Tax leaders are concentrating on recruiting and coaching new and present expertise this 12 months, whereas emphasizing private growth and well being and wellness with the intention to entice and retain good individuals, in keeping with a brand new survey.

The survey, launched Tuesday by Thomson Reuters Tax and Accounting, is predicated on a survey from final September that polled greater than 500 staff from tax corporations throughout the globe. It discovered an enormous shift in priorities in comparison with 2020, when tax professionals had been extra centered on progress and effectivity. Pre-pandemic, greater than a 3rd (34%) of corporations rated enhancing effectivity as their prime precedence. However that proportion dipped to 24% throughout the pandemic, declining additional to 21% by final September.

Buying prime expertise is a crucial space of funding for almost all of respondents. Generally, the necessity for tax professionals and administrative assist far outweighed the necessity for knowledge scientists, monetary analysts, and IT assist, with 64% indicating they intend to rent tax professionals within the coming 12 months, with a median headcount enhance of 6.6. In the meantime, greater than half (55%) of the greater than 30 corporations surveyed stated they count on so as to add a median of 1 or two individuals to their IT assist workers.

“At the beginning of 2021, tax professionals emerged from COVID-19 lockdowns in survival mode, nonetheless working to acclimate to distant work and the industry-wide shifts the pandemic left in its wake,” stated Thomson Reuters Tax and Accounting president Elizabeth Beastrom in an announcement. “Now, as one other 12 months involves a detailed, we’re seeing tax leaders redefining what’s vital to the continued progress of {industry}. Inserting an emphasis on hiring and supporting the correct expertise, streamlining processes and leveraging know-how to extend productiveness, and upping providers that present larger worth to the consumer, the tax {industry} is poised to see main progress and success on the backswing of the continuing pandemic.”

Many corporations plan to prioritize know-how expertise corresponding to enterprise useful resource planning and tax software program and knowledge evaluation, for brand new and incoming personnel, together with the flexibility to remain present with adjustments to Tax Code and communication expertise, above others. In corporations with over 30 staff, investing in new tax applied sciences is the popular path to larger effectivity. For leaders in bigger corporations, new analytics instruments and auditing applied sciences are on the prime of their technological want record, adopted by new practice-management instruments, accounting software program, and normal enhancements within the agency’s primary IT infrastructure and technical assist. Respondents cited the creation of tax-specific workflows, new tax know-how, and higher coaching as prime priorities as they head into the New Yr.

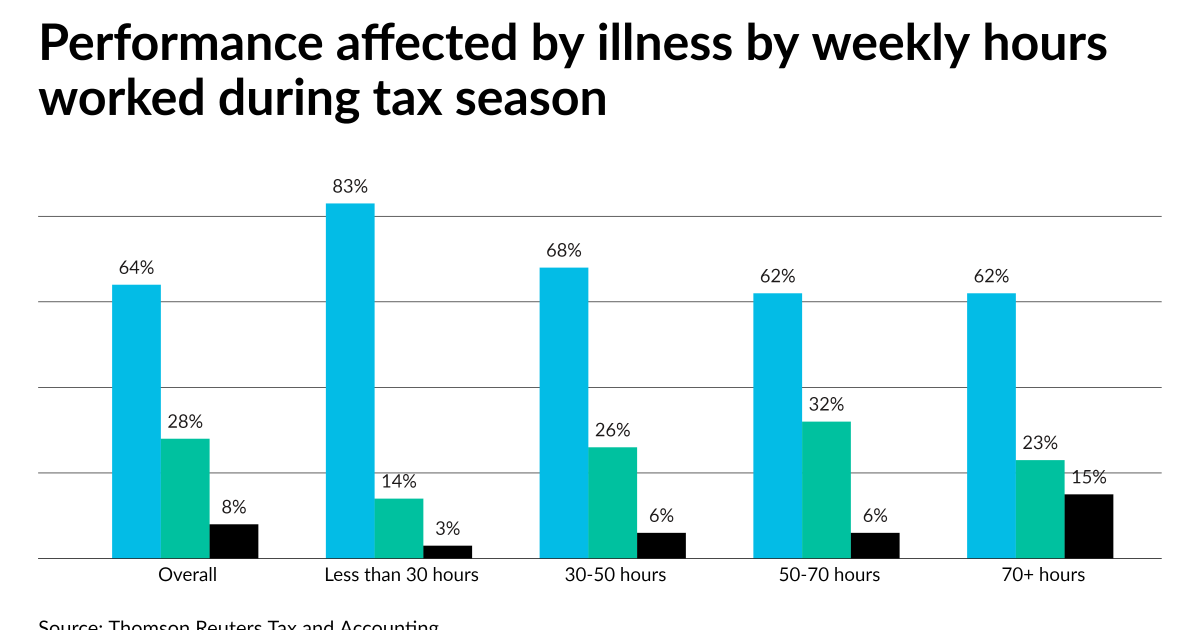

Companies and their staff have been scuffling with work-life stability throughout the pandemic. Throughout tax season, practically one-third (32%) of employees who logged 50 to 70 hours per week reported experiencing well being points at the least a few of the time. Tax leaders are taking a look at these industry-wide burdens on well being and wellbeing and exploring methods to alleviate the stress.

“Tax season per se isn’t essentially the offender behind in poor health well being, however as a result of individuals who stated they work 50 or extra hours the remainder of the 12 months reported virtually similar ranges of sickness,” stated the report. “Additional, those that work 30 to 50 hours per week and those that put in 50 to 70 hours skilled roughly the identical variety of well being points, with 6% saying that full-time hours virtually at all times had a detrimental impression on their well being, and roughly one-third saying it often affected them. Throughout tax season or not, the one cohort that reported comparatively few health-related efficiency points had been those that labored lower than 30 hours per week, with 83% of those part-timers saying they seldom or by no means have well being points that have an effect on their efficiency, and solely 3% reported a relentless or recurring well being subject associated to work.”

An amazing majority (95%) of the corporations surveyed indicated their purchasers wish to get extra tax planning, enterprise and monetary recommendation. A rising space of curiosity is environmental, social and governance reporting, and near half (46%) of respondents indicated their agency’s strategy to ESG was vital to them, with 20% saying it was “crucial.” Ladies and know-how innovators had been extra prone to place significance on their agency’s strategy to ESG, with their fundamental considerations being the agency’s potential to work with ESG purchasers, its efforts to scale back waste in areas corresponding to paper and power, and its group involvement and sustainability.