This contains creating personalised spending plans, setting individualized financial savings targets, and customizing spending classes.

- Complete Monetary Image – The power to sync with numerous monetary establishments and account sorts gives customers with a holistic view of their monetary scenario. That is significantly worthwhile for these managing a number of accounts on completely different platforms.

- Proactive Cash Administration – Simplifi retains you within the loop with real-time alerts about upcoming payments, spending targets, and financial savings targets. These alerts provide help to keep on high of your monetary scenario and keep away from any disagreeable monetary surprises.

- Value-Efficient – Simplifi gives a 30-day free trial, permitting you to discover its options earlier than committing. Afterward, it’s priced at simply $3.99 per 30 days for month-to-month billing or $35.99 per yr for an annual plan. This pricing is sort of aggressive in comparison with different private finance apps, making Simplifi a cheap alternative.

Remaining Ideas on Simplifi by Quicken

Simplifi by Quicken gives a recent method to private finance software program, simplifying cash administration like by no means earlier than. Its key options, similar to complete spending monitoring, financial savings targets, and synchronization with monetary establishments, empower customers to take management of their monetary future.

Whereas Simplifi could not provide funding monitoring or credit score rating monitoring like some rivals, its emphasis on spending plans, financial savings targets, and total simplicity makes it a compelling alternative for people in search of to regain management of their monetary lives.

Should you’re in quest of a budgeting app that gives a holistic view of your monetary accounts, helps you handle your spending habits, and aids you in reaching your financial savings targets, Simplifi by Quicken might be the right match for you. Able to take management of your funds? Click on right here to start out your 30-day free trial and embark in your journey towards monetary empowerment with Simplifi.

Article Sources