The Tax Practitioners Board (TPB) lately introduced that each one Tax and BAS brokers in Australia must undertake proof of identification verifications for brand spanking new shoppers, to cut back the danger of tax and identification fraud. A robust verification course of — additionally known as a 100-point examine — provides you confidence that your shoppers have the authority to behave on the enterprise’ behalf.

Proper now, it’s a suggestion. However within the later half of 2022, endeavor and recording consumer verifications will grow to be necessary. That is the following step in direction of stronger due diligence throughout the business — pushed by new Anti-Cash Laundering laws, in addition to tighter business requirements by different skilled our bodies, like CPA Australia and Chartered Accountants Australia & New Zealand.

It might additionally type the muse for different modifications sooner or later. For instance, it’s possible you’ll not be capable of lodge a tax return or name the ATO should you haven’t verified the identification of your consumer. That’s why we’ve made some modifications in Xero, to make recording your verifications as simple as attainable.

What identification paperwork do it’s essential to sight?

You’ll must undertake a proof of identification examine earlier than offering Tax or BAS agent companies to new shoppers. The kinds of shoppers you need to confirm and the paperwork you should utilize to confirm their identification is dependent upon various elements — the TPB has a record of verification necessities and a truth sheet for shoppers which may be useful.

It’s necessary to notice that you just must witness the paperwork. There isn’t a must retailer a duplicate, and in reality we advocate in opposition to it. You possibly can sight them in particular person, or do it remotely — reminiscent of becoming a member of a Zoom name to match the face of your consumer to their identification paperwork. The excellent news is that anybody in your apply can undertake the verification course of.

The data should be stored for at the very least 5 years after the engagement together with your consumer and/or their consultant ceases.

file your consumer verifications in Xero

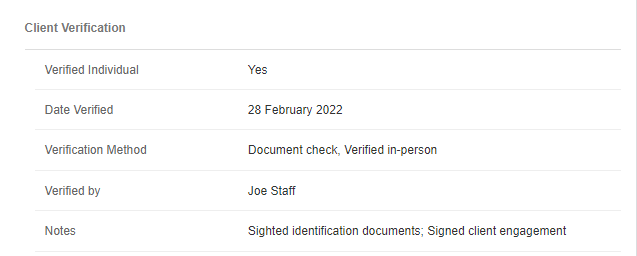

We’ve added new fields into the ‘Tax and Firm’ part of the consumer file in Xero Follow Supervisor (XPM) and Xero Tax, so you may file the identification verification course of. By making a report within the report builder and choosing the consumer verification fields, you may rapidly see which shoppers are but to be verified, or which current shoppers you would possibly prefer to formally confirm.

The brand new fields embrace:

- A ‘verified particular person’ checkbox to verify whether or not the person (or a person appearing on behalf of an entity) has been verified

- The date that the person was verified by your apply

- How the person was verified (a number of choices may be chosen)

- The title of the employees member that verified the person

- A notes part the place you may add another info it’s essential to file as a part of the verification course of, reminiscent of whether or not the verification was accomplished in particular person or remotely

Recording the Director ID of your consumer

From November 2021, new firm administrators in Australia want to use for a director identification quantity with Australian Enterprise Registry Companies. Present firm administrators have till November 2022 to use for his or her Director ID. It’s a part of the broader anti-phoenix initiative carried out by the Australian Federal Authorities, designed to stop the usage of false director identities and make it simpler for regulators to hint administrators’ relationships with firms over time.

You possibly can file the Director ID of your consumer utilizing the sphere within the ‘Tax and Firm’ part of the consumer file in XPM and Xero Tax. You can even import this info whenever you import your consumer record.

Don’t neglect, should you fail to undertake a proof of identification examine on your shoppers after it turns into necessary, it’s possible you’ll be in breach of the TPB code and have sanctions imposed on you. So it’s value taking the time to assessment your consumer record, finishing the verification checks, and recording them in XPM or Xero Tax on your peace of thoughts.