A latest FCF Life Sciences evaluation confirmed a major decline in funding volumes for European life sciences markets within the first half of 2022 in comparison with 2021. This pattern is now confirmed for the US life sciences markets as properly. It impacts all related subsectors, specifically Biotech and HealthTech.

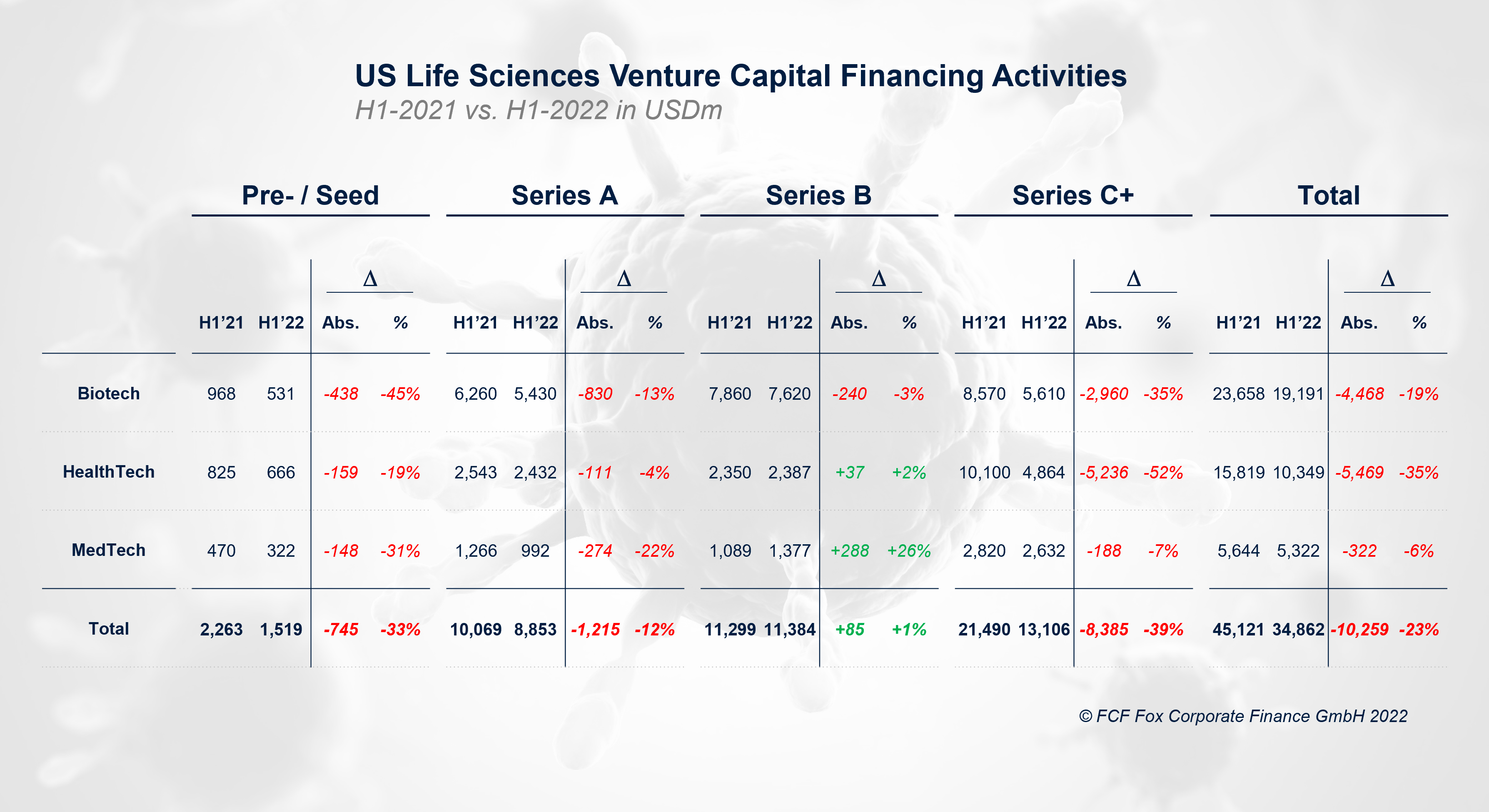

The overall financing volumes declined by virtually 1 / 4 from USD 45.1bn to USD 34.9bn. The HealthTech subsector has been particularly affected with a discount in funding by greater than -35 %.

Apparently, solely Collection B firms have been in a position to appeal to extra funding. The excess is partly attributable to 2 offers within the MedTech sector: Noah Medical (USD 150m) and Biolinq (USD 116m). If excluded, the funding state of affairs for Collection B firms would additionally flip adverse in H1/2022, leading to a decline in funding for firms throughout all phases.