Even because the Inner Income Service started sending out the second batch of advance Youngster Tax Credit score funds, proof has emerged that the primary spherical might have had a measurable impression on starvation and poverty within the U.S.

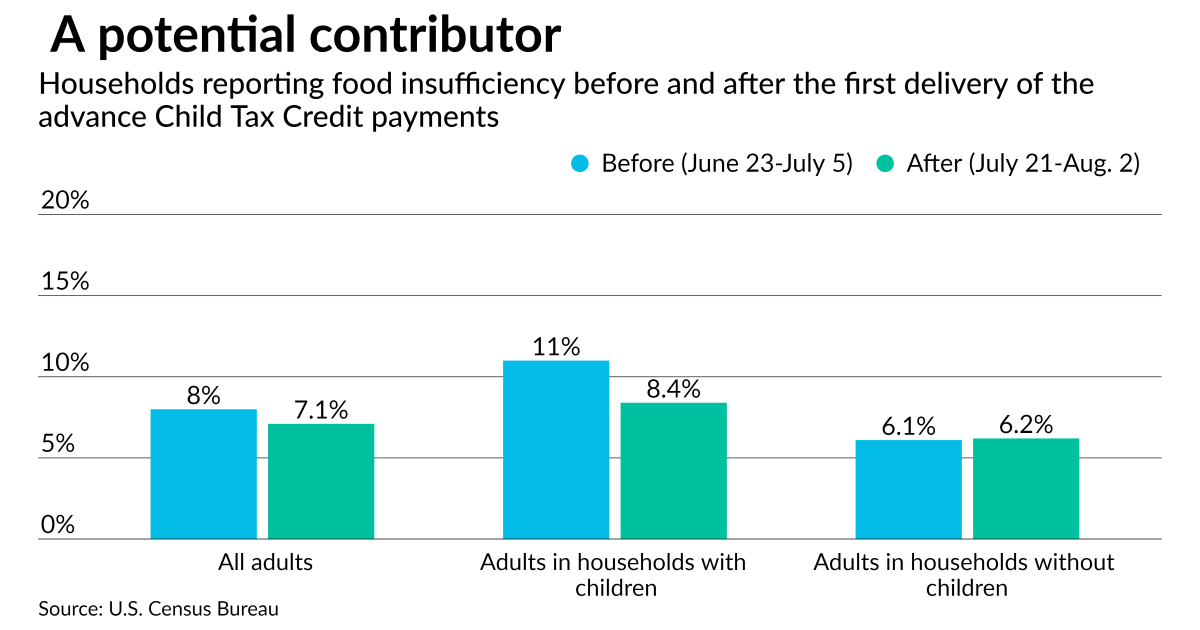

The Census Bureau reported Friday that in accordance with two Family Pulse Surveys that it carried out — one simply earlier than the primary tranches of advance funds went out on July 15, and one simply after — adults in households with youngsters reported a 2.6 proportion level drop in meals insufficiency, and a 2.5 proportion level drop in issue paying their bills.

Whereas the Census Bureau identified that the survey didn’t show that the advance funds had been accountable for the drops, it did notice that adults in households with out youngsters — who wouldn’t be eligible — reported slight will increase in meals insufficiency and issue in paying their bills.

Spherical 2 for the IRS

Additionally on Friday, the IRS began sending out the second tranche of funds to roughly 36 million taxpayers.

Most the roughly $15 billion in August funds will likely be delivered by direct deposit, however the service did notice {that a} small portion of those that acquired a direct deposit cost within the first spherical will obtain paper checks within the mail. The problem, which is anticipated to be resolved by the September spherical of funds, ought to impression lower than 15% of taxpayers.

Households can examine to see if the problem will have an effect on them on the Youngster Tax Credit score Replace Portal. Taxpayers who acquired their first cost by examine may use the portal to get future funds by direct deposit.

The funds, which had been established beneath the American Rescue Plan, will likely be despatched out month-to-month for the remainder of the yr, on September 15, October 15, November 15 and December 15.

The IRS additionally famous that eligible taxpayers who didn’t obtain a cost on July 15 will nonetheless obtain the complete quantity of the credit score, however it is going to be unfold over 5 months, as an alternative of six.

Low-income households can nonetheless signal as much as obtain the funds; they’ll examine to see in the event that they qualify through the use of the IRS’s advance Youngster Tax Credit score Eligibility Assistant.

These receiving funds may unenroll any time they like — as an example, in the event that they suppose they could now not qualify for the credit score once they file their 2021 return — utilizing the CTC Replace Portal. For married {couples}, every partner should unenroll individually.