A high Home Democrat instructed Thursday that his get together reduce eligibility for little one tax credit as a approach to unlock President Joe Biden’s stalled financial agenda.

Consultant Jim Clyburn of South Carolina, talking in a video interview with the Washington Publish, mentioned he would help a decrease earnings cap in a revived type of the kid tax credit score to get West Virginia Senator Joe Manchin to vote for Biden’s Construct Again Higher agenda.

“I wish to see him come ahead with a invoice for the kid tax credit score that’s means-tested. I believe it could cross. He’d get it by way of the Senate. I believe we might get it by way of the Home,” Clyburn mentioned. “So, there’s so much in Construct Again Higher that he says he’s for — so, let’s try this.”

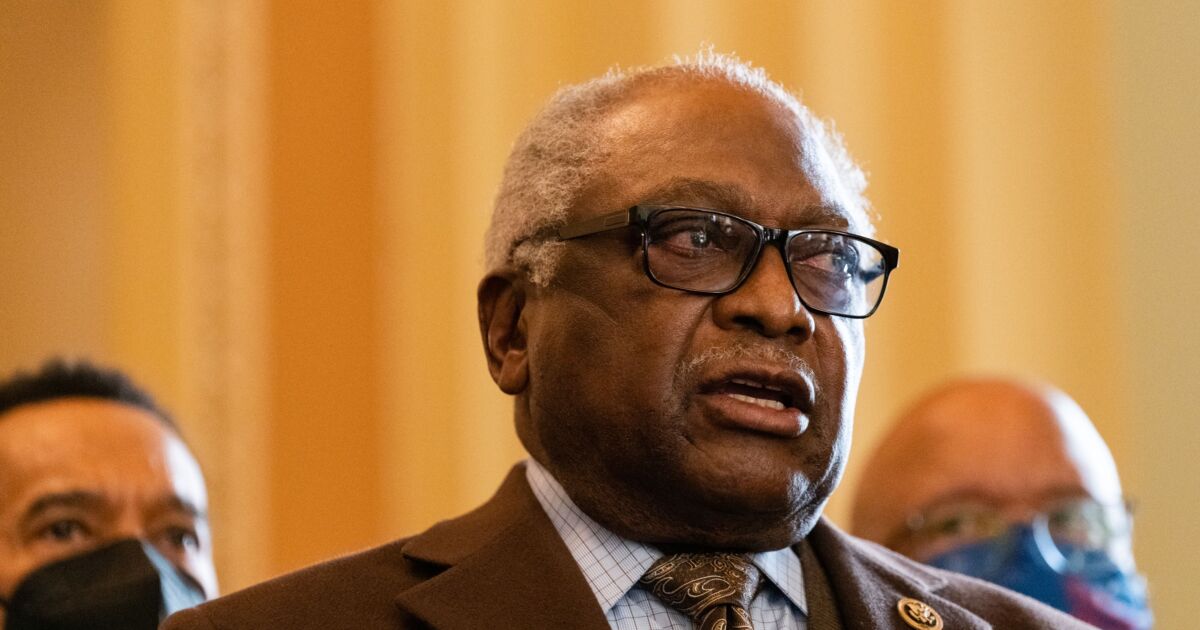

Consultant Jim Clyburn, a Democrat from South Carolina, speaks beside members of the Congressional Black Caucus on the Senate aspect of the U.S. Capitol in Washington, D.C.

Eric Lee/Bloomberg

Manchin, in a radio interview Thursday, instructed the kid tax credit score needs to be “focused” to people making lower than $75,000 per yr and that he’s prepared to debate revisions to that could possibly be made to maintain it within the laws.

“There’s quite a lot of conversations occurring now. They’ve been reaching out and all the things. We haven’t sat down, bodily, and began any negotiations,” Manchin mentioned on West Virginia MetroNews’s “Talkline” on Thursday.

However Manchin additionally reiterated issues about inflation, which he has mentioned could be exacerbated by extra federal spending.

“You ought to be scared to loss of life about inflation and what it may possibly do,” Manchin mentioned.

Clyburn mentioned Manchin has spoken in favor of accelerating health-care protection for lower-income people by way of the growth of Medicaid. Clyburn argued that making well being care and little one care extra inexpensive would improve the variety of working adults.

“I believe the president says, let’s cross this chunk, and that chunk, and perhaps we’ll get some elements accomplished,” Clyburn mentioned.

The Home in November handed a $2 trillion tax, local weather and social spending invoice, however it stalled within the Senate in December after Manchin mentioned he opposed it. Manchin’s vote is required within the 50-50 chamber to cross any invoice below the funds course of.

Senators anticipate casual conversations on Construct Again Higher to select up when the Senate returns to Washington subsequent week, based on an individual accustomed to the state of affairs.

Democrats nonetheless don’t know what Manchin will finally conform to and whether or not he must see decrease month-to-month inflation numbers earlier than ending his pause within the talks, the particular person mentioned. Manchin has mentioned he’s open to negotiating once more with the White Home on the stalled plan.

Manchin instructed scaling again the tax profit for {couples} incomes between $200,000 and $400,000 and he mentioned he didn’t imagine that oldsters who didn’t earn any earnings ought to be capable to get the credit score. Democrats final yr allowed these with out earnings tax legal responsibility to say the credit score within the type of month-to-month superior funds.

Final yr Democrats expanded the credit score for households making as much as about $150,000 a yr, rising the kid subsidy to as a lot as $3,600 per little one, up from $2,000. The credit score phases out for folks making above that earnings threshold.

Scaling again the kid tax credit score based mostly on earnings is more likely to battle with Biden’s pledge to not increase taxes on anybody incomes lower than $400,000.

Biden at a information convention this month instructed that the kid tax credit score might should be dropped from the plan for it to cross the Senate. That prompted key Democratic senators, led by Colorado’s Michael Bennet, to demand the credit score be retained as a centerpiece of the invoice.

— With help from Laura Davison