Pgiam/iStock by way of Getty Photographs

Funding Thesis

You simply learn it within the bullets above, in case your superior age places you there. If not, it’s NEVER too quickly to consider it, as a result of in the end you’ll have concern and the escaped time can by no means be recovered.

So here’s a today-practical first-step instance of what CAN be finished: Swap a Taiwan Semiconductor (TSM) inventory holding right into a Energy Integrations, Inc. (POWI) semiconductor inventory holding.

Purpose: That’s what main investing “Establishments” are doing and the Market-Making neighborhood of block-trade “facilitator” MM companies and mandatory Wall-street professional hedging companies, by their very own self-protective actions inform how they assume your different selections look.

First, what are TSM and POWI? Then, what are the market execs betting that these shares’ costs are prone to do in time durations that may moderately be forecast?

Descriptions of the Funding Options

“Taiwan Semiconductor Manufacturing Firm Restricted manufactures, packages, checks, and sells built-in circuits and different semiconductor gadgets in Taiwan, China, Europe, the Center East, Africa, Japan, the US, and internationally. It supplies complementary metallic oxide silicon wafer fabrication processes to fabricate logic, mixed-signal, radio frequency, and embedded reminiscence semiconductors. The corporate additionally provides buyer help, account administration, and engineering providers, in addition to manufactures masks. Its merchandise are utilized in cell gadgets, excessive efficiency computing, automotive electronics, and web of issues markets. The corporate was integrated in 1987 and is headquartered in Hsinchu Metropolis, Taiwan.”

Supply: Yahoo Finance

Yahoo Finance

“Energy Integrations, Inc. designs, develops, manufactures, and markets analog and mixed-signal built-in circuits (ICs), and different digital elements and circuitry utilized in high-voltage energy conversion worldwide. The corporate supplies a spread of alternating present to direct present energy conversion merchandise that handle energy provide starting from lower than one watt of output to roughly 500 watts of output. The corporate sells its merchandise to authentic tools producers and service provider energy provide producers by means of direct gross sales power, in addition to a community of impartial gross sales representatives and distributors. Energy Integrations, Inc. was integrated in 1988 and is headquartered in San Jose, California.”

Supply: Yahoo Finance

Yahoo Finance

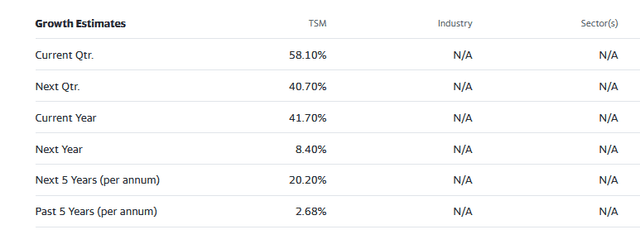

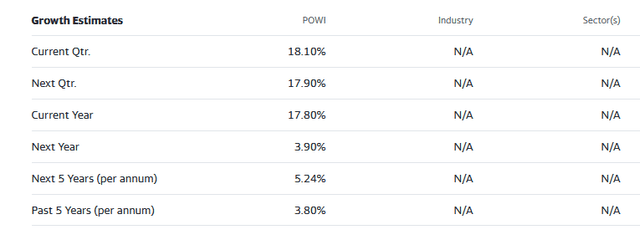

These progress estimates have been made by and are collected from Wall Road analysts to counsel what typical methodology at present produces. The everyday variations throughout forecast horizons of various time durations illustrate the problem of creating worth comparisons when the forecast horizon will not be clearly outlined.

Threat and Reward Balances Amongst Semiconductor Suppliers

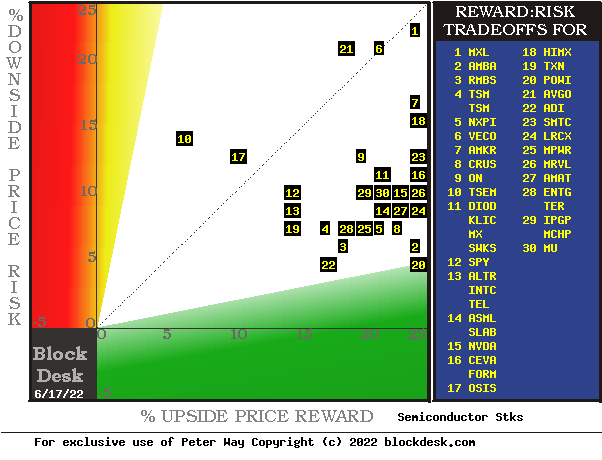

Let’s take into account choices from at an “Alternative Set” of comparable corporations ranging throughout areas of Semiconductors. Among the many many lively contributors are two through which now we have an curiosity, TSM and POWI.

Right here in Determine 1 is how the markets at present appraise their Reward ~ Threat trade-offs amongst opponents, based mostly on behavioral evaluation (of what investing techniques require to be finished, not of emotional investor errors) of actions by Market-Makers [MMs] as they defend their at-risk capital from potential damaging future market-price strikes..

Determine 1

blockdesk.com

(used with permission)

The danger dimension is of precise worth drawdowns at their most excessive level whereas being held in earlier pursuit of upside rewards much like those at present being seen. They’re measured on the purple vertical scale.

Each scales are of % change from zero to 25%. Any inventory or ETF whose current danger publicity exceeds its reward prospect might be above the dotted diagonal line. Capital-gain engaging to-buy points are within the instructions down and to the proper.

Our principal curiosity is in TSM at location [4], halfway between places [19 and 22]. Down within the inexperienced space of forecast outcomes the place 5 occasions as a lot achieve as loss lives is POWI at [20]. A “market index” norm of reward~danger tradeoffs is obtainable by SPY at [12]. Most interesting by this Determine 1 view is POWI.

Evaluating aggressive options of Semiconductor Shares

The Determine 1 map supplies a great visible comparability of the 2 most essential features of each fairness funding within the quick time period. There are different features of comparability which this map generally doesn’t talk nicely, significantly when basic market views like these of SPY are concerned. The place questions of “how doubtless’ are current different comparative tables, like Determine 2, could also be helpful.

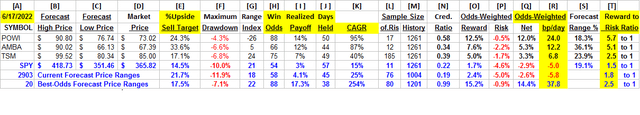

Yellow highlighting of the desk’s cells emphasize components essential to securities valuations and the safety POWI of most promising of close to capital achieve as ranked in column [R].

Determine 2

blockdesk.com

(used with permission)

Why do all this math?

Determine 2’s goal is to aim universally comparable solutions, inventory by inventory, of a) How BIG the potential worth achieve payoff could also be, b) how LIKELY the payoff might be a worthwhile expertise, c) how SOON it could occur, and d) what worth drawdown RISK could also be encountered throughout its holding interval.

Readers acquainted with our evaluation strategies after fast examination of Determine 2 might want to skip to the subsequent part viewing worth vary forecast developments for TSM and POWI.

Column headers for Determine 2 outline investment-choice desire parts for every row inventory whose image seems on the left in column [A]. The weather are derived or calculated individually for every inventory, based mostly on the specifics of its scenario and current-day MM price-range forecasts. Knowledge in purple numerals are destructive, normally undesirable to “lengthy” holding positions. Desk cells with yellow fills are of information for the shares of principal curiosity and of all points on the rating column, [R].

The worth-range forecast limits of columns [B] and [C] get outlined by MM hedging actions to guard agency capital required to be put prone to worth adjustments from quantity commerce orders positioned by big-$ “institutional” shoppers.

[E] measures potential upside dangers for MM quick positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the current present a historical past of related worth draw-down dangers for patrons. Probably the most extreme ones really encountered are in [F], throughout holding durations in effort to succeed in [E] features. These are the place patrons are emotionally almost certainly to just accept losses.

The Vary Index [G] tells the place right now’s worth lies relative to the MM neighborhood’s forecast of higher and decrease limits of coming costs. Its numeric is the share proportion of the complete low to excessive forecast seen under the present market worth.

[H] tells what quantity of the [L] pattern of prior like-balance forecasts have earned features by both having worth attain its [B] goal or be above its [D] entry price on the finish of a 3-month max-patience holding interval restrict. [ I ] provides the online gains-losses of these [L] experiences.

What makes POWI most tasty within the group at this time limit is its potential to supply earnings most constantly at its current working steadiness between share worth danger and reward, the Vary Index [G]. Credibility of the [E] upside prospect as evidenced within the [I] payoff is proven in [N]. For POWI it’s .56

Additional Reward~Threat tradeoffs contain utilizing the [H] odds for features with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return rating [Q]. The everyday place holding interval [J] on [Q] supplies a determine of advantage [fom] rating measure [R] helpful in portfolio place preferencing. Determine 2 is row-ranked on [R] amongst different candidate securities, with POWI in prime rank.

Together with the candidate-specific shares these choice issues are supplied for the averages of some 2900 shares for which MM price-range forecasts can be found right now, and 20 of the best-ranked (by fom) of these forecasts, in addition to the forecast for S&P 500 Index ETF (SPY) as an equity-market proxy.

Present-market index SPY will not be aggressive as an funding different. With its Vary Index of 24 the indication is 3/4ths of its forecast vary is to the upside, however little greater than half of earlier SPY forecasts at this vary index produced worthwhile outcomes, with sufficient losers to place its common in destructive outcome.

As proven in column [T] of determine 2, these ranges range considerably between shares. What issues is the online achieve between funding features and losses really achieved following the forecasts, proven in column [I]. The Win Odds of [H] tells what quantity of the Pattern RIs of every inventory have been worthwhile. Odds under 80% typically have confirmed to lack reliability.

Latest Forecast Traits of Main Topics

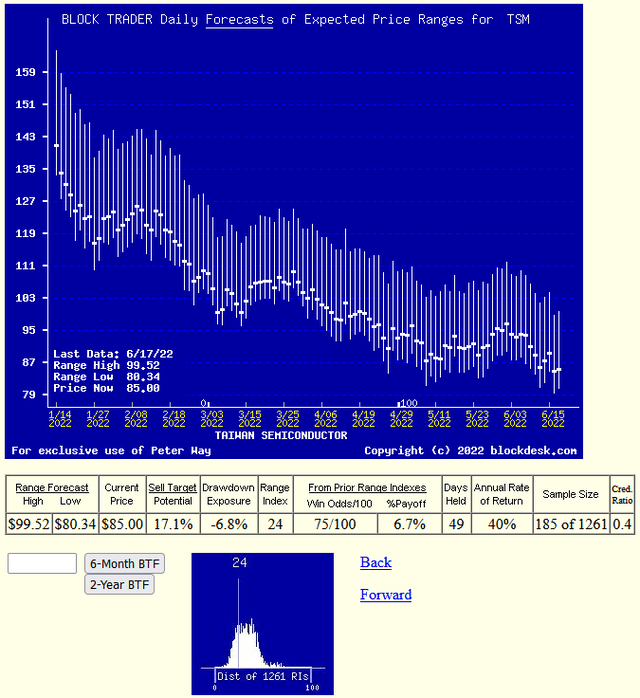

Determine 3

blockdesk.com

(used with permission)

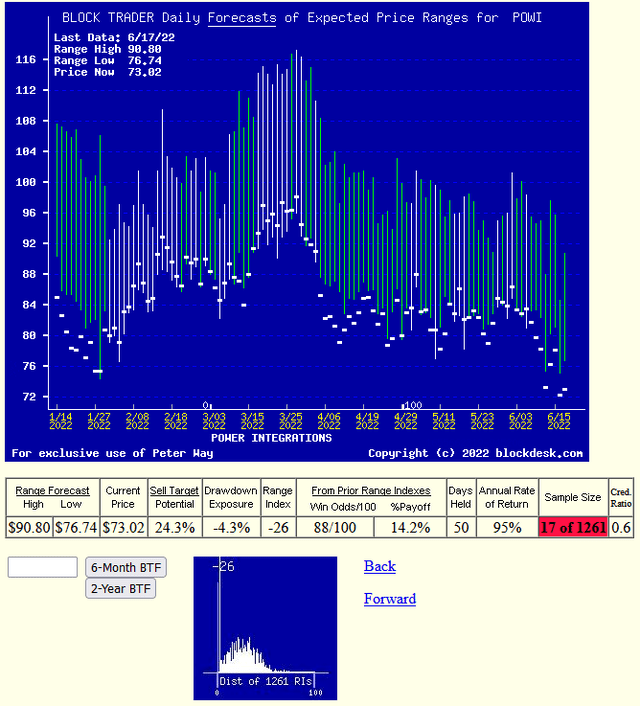

Determine 4

blockdesk.com

(used with permission)

Many buyers confuse any time-repeating image of inventory costs with typical “technical evaluation charts” of previous inventory worth historical past. These are fairly completely different of their content material. As an alternative, right here Figures Three and 4’s vertical traces are a daily-updated visible report of worth vary forecast limits anticipated within the coming few weeks and months. The heavy dot in every vertical is the inventory’s closing worth on the day the forecast was made.

That market worth level makes an specific definition of the value reward and danger publicity expectations which have been held by market contributors on the time, with a visible show of their vertical steadiness between danger and reward.

The measure of that steadiness is the Vary Index (RI). Right here in POWI, the present market worth of $73 is under the bottom forecast worth (of $76) regarded by hedging as affordable. That produces a destructive Vary Index.

With right now’s RI there’s 24% upside worth change in prospect and no draw back. Of the prior 53 forecasts like right now’s RI, 51 have been worthwhile. The market’s actions of prior forecasts turned accomplishments of +14% features in 50 market days. So historical past’s benefit might be repeated 5 occasions a 252 market-day 12 months, which compounds right into a CAGR of +95% which compares to lower than half as a lot from TSM.

Additionally please word the smaller low photos in Figures Three and 4. They present the previous 5 12 months distribution of Vary Indexes with the present stage visually marked. For POWI practically all forecasts have been of upper costs and Vary Indexes.

Conclusion

Based mostly on direct comparisons with TSM and different Semiconductor producers, there are a number of clear causes to choose a capital-gain in search of purchase in Energy Integrations, Inc.