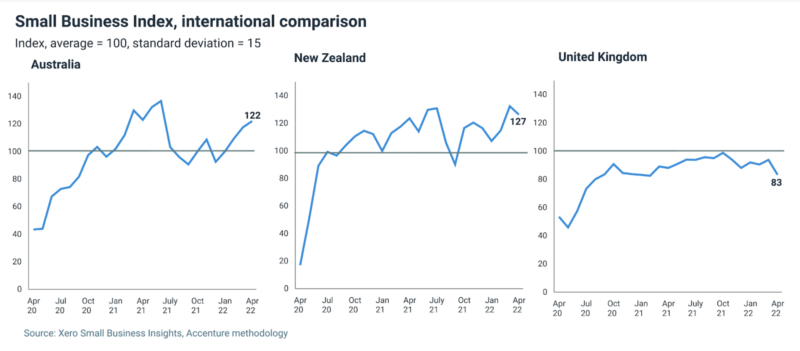

Xero Small Enterprise Insights (XSBI) knowledge for April 2022 exhibits indicators of rising dangers to small companies within the UK, Australia and New Zealand. The rising price of dwelling pressures, inflation, ongoing provide chain points and tight labour markets are a number of the key elements contributing to small enterprise efficiency.

The Xero Small Enterprise Index is a novel indicator that makes use of well timed knowledge to indicate how small companies are performing general every month. The Index relies on 4 key measures of jobs, gross sales, time to be paid and wages, and exhibits efficiency adjustments within the brief and long run.

Value of dwelling pressures hit small enterprise gross sales, wages proceed to rise

In latest months we’ve seen small companies within the UK, Australia and New Zealand exhibit sturdy gross sales development, nevertheless in March and April gross sales development slowed throughout all three international locations. Gross sales rose 6.3% year-on-year (y/y) within the UK after 13 months of double-digit development, 5.8% y/y in Australia and solely 2.9% y/y in New Zealand. This slowdown in gross sales is probably going an early signal of the affect of the rising price of dwelling affecting customers’ capability to spend.

One other pattern we’re seeing within the small enterprise sector is rising wages. Wages rose 4.5% y/y within the UK in April, 4.1% y/y in Australia and 4.8% y/y in New Zealand. The impacts of inflation imply actual wages are falling, which is decreasing the buying energy of customers. Primarily, inflation is hitting small companies twice. Not solely are they coping with rising prices, however their potential prospects are tightening their purse strings. This weblog submit from Xero Economist, Louise Southall, explains the affect of inflation on small companies in additional element.

Late funds including to difficult circumstances within the UK

Within the UK, the Xero Small Enterprise Index in April was 83, its lowest level since February 2021 and essentially the most drastic month-to-month fall since April 2020. British small companies proceed to face challenges, now with the slowdown in client spending and having to attend longer to receives a commission. The time it took for small companies to be paid on common elevated to 29.9 days in April. Equally, they skilled the longest late fee time since September 2020, at a mean of seven.7 days late.

What small companies can do to handle the present challenges

With so many elements placing stress on small companies proper now – from elevated prices, provide chain points, to having to extend wages, and experiencing slower gross sales, listed below are some suggestions for small companies to assist them cope:

- Know what your prices are doing: Getting knowledge into Xero is step one to having visibility over the prices flowing out and in of your corporation. There are a lot of methods to do that, from recording your transactions with financial institution reconciliation, to including payments and receipts utilizing Hubdoc. You may then benefit from instruments like reporting and Xero Analytics, to see the place you stand and higher handle your money stream.

- Think about if a worth enhance is correct for your corporation: On this setting of rising prices, one of many few methods you may keep your revenue margins is to extend costs. With inflation rising so rapidly, potential prospects are going through their very own rising price of dwelling pressures, so remember to get recommendation out of your accountant or bookkeeper on whether or not it’s essential enhance your personal costs and by how a lot.

- Deal with non-cost associated features of your corporation: Take into consideration how one can present glorious service that can hold prospects coming again. Personalising your service is a method to do that, for instance by extra focused communications utilizing the knowledge you may have about your prospects. One other method is to start out a loyalty program that provides recurring prospects rewards like reductions or bonus companies or merchandise.

- Get inventive with worker advantages to retain employees: Rising wages just isn’t the one factor you are able to do to maintain employees. Take into consideration what else you may supply workers. Think about how one can make your office one the place workers really feel comfy, empowered and motivated to do nice work. Create a tradition of recognition and celebration, and create alternatives on your staff to attach and get to know one another higher. Growing an open, collaborative and pleasant tradition may also help scale back stress, enhance happiness and enhance productiveness.

With so many elements influencing working circumstances for small companies, it’s critical that you just keep throughout your funds and work intently together with your trusted advisors to make the precise choices that can permit the enterprise to remain worthwhile.

Learn extra concerning the XSBI metrics for April in these updates:

Or go to the XSBI homepage.