Even when the accident isn’t your fault, you’re in hassle should you don’t have insurance coverage. “You should still be topic to fines beneath the CAIA,” says Mitchell. “You additionally would haven’t any proper to recuperate to your damages or accidents since The Insurance coverage Act prevents uninsured drivers from recovering funds even when they aren’t at fault for the accident.”

In case you are concerned in a hit-and-run accident and also you’re not capable of get the insurance coverage information from the opposite driver as a result of they fled, at first, name the police. “You’re legally obligated to remain on the scene of an accident,” says Karageorgos. “If somebody doesn’t cease, that’s a pink flag—they could be beneath the affect or uninsured.”

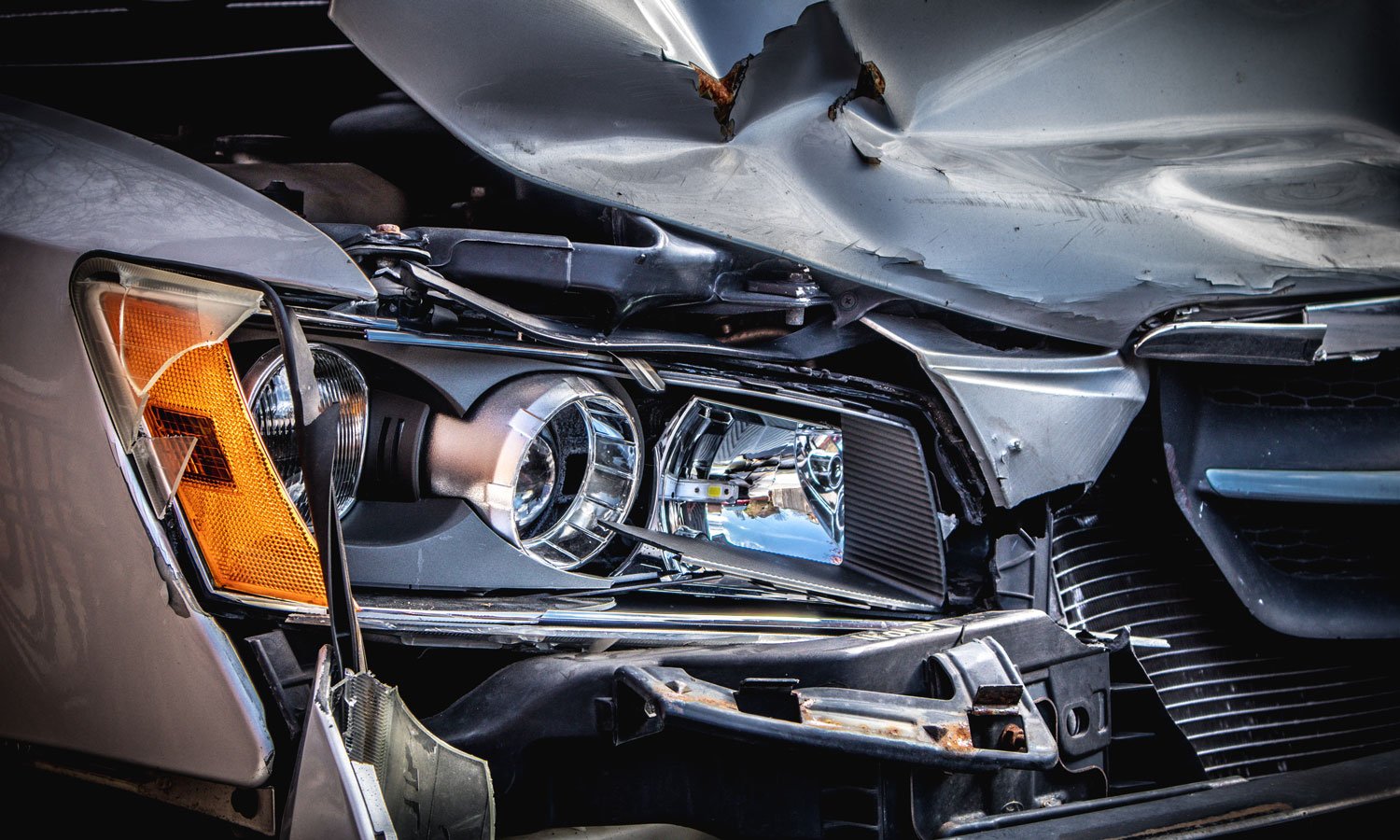

He additionally recommends recording as many particulars as you possibly can and taking photographs and movies. “Being in a collision is a nerve-racking and traumatic occasion, so that you wish to have these particulars out there when the police or your insurance coverage firm wants them.”

Make a report of the whole lot that occurred so that you don’t overlook, together with notes on the situation and which method the automobiles have been travelling. Observe the main points concerning the automobile itself, just like the make, color and mannequin, any identifiers (like a bumper sticker or damaged tail mild) and if there have been any passengers.

What if somebody refuses to offer their insurance coverage information?

If somebody doesn’t wish to present their insurance coverage info, contact the police. In an car accident, drivers are obligated by legislation to trade insurance coverage info. Within the meantime, safely receive no matter info you possibly can, comparable to a licence plate, and an outline of the automobile and the motive force. Typically a plate quantity and automobile description can be utilized to find the insurance coverage related to the plate. All of that is after the actual fact, we all know. Once more, attempt to bear in mind as many particulars as doable so you possibly can to go them alongside to the police.

Evaluate personalised quotes from Canada’s prime automotive insurance coverage suppliers.All in beneath 5 minutes with ratehub.ca. Let’s get began.*You may be leaving MoneySense. Simply shut the tab to return.

Making a declare with uninsured auto insurance coverage

Name your dealer or insurer as quickly as doable, earlier than fixing your automotive or incurring massive bills. In fact, it’s OK to do what within reason essential to get your self secure or to comply with a physician’s orders. Keep in mind, your insurance coverage firm has the fitting to guage all parts of the declare earlier than issuing a fee to you. The earlier you make your insurer conscious, the earlier you possibly can anticipate to obtain your advantages.

Know that an uninsured auto declare will take time and require documentation. As famous above, write the whole lot down, take photographs and accumulate witnesses’ contact info too, should you can.

Anticipate your insurance coverage protection to have limits. Uninsured auto limits are fairly low. If you wish to be sure that all potential prices of an accident are coated, you should purchase larger limits on different forms of protection, comparable to collision and complete (earlier than a declare occurs, after all). This reduces the probabilities that your precise loss will exceed the usual advantages.