The 2022 submitting season kicked off with nobody predicting easy crusing. Practitioners, pundits and even the IRS itself foresee issues forward.

The beginning of the season on Jan. 24 was two weeks sooner than final yr’s Feb. 12 opening — however there are a selection of complicating elements, based on Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting.

The IRS begins the tax season with a a lot bigger than standard overhang from the 2021 submitting season, Luscombe noticed. “There’s a backlog on processing 2020 returns and there’ll probably be a backlog on 2021 returns,” he stated. “The message from the IRS is principally, ‘Don’t count on to get your refunds on time, and don’t attempt to name us.’” (See our story.)

“You might need higher luck with on-line providers however until you’re speaking to an individual, you’ll be able to’t actually get solutions to your questions,” he continued. “Practitioners had been complaining all via 2021 about unopened mail on the IRS, and the ensuing computer-generated notices.”

Barbara Weltman, a tax legal professional and creator of Small Enterprise Taxes 2022, agreed. “Do every thing you are able to do electronically, particularly for those who’re due a refund,” she suggested. “Maintain the human factor out. And don’t count on to get via to the IRS by phone.”

“We might not have the ultimate story on due dates,” Luscombe steered. “Final yr they prolonged [the] submitting season by a month, however it wasn’t introduced this early.”

High points for tax season

Luscombe famous quite a lot of adjustments within the tax panorama from final yr.

“Taxpayers will as soon as once more have to trace Financial Affect Funds within the calculation of the Restoration Rebate Credit score and distinguish funds in early 2021 from these within the third spherical later within the yr,” he stated. “It’s considerably much like final yr, however the brand new wrinkle is a bigger quantity utilized to non-child dependents, so there’s a higher potential that individuals didn’t get the complete RRC prematurely. Taxpayers may even be confused as a result of the second spherical of funds that got here out in 2021 was associated to 2020 returns, so taxpayers could report back to their preparers what they obtained for all of 2021. They need to have Letter 6475, which is able to make clear what they obtained within the third spherical. It is going to be a bit tougher than final yr due to the third spherical of funds.”

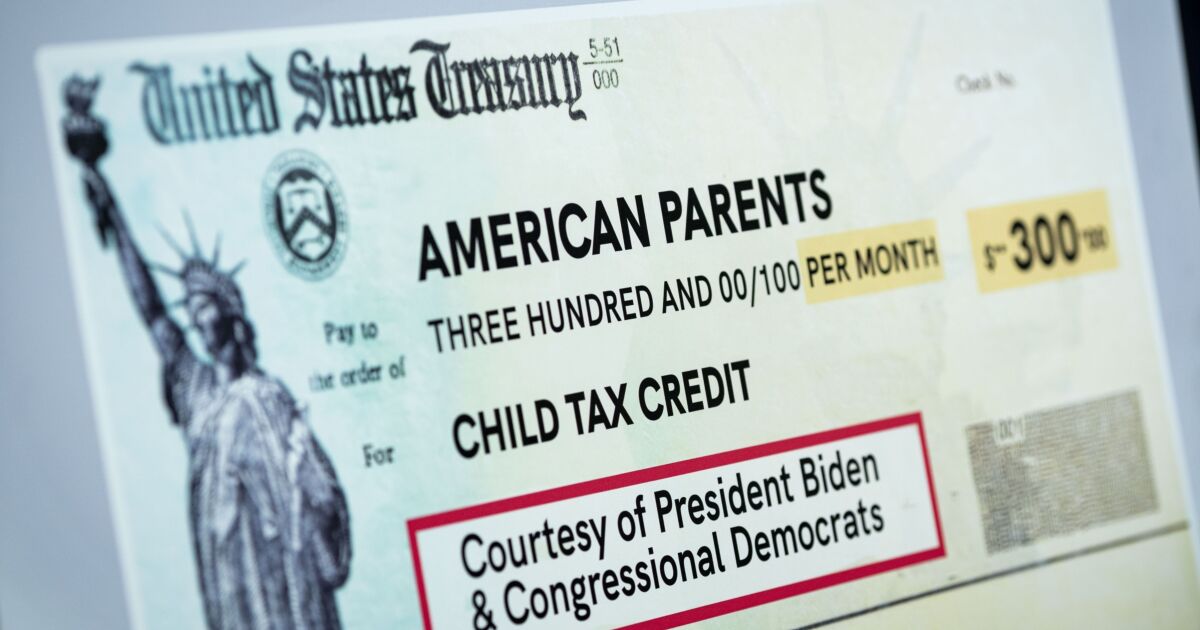

One other complicating issue on the 2021 tax return can be a bigger and totally refundable Youngster Tax Credit score and the necessity to observe and account for advance funds in 2021, based on Luscombe: “This can be a completely new state of affairs. The IRS will shortly be popping out with Letter 6419, which is able to assist make clear the state of affairs. The CTC raises a few extra points due to the advance funds that might really trigger individuals to be beneath withheld. Not like the EIP, in the event that they get an excessive amount of they need to repay it. It will doubtlessly end in the next tax than they count on, and should end in being answerable for the underpayment of estimated tax penalty.”

A poster of the Youngster Tax Credit score throughout a information convention on the U.S. Capitol on July 15, 2021.

Al Drago/Bloomberg

Extra taxpayers can be eligible for the improved Earned Revenue Tax Credit score. “Many of the beneficiaries of the enhancements can be childless low-income people,” stated Luscombe. “There’s an expanded age restrict for eligible people, they usually additionally elevated the revenue degree and quantity that childless people can obtain, so there could possibly be much more individuals eligible for this.”

Dad and mom can now declare the childless EITC if they’ve kids with out a Taxpayer Identification Quantity, which is a change from final yr, he defined. Additionally, a taxpayer who’s separated and is submitting as married submitting individually can declare the EITC as being single with a view to declare qualifying kids.

Extra middle-income taxpayers can be eligible for the improved and totally refundable Youngster and Dependent Care Credit score on 2021 returns, though some higher-income taxpayers might now not be eligible. “The phaseout vary and the share vary had been elevated, so much more taxpayers had been eligible on the middle-income degree,” he stated. “One other complication is that the credit score is now totally refundable, in order that extra lower-income taxpayers that didn’t have sufficient revenue to be eligible can now qualify. One caveat for all individuals to qualify is the necessity for documentation of daycare suppliers with their TINs. this is likely to be a hurdle to place collectively after the actual fact — it’s a approach for the IRS to trace if daycare suppliers are reporting the funds as revenue.”

Extra individuals can be eligible for the improved Premium Tax Credit score for medical health insurance obtained beneath the Inexpensive Care Act, Luscombe noticed.”The premium is extra beneficiant and extra obtainable to extra individuals,” he stated.

Enhanced charitable contribution deductions are once more obtainable on 2021 returns for nonitemizers, with some modifications. In 2020 it was $300 most for all non-itemizers whether or not they had been married or not, Luscombe stated, whereas for 2021, the utmost is $600 for married submitting collectively.

The enterprise meals deduction will improve from 50% to 100% for meals and drinks supplied by a restaurant. “It needs to be supplied by a restaurant,” he emphasised. “It may possibly’t be a deli tray bought at a grocery store. Supply or takeout additionally qualifies for 2021 and 2022 returns. That was not obtainable for 2020.”

Companies should take care of modifications to the assorted COVID-related payroll tax credit and tax deferrals, Luscombe indicated. “Companies that closed down as a result of they weren’t making any revenue might have taxable revenue ensuing from payroll tax advantages,” he cautioned. “And the Worker Retention Credit score was prolonged in phases, in the end to Dec. 31, 2021. Then it was terminated 1 / 4 earlier, after the actual fact in mid-November. Quite a lot of employers diminished their payroll taxes for the primary half of the fourth quarter. In the event that they did, they need to repay by Dec. 31, 2021.”

‘One other depressing tax season’

Whereas not an enormous fan of the proposed Construct Again Higher laws, Ryan Losi, govt vice chairman of Piascik, was optimistic about its inclusion of funding for the IRS. “I believed it will affect the economic system negatively, however I believed a minimum of the IRS would get the funding that was wanted,” he stated.

Nonetheless, the Nationwide Taxpayers Union Basis factors out that a lot of the funding for the IRS in Construct Again Higher is for enforcement, not taxpayer service.

Losi anticipates “one other depressing tax season. It seems that the main target can be merely on digital submitting. They received’t have the ability to allocate assets to manning the telephones or practitioner helplines, or responding to correspondence or processing powers of legal professional. We’ll proceed to get incorrect notices and levies. I’d like to see a moratorium positioned on any notices till the backlog is cleared up.”

Actually, 11 tax skilled teams have beneficial quite a lot of steps for the IRS to take with a view to scale back the necessity for taxpayers and tax professionals to speak with the IRS as a consequence of “persistent and misguided notices.” Amongst different issues, the steps embrace discontinuing automated compliance actions till the service is ready to dedicate the required assets for a correct and well timed decision of the matter, and offering taxpayers with focused aid from each the underpayment of estimated tax penalty and the late cost penalty for the 2020 and 2021 tax years. (See our story.)

As we go to press, the IRS is scheduling a gathering with the teams to contemplate these steps.

“The largest new problem this season would be the reconciliation of advance cost of the Youngster Tax Credit score,” stated Roger Harris, president of Padgett Enterprise Companies, one of many stakeholder teams set to fulfill with the IRS. “It’s one thing new, and proper now it’s only a one-year problem. However it’s a complicating issue that needs to be handled. It provides extra complexity than final yr as a result of practitioners by no means needed to take care of it earlier than. It can most likely create issues for the IRS when returns are filed and the numbers don’t match their data.”

“It is going to be a nasty submitting season,” predicted Phil Gross, a member at Kleinberg Kaplan. The largest complexities, he believes, are new schedules Ok-2 and Ok-3, the passthrough entity SALT cap workarounds within the 25 states which have them, the surplus enterprise loss rule, and the Code Part 475(f) mark-to-market election, which permits merchants to elect to deal with losses from inventory gross sales as unusual losses relatively than capital losses.

Gross shouldn’t be a fan of extending the submitting season: “We’d not essentially profit from an prolonged season. It might complicate issues each for preparers and taxpayers.”

Harris agreed. “It’s time to get again to predictable deadlines,” he stated. “There are methods to get extensions with out altering the due date for everyone else. Hopefully we’re attending to the purpose the place we are able to put some certainty again into tax season.”