The Inside Income Service’s Legal Investigation division launched statistics Thursday on its COVID-related fraud probes and stated it has carried out greater than 660 investigations over the previous two years, uncovering a complete of $1.eight billion in alleged fraud.

The instances encompassed a variety of felony exercise, together with fraudulently obtained loans, credit and funds. IRS Legal Investigation and the Justice Division achieved a 100% conviction fee for prosecuted instances, with jail sentences averaging 42 months. Instances included a California household whose members had been sentenced for as much as 17 and a half months in jail for fraudulently acquiring tens of thousands and thousands of {dollars} in COVID reduction funds and spending it on luxurious properties, gold cash, jewellery designer purses and different objects, and a pair of Florida residents who had been sentenced for as much as 44 months in jail for wire fraud for fraudulently securing Paycheck Safety Program loans.

The statistics come roughly two years after the CARES Act was signed into legislation and ushered within the Paycheck Safety Program, a number of rounds of Financial Affect Funds and different types of tax reduction in response to the pandemic. Nevertheless, lots of the applications had been rolled out unexpectedly and attracted fraudsters who bilked the federal government out of billions of {dollars} and solely hardly ever bought caught.

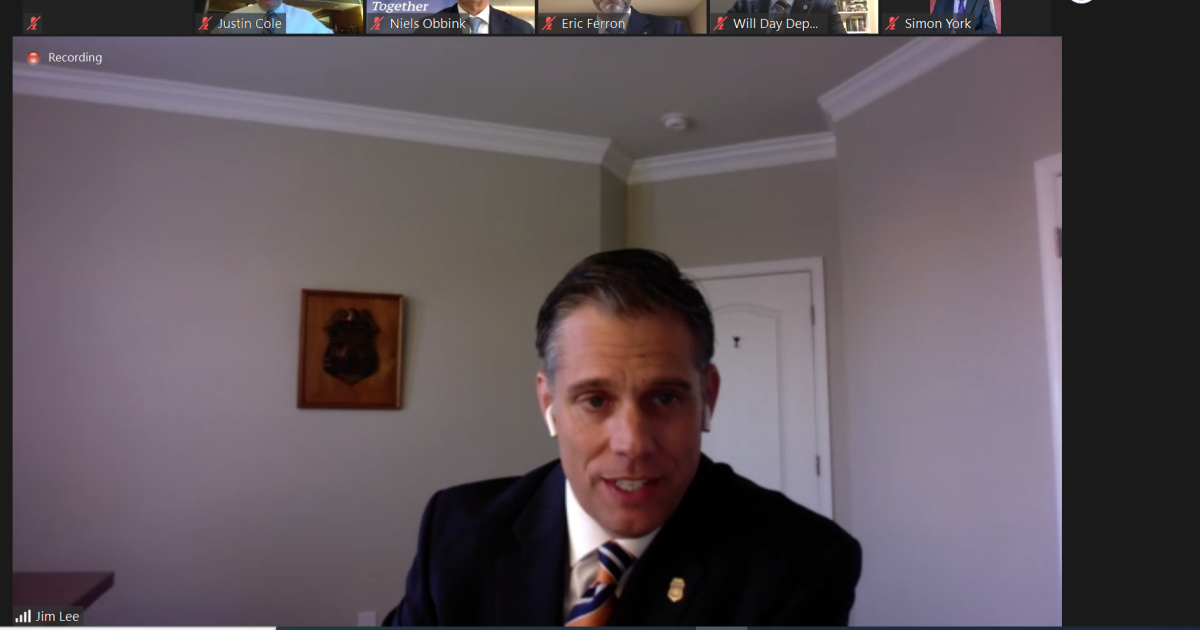

IRS Legal Investigation chief Jim Lee throughout a web-based press convention of the Joint Chiefs of World Tax Enforcement, or J5.

“The Coronavirus Support, Reduction, and Financial Safety (CARES) Act was signed into legislation almost two years in the past as a security internet for Individuals in gentle of an unprecedented well being disaster,” stated IRS-CI Chief Jim Lee in a press release. “Sadly, even throughout instances of disaster, criminals pop their heads out to search for methods to reap the benefits of these of their most weak state. Due to the investigative work of IRS-CI particular brokers and our legislation enforcement companions, we’ve ensured criminals who attempt to defraud CARES Act applications face penalties for his or her actions.”