The Inner Income Service introduced Wednesday that it’s going to begin sending out info letters to recipients of the advance Youngster Tax Credit score and of the third spherical of Financial Affect Funds that have been made in January.

Taxpayers will likely be required to reconcile any superior CTC obtained and the funds with their 2021 tax returns, that are presently anticipated to be due April 18, 2022.

Letter 6419 for superior CTC recipients will embrace the overall quantity of credit that the taxpayer obtained. The credit have been despatched out month-to-month beginning final June 15, and have been calculated primarily based on info from taxpayers’ earlier returns, so the taxpayer have obtained an excessive amount of – or too little.

In the event that they obtained an excessive amount of, they’ll must repay it; in the event that they obtained too little, or have been due the credit score however didn’t obtain it in any respect, they will declare the complete quantity on their 2021 tax return.

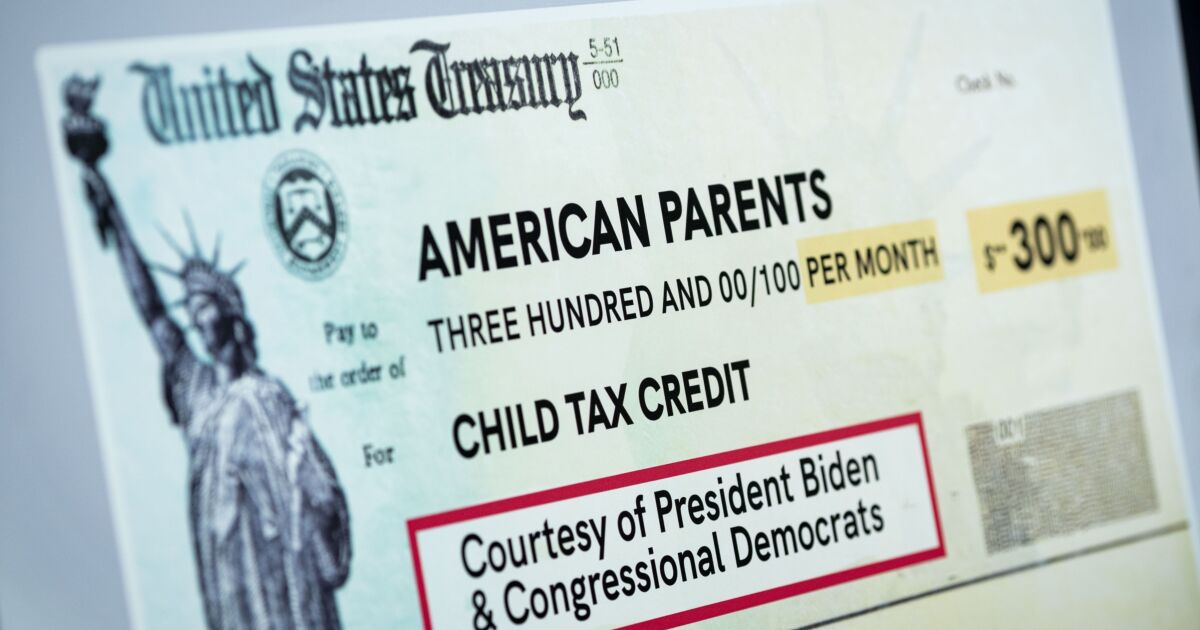

A poster of the Youngster Tax Credit score throughout a information convention on the U.S. Capitol on July 15, 2021.

Al Drago/Bloomberg

The superior CTC letters will begin going out this month, and proceed into January 2022.

In late January, the IRS will begin sending out Letter 6475, “Your Third Financial Affect Fee,” to EIP recipients. That third spherical, which was despatched out beginning in March of this yr, have been superior funds of the 2021 Restoration Rebate Credit score. Just like the superior CTC funds, they have been primarily based on info from earlier returns, and so will have to be reconciled with the taxpayer’s 2021 tax return.

Go to IRS.gov for extra details about the advance Youngster Tax Credit score and Financial Affect Funds.