To date this 12 months, the Monetary Trade Regulatory Authority has introduced extra instances involving Regulation Greatest Curiosity violations for corporations and their brokers than it did for all of 2024, in accordance with an enforcement official on the Monetary Trade Regulatory Authority.

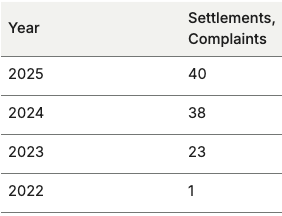

As of November 25, Finra has posted 40 settlement letters or complaints primarily based on alleged Reg BI violations towards corporations or people, in accordance with a evaluation of the agency’s disciplinary actions database. That compares to 38 for 2024.

“We’ve already surpassed final 12 months’s whole 12 months’s whole Reg BI instances,” Invoice St. Louis, Finra’s head of Enforcement, stated on a podcast, in accordance with a transcript posted by the business’s self regulatory group. The podcast coincided with FInra’s 2026 Annual Regulatory Oversight Report.

The Securities and Change Fee’s Reg BI, which grew to become efficient in June 2020, mandates the broker-dealers and brokers preserve a retail investor’s “finest curiosity” because the precedence overriding their very own self curiosity once they make suggestions of securities transactions or associated funding methods, together with account suggestions.

They “should not put their monetary or different pursuits forward of the pursuits of a retail buyer when making a advice,” Finra’s annual regulatory report stated. “The usual of conduct established by Reg BI can’t be happy by disclosure alone,” it provides, mirroring the SEC’s language.

Since 2022, when Finra posted just one Reg BI associated enforcement motion, the annual quantity has steadily grown, in accordance with the information.

Finra Reg BI Enforcement Actions

Finra’s actions towards particular person brokers exceed these towards corporations. In 2025, 25 focused people.

“The vast majority of our Reg BI instances contain people who’ve violated the care obligation vis-a-vis the suggestions to retail clients,” St. Louis stated on the podcast. “However we additionally deliver some corresponding instances towards member corporations for failing to oversee such suggestions.”

“We nonetheless see corporations having basic errors and software of the rule,” St. Louis stated.

In its oversight report, Finra listed quite a lot of frequent violations together with when brokers or corporations are “improperly utilizing the phrases ‘advisor’ or ‘adviser’ in their titles or agency names, though they lack the suitable registration and do not interact in different actions that permit using these phrases.”

The report offers the instance of a agency that was beforehand registered as broker-dealer and an funding advisor with the SEC retaining the “advisor” or “adviser” title, implying they’re fiduciaries, even after they’ve withdrawn their funding advisor registration.

Whereas the tally of Reg BI instances elevated, Finra didn’t present a take a look at its total enforcement statistics for the 12 months. Finra appeared to match with a broader de-regulatory agenda underneath the Trump administration when it earlier this 12 months stated it could undertake a broad evaluation to modernize its guidelines primarily based on member suggestions.

Finra has additionally confronted criticism over the previous 12 months that it had not been aggressive sufficient and targeted on small-ticket violations.

The put up Reg BI Instances Tick Up at Finra’s Enforcement Division appeared first on AdvisorHub.